Photo: THANH DAT

Gold hits new high, people line up to buy

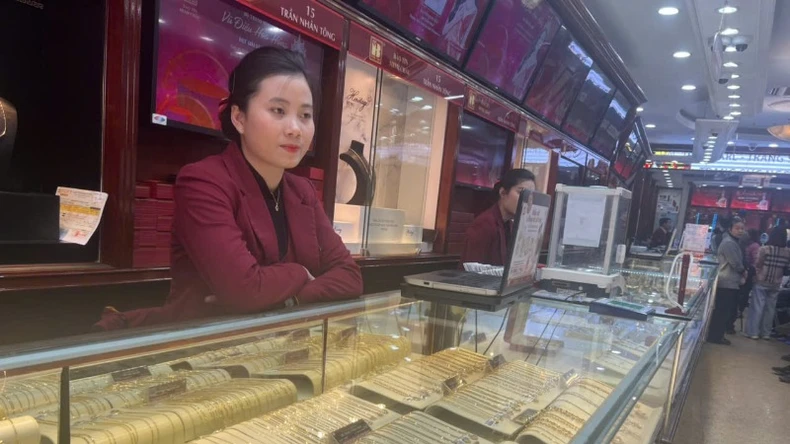

In recent days, when the price of gold has continuously increased, at Bao Tin Minh Chau gold shop on Tran Nhan Tong street, Hanoi, since the morning, people have lined up on the sidewalk waiting for their turn to buy gold.

People lined up to buy gold last week (PHOTO: QUYNH TRANG)

Mr. Tran Nam Tien, Hanoi City said, he saved all his money to buy gold. The price of gold is high but he tried to buy one tael.

Ms. Hoang Thi Hanh, Gold Sales Director, Bao Tin Minh Chau Company Limited, said that Bao Tin Minh Chau is receiving a relatively large number of customers, mainly people coming to buy gold, accounting for about 80%, the remaining 20% of people come to sell gold. Ms. Hanh added that normally, when the price of gold is high, the number of people coming to buy increases more than usual.

According to the sales person at Bao Tin Minh Chau gold shop, the shop has prepared many types of gold rings for sale to buyers. Currently, the shop has gold rings of one chi, two chi, five chi... but small retailers buy a lot so some types are out of stock early.

The phenomenon of gold rising and small investors "rushing" to buy gold can create many risks that small investors cannot fully anticipate.

People wait their turn to buy gold (Photo: QUYNH TRANG)

Risks from the uncontrollable gold market

Domestic gold prices have increased sharply for about a week now, since April 8, the price of gold has been around 102 million VND/tael.

As of April 16, the listed price of SJC gold bars at some gold trading enterprises such as Saigon Jewelry Company (SJC), Bao Tin Minh Chau Company Limited, and Phu Nhuan Jewelry Company (PNJ) was close to 110 million VND/tael.

According to Dr. Vo Tri Thanh, Director of the Institute for Strategy and Competitiveness Research, gold prices fluctuate strongly because they depend on the international economic and political situation. Recently, gold prices have increased, continuously creating new "peaks" due to the influence of geopolitical conflicts in the world and US tariff policies, making gold a safe haven for investors.

Dr. Le Xuan Nghia, member of the National Financial and Monetary Policy Advisory Council, further emphasized that the USD is currently weakening against major currencies. Meanwhile, gold is priced in USD, which has led to investors switching to gold, contributing to the increase in gold prices.

Sharing the same view, Mr. Tran Cong Danh, a financial and banking expert, said that in the short term, financial fluctuations will occur quickly, creating risks and being unpredictable, so investors will look for stable investment channels such as gold, especially in countries like Vietnam.

However, it is necessary to look at it more generally, when before that, from April 4 to April 7, the gold price continuously decreased sharply, the price of SJC gold bars fell from 102 million VND to around 100 million VND/tael.

If calculated from the beginning of 2025, gold prices have had "unusual" fluctuations, after continuously setting new peaks, they turned to decrease.

