The additional tax payment is made by TCBS according to the decision of the General Department of Taxation on April 16, 2025.

Previously, TCBS was in the Top 50 of 1,000 enterprises (V1000) paying the largest taxes in Vietnam for 3 consecutive years 2020 - 2022, announced by the General Department of Taxation in October 2023. The General Department of Taxation determines the V1000 ranking list based on the annual corporate income tax payment to the state budget of enterprises.

According to the Financial Report for the first quarter of 2025 just announced by TCBS, TCBS's pre-tax profit reached VND 1,310 billion, up 40% compared to the fourth quarter of 2024 and 13% compared to the same period last year. TCBS has successfully diversified its various sources of income including stocks, bonds, fund certificates and other products, thereby maintaining stable profit growth results over a long period of time. In March 2025, TCBS completed the disbursement under a syndicated unsecured loan contract with a record limit of USD 230 million (about VND 5,900 billion) for a securities company in Vietnam. TCBS is the first Vietnamese securities company to be approved by three global and regional financial groups to guarantee capital arrangement for the loan with a firm commitment.

Previously, in 2023, TCBS was the first securities company to be approved by the State Bank of Vietnam for a medium- and long-term foreign loan. In 2024, the Company broke the international capital mobilization record with a contract worth 175 million USD.

With the success of the above deal, the total cumulative value of foreign unsecured syndicated loans that TCBS has accessed from the end of 2020 to 2025 is more than 991 million USD (equivalent to 25,378 billion VND). Currently, TCBS is one of the securities companies with the highest credit rating in Vietnam.

The implementation of the Zero Fee transaction policy with no time limit and the most flexible and attractive margin loan pricing policies on the market for customers helps TCBS continue to lead the margin lending market share.

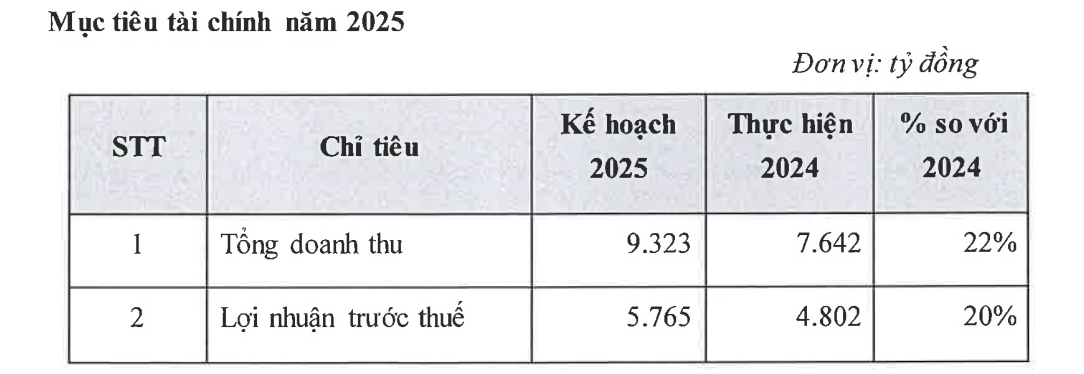

According to the document published for the 2025 Annual General Meeting of Shareholders, TCBS set a profit target of VND5,765 billion for 2025, up 20% over the previous year. This target is considered to be the highest in the industry.

