(NLDO)- The Chairman of the Board of Directors of this enterprise is Mr. Nguyen Thanh Tien, a famous speaker in the investment field with millions of followers on social networks.

Van Lang Technology Investment and Development Joint Stock Company (stock code: VLA) - a unit specializing in selling investment and enrichment courses has just announced its financial report for the third quarter of 2024, recording net revenue of 2.5 billion VND, a sharp increase of 151% over the same period in 2023.

A representative of Van Lang Technology Investment and Development Joint Stock Company said that the sharp increase in revenue in the third quarter was due to the increase in the number of students participating in courses.

After deducting expenses, Van Lang Technology Investment and Development Company reported a profit after tax of more than 500 million VND, 5 times higher than the same period last year.

Accumulated in the first 9 months of the year, the company's net revenue reached nearly 5 billion VND, down 50% compared to the same period. After deducting expenses, Van Lang reported a loss of more than 6 billion VND. The main reason was that the company suffered heavy losses in the first 2 quarters of the year.

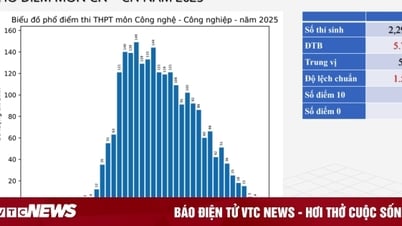

Recent stock performance Source: Fireant

Van Lang Technology Investment and Development Joint Stock Company is known for its courses on investment and personal development.

The Chairman of the Board of Directors of this enterprise is Mr. Nguyen Thanh Tien, a famous speaker in the investment field with millions of followers on social networks.

Mr. Tien introduces himself as the number 1 paid real estate training expert in Vietnam and claims to have trained more than 200,000 students since 2012. His courses are free and paid, with the paid course costing up to 180 million VND.

In the 2023 annual report, Van Lang said it had successfully organized courses such as: Real Estate Investment Strategy; Intelligence 5.0; Secrets to effective capital mobilization; Business intelligence...

However, Van Lang itself has not been very successful in its investment activities.

Specifically, Van Lang purchased a hotel in Quang Ninh worth 18 billion VND in 2022. The main purpose is to use a part as a representative office, while still maintaining the main business categories such as restaurants, hotels, and accommodation services.

However, due to difficulties in transferring property ownership and the impact of the economy , the company said it had to liquidate this contract.

In the stock market, VLA shares attracted attention when in 2022 there were a series of increasing sessions, pushing the stock price from 30,000 VND/share to nearly 90,000 VND/share - the highest level in history.

Up to now, this stock only fluctuates in the price range of 14,000 - 15,000 VND/share. Compared to the beginning of 2024, VLA stock has decreased by more than 22% but compared to the peak in 2022, it has decreased by 6 times.

Source: https://nld.com.vn/cong-ty-cua-chuyen-gia-day-lam-giau-tiep-tuc-lo-196241017170523408.htm

Comment (0)