Gold prices are constantly fluctuating, surpassing experts' predictions. And will continue to be unpredictable in the coming time when the geopolitical situation in the world is still uncertain.

Gold prices fluctuate constantly (Photo: QUYNH TRANG)

Retail Investors - Be Careful When Investing

Speaking to Nhan Dan Newspaper reporters, Mr. Nguyen Minh Cuong, former Chief Economist of the Asian Development Bank in Vietnam (ADB), said that gold is one of the assets that is often favored when the market fluctuates strongly. In the world, from 1971 to 2022, gold has generated an average annual return of 7.7%, higher than the nominal return of 4.2% that the USD generated in the same period. However, the return of gold is still not equal to the performance of stocks, for example the S&P 500, which has generated an average annual return of 10.2% since 1971.

Gold is a safe haven asset that does not pay dividends, does not generate interest, does not generate cash flow or revenue, and is also risky and expensive to maintain, especially in large quantities, said expert Nguyen Minh Cuong.

Mr. Tran Cong Danh pointed out that the gold market in Vietnam is a decentralized market, with individual transactions, and currently there is no exchange or overall regulations like stock trading.

The difference between buying and selling prices is quite high, sometimes up to 2 or 3 million VND/tael. On the other hand, the domestic gold price is also higher than the world gold price, sometimes up to 6 million VND/tael. Therefore, there are still many risks for people when investing based on psychology, investing when the gold price is high, or "surfing".

When the price of gold suddenly reverses and falls sharply, short-term investors or those who borrow money to invest will face significant financial risks. Mr. Nguyen Quang Huy, Executive Director of the Faculty of Finance and Banking, Nguyen Trai University, added.

Small investors need to be careful when investing in gold (Photo: QUYNH TRANG)

In the context of rising gold prices, small investors tend to invest more money in gold. Associate Professor, Dr. Le Duc Hoang, Head of the Department of Corporate Finance, National Economics University, warned: “When gold prices increase sharply, many people invest too much, causing demand to increase too much while supply cannot meet it. This can lead to risks for a period of time, because in reality, such situations have happened many times. Therefore, the investment principle is still to minimize risks and allocate capital reasonably.”

Economist Nguyen Minh Cuong shared his experience in countries around the world: “Individual investors minimize risks when investing in gold by applying strategies such as diversifying their investment portfolio across different types of assets, choosing ETFs (investment funds traded on stock exchanges) or gold investment funds to avoid the risk of storing physical gold, and buying gold in small amounts periodically instead of investing a large amount at once to minimize the impact of price fluctuations. Investors also buy gold from reputable sources to avoid quality risks.”

Mr. Nguyen Quang Huy acknowledged that money flows tend to withdraw from production and business to find a safe haven in gold. If this phenomenon continues to persist and spread, it will not only cause imbalances in the social investment structure but also increase the risk of “goldenization” of the economy, something the Government has been trying to control for many years.

For small investors, to reduce their dependence on gold as a traditional investment and storage channel, it is necessary to equip themselves with financial knowledge, starting from the root of awareness. Then, people will gradually escape the passive mentality in investing and switch to the mindset of creating value through production, business, innovation and systematic investment. Mr. Nguyen Quang Huy said.

Mr. Nguyen Minh Cuong recommended that in the current period, there should be a comprehensive stimulus solution, in which fiscal policy is important, along with public investment to promote growth, thereby "pulling" gold into circulation and production. In addition, reforming the financial market to increase investment channels other than gold, will be a long-term solution not only to relieve pressure on the gold market, but also to ensure a sustainable and stable financial market.

Source: https://baotuyenquang.com.vn/con-sot-vang-tro-lai-nha-dau-tu-nho-le-co-the-doi-mat-nhieu-rui-ro-210180.html

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

![[Photo] Close-up of An Phu underpass, which will open to traffic in June](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/5adb08323ea7482fb64fa1bf55fed112)

Comment (0)