Securities companies in Vietnam are stepping up bond issuance to raise capital, with the total issuance value reaching VND5.8 trillion in the first quarter of 2025, up 11 times compared to the same period last year. The move is aimed at supplementing capital for activities such as margin lending, advances for securities sales, and business expansion.

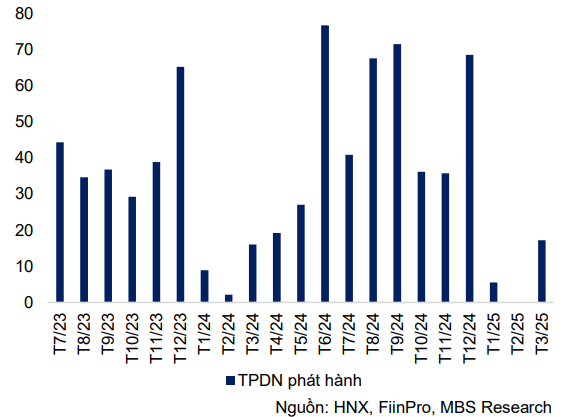

According to MBS Securities Report, corporate bond issuance in March was more active than the previous month when 8 new issuances were recorded with the total value of successfully issued corporate bonds in the month estimated at nearly 17.2 trillion VND - more than 7 times higher than the previous month, and up 7.3% over the same period. However, 100% of the issuances came from the Banking group (accounting for 68% of the total issuance value) and Securities, while the Real Estate group has not recorded any issuances in the first 3 months of this year.

Notable issuances in March include: HDB (VND 5 trillion, term 84 - 96 months, interest rate 7.38% - 7.58%), LPB (VND 3 trillion, term 84 - 120 months, interest rate 7.58% - 7.88%), MBB (VND 2.2 trillion, term 72 months, interest rate 6.18%).

Commercial banks are stepping up capital mobilization through bonds to increase capital scale to boost lending activities in the context of capital demand recovering rapidly. According to the State Bank of Vietnam, by the end of the first quarter, credit growth reached 3.9% - 2.5 times higher than the 1.42% of the same period last year.

Since the beginning of the year, the total value of corporate bonds issued has reached over VND25.1 trillion, down 2.7% year-on-year. The average weighted corporate bond interest rate in the first 3 months of the year is estimated at 7.2%, equal to the average level in 2024. Notably, in the first quarter, public issuance activities grew strongly when 11 new issuances were recorded with an estimated value of over VND23.1 trillion - up 116% year-on-year.

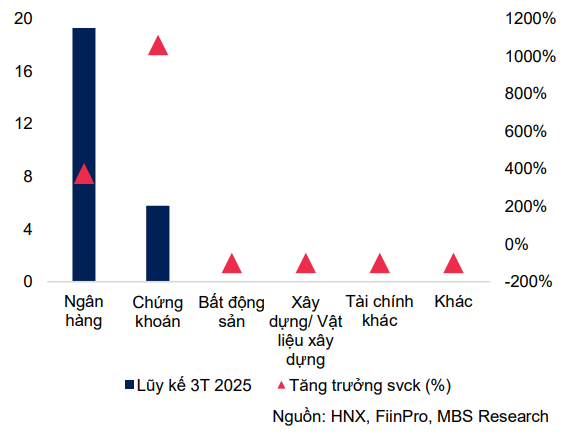

Banking is the industry group with the highest issuance value with more than 19.3 trillion VND (+377% compared to the same period), accounting for 77%, the average weighted interest rate is 6.9%/year, the average term is 6.9 years. Banks with the largest issuance value since the beginning of the year include: HDB (5 trillion VND), Vietinbank (4 trillion VND), LPB (3 trillion VND).

The total issuance value of the Securities group reached VND5.8 trillion - more than 11 times higher than the same period, accounting for 23%. The average weighted interest rate of the Securities group's bonds was 8.3%/year, with an average term of 1.9 years. The enterprises issuing the largest value included: VPS Securities JSC (VND5 trillion), Rong Viet Securities JSC (VND500 billion), and DNSE Securities JSC (VND300 billion).

The vibrant trading market is the main reason why securities companies are stepping up bond issuance during this period. The trading value on all three exchanges in March reached VND22,732 billion in March 2025. In terms of order matching alone, the average trading value per session was VND19,858 billion, up 22.5% month-on-month.

Individuals and foreign investors continued to boost trading in March 2025, with the average trading value of individuals and foreign investors increasing by nearly 34% each, but the trading positions reversed. Specifically, foreign investors maintained net selling for the 6th consecutive month, with the cumulative net selling value in the first quarter being nearly VND 24.3 trillion, equivalent to 33% of the net selling scale of the whole year 2024. The corresponding net buyers were mainly individuals, with the cumulative net buying value in the first quarter reaching VND 18.2 trillion, while domestic organizations "balanced" the remaining amount of more than VND 6 trillion.

According to statistics, by the end of the first quarter of 2025, outstanding loans at securities companies are estimated at about VND 280,000 billion (~ USD 11 billion), an increase of VND 35,000 billion compared to the end of 2024 and a record high. The increase in capital after issuing shares and bonds has boosted the lending capacity of securities companies, especially preparing to meet the borrowing needs of foreign institutional investors when applying Non Pre-funding.

In March, the value of corporate bonds repurchased before maturity was estimated at nearly VND9.6 trillion, up 147% compared to the previous month, and down 2.3% compared to the same period. Of which, the Real Estate group accounted for 11.7%, and the Banking group accounted for 0.3%. In the first quarter, approximately VND27 trillion of corporate bonds were repurchased before maturity (+26.8% compared to the same period), largely due to the value of corporate bonds repurchased by the real estate sector increasing by 21.2% compared to the same period. The month recorded two new enterprises late in paying principal and interest.

Regarding the situation of late payment, March recorded 2 new enterprises announcing late payment of principal and interest with a value of about 516 billion VND. By the end of March, the total value of corporate bonds with late payment obligations was estimated at about 209.3 trillion VND, accounting for about 20% of outstanding corporate bond debt of the entire market, in which the Real Estate sector continued to account for the largest proportion of about 69% of the late payment value.

Forecasting the outlook for the corporate bond market in 2025, FiinGroup forecasts that outstanding debt value will increase by 15-20%. The reason is that in the current context, commercial banks will still have to promote the issuance of corporate bonds to increase Tier 2 capital, serve the demand for credit growth under the direction of the Government, and at the same time maintain stable mobilization interest rates.

This will pose challenges in ensuring capital adequacy indicators, such as the LDR (loan-to-deposit ratio) and the use of short-term capital for long-term lending. Many banks are also planning to increase Tier 1 capital through issuing shares, however, this process will take time and depend on the stock market situation.

In addition, new regulations on private bond issuance and public offerings are expected to be applied in the second half of 2025. These changes will improve the quality of bonds and attract more investors to participate in the corporate bond market, especially when savings interest rates remain low.

Demand for refinancing and restructuring will increase, especially from capital-intensive sectors such as real estate, energy, construction and materials in the coming quarters. Banks continue to be the main buyers of corporate bonds, and with high credit growth targets, banks will be encouraged to increase their investment in corporate bonds.

Source: https://baodaknong.vn/cong-ty-chung-khoan-tang-cuong-phat-hanh-trai-phieu-250352.html

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)