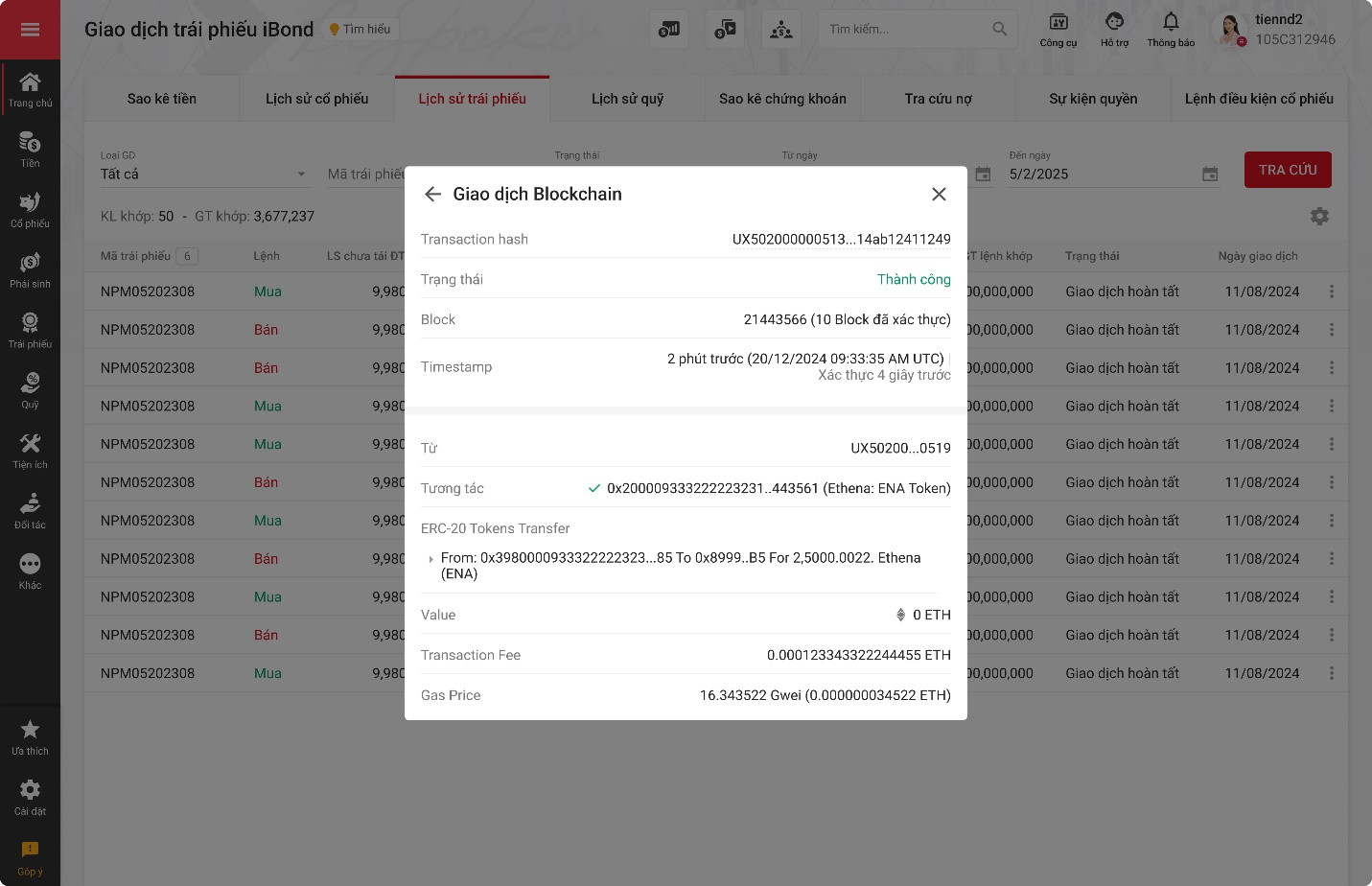

In addition to expanding the investment product supermarket for digital asset management, TCBS will focus on upgrading its trading infrastructure. In particular, the key project in 2025 is to build a new core securities trading system to ensure compatibility with HoSE's KRX system, and develop a core warrant trading system to better support covered warrant transactions.

In particular, TCBS determines to invest heavily in Blockchain application products and services, ensuring transparency, security and transaction efficiency.

In 2024, TCBS has upgraded and prepared to complete a comprehensive Blockchain system framework, ready to expand to all types of financial assets on digital platforms. This system not only optimizes operations, enhances transparency but also lays the foundation for a safe and sustainable digital financial ecosystem at TCBS. This strategy is completely consistent with the National Blockchain Strategy, issued by the Government at the end of 2024 with a vision to 2030, Vietnam becomes a leading country in the region and has an international position in researching, deploying, applying and exploiting Blockchain technology.

Bui Huy

Source: https://vietnamnet.vn/cong-ty-co-phan-chung-khoan-ky-thuong-tcbs-hoan-tat-nop-bo-sung-thue-2393734.html

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)