The consequences of recent extreme weather events have heralded a new era of climate-conscious investment, particularly in Southeast Asia – a region particularly vulnerable to climate change due to its long coastline and low-lying terrain.

In Q3 2023 alone, 16 green tech startups in Southeast Asia raised capital, with the highest quarterly deal volume in at least five years.

The 16 startups raised $140 million, according to DealStreetAsia's figures. Leading the way was Singapore-based renewables company InterContinental Energy, which raised $115 million in September from the city-state's sovereign wealth fund GIC and clean hydrogen industry investor Hy24. Singapore-based waste management companies Blue Planet Environmental Solutions and Indonesia-based Rekosistem were also among the big climate tech fundraisers in Q3 2023.

Additionally, several other companies have been successful thanks to the boom in investments focused on climate and its impact, such as Singaporean green wastewater technology company Hydroleap – which raised $4.4 million; Climate Alpha, a Singapore-based AI-powered analytics platform, which raised about $5 million.

Throughout 2023, a number of impact and climate-focused funds emerged in Asia and Southeast Asia to support entrepreneurs building solutions to mitigate climate-related challenges, including Singaporean venture capital firm TRIREC, which announced a $100 million climate fund in May 2023 in partnership with Thai energy technology company Innopower and The Radical Fund.

In December alone, climate tech venture builder Wavemaker Impact closed a $60 million fund, while UK-based British International Investment has invested in three separate Asia-focused climate finance funds. In November, Swiss investor ResponsAbility Investments announced a $500 million climate investment strategy, and Swiss-based asset manager Edelweiss Capital Group launched a $150 million private equity fund to make climate-related investments in Asia…

We are seeing cross-border collaboration on technologies to maximise the extraction and use of critical minerals between countries such as Australia, Singapore and Indonesia. Southeast Asian governments are also encouraging proactive initiatives to create a conducive environment to attract green technology investment as the region’s climate technology startups remain in their early stages of development.

Entering 2024, Asian businesses will face new challenges in technology, environmental regulations and geopolitics, not to mention the potential impact of elections in several key countries. However, according to Nikkei Asia, Southeast Asian investors see a promising future for the climate technology sector, believing it to be one of the fastest growing sectors globally.

HAPPY CHI

Source

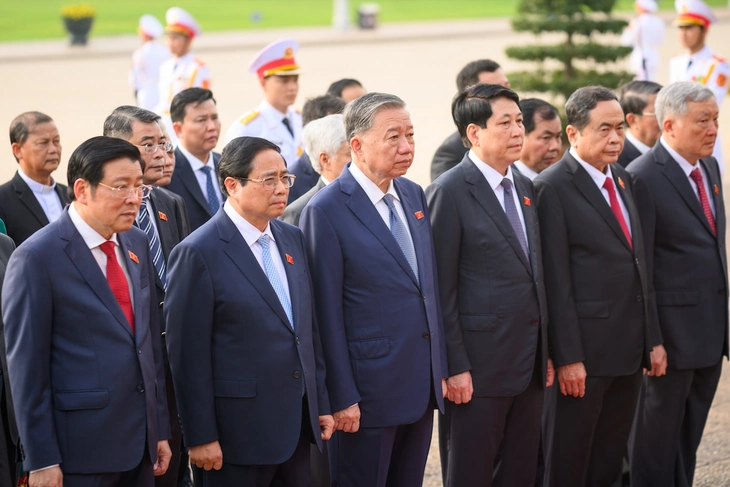

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)