Supply increases thanks to promotion policies

According to the Ho Chi Minh City Real Estate Market Report for the third quarter of 2023 recently announced by Savills, in the third quarter of 2023, the supply of apartments returned to the market with a record increase of 572% quarter-on-quarter and 11% year-on-year to 2,528 units.

This supply comes from two new projects and six subsequent phases of projects in the city. In particular, Thu Duc City alone accounts for 74% of the market share with projects with large quantities such as The Glory Heights (grade B) accounting for 59% of the market share.

The remaining apartments to be launched on the market are Class B and C projects in the western part of Ho Chi Minh City, located in Binh Tan and Binh Chanh.

Primary supply increased 32% QoQ and 12% YoY to 7,722 units, partly relieving the pressure of supply shortage. Grade B had the largest supply with 49% market share, followed by Grade C with 34% market share and Grade A with 17%.

Explaining the increase in supply of this type, Mr. Troy Griffiths, Deputy General Director, Savills Vietnam said: "Lower lending interest rates and support moves from the Government are expected to stimulate supply growth and boost the market."

Apartment supply is increasing, responding to the gap between supply and demand in the market.

Regarding market liquidity, Savills said that segment C projects recorded 651 transactions, showing that the demand for affordable housing in the current market remains high. Meanwhile, segment A and segment B projects recorded 42 and 210 transactions, respectively, in the recent period.

To resolve legal issues, the Ho Chi Minh City People’s Committee has focused on resolving 148 projects; 39 projects have achieved results. The State Bank of Vietnam (SBV) has continuously lowered interest rates and Circular 10 will provide better access to capital for ongoing projects. These mechanisms are expected to help increase supply and promote market development.

It is expected that by the end of 2023, more than 1,900 new units will be offered for sale. Class C will be the main product with 69% market share, Class B will have 26% market share and Class A will have 5%.

Serviced apartments are operating at near full capacity.

In the serviced apartment market, in Q3/2023, supply was at 7,463 units, up 6% QoQ and 23% YoY. Five projects reopened after renovation provided 233 units and 12 existing projects.

Savills recorded an occupancy rate of 81%, down 2% quarter-on-quarter due to tenants delaying contract renewals and reduced short-term demand during the low season. However, occupancy increased 3% year-on-year due to a recovery in long-term demand from the return of expats and domestic short-term business travellers.

“The serviced apartment segment is performing relatively well, but is facing increasing competition from rental properties. This has prompted renovations and the entry of new operators,” said Neil MacGregor, CEO of Savills Vietnam.

Serviced apartments are operating at near full capacity, partly due to the market's still high demand for housing.

Accordingly, since 2019, Ho Chi Minh City has had more than 100,000 apartments handed over, fiercely competing with serviced apartments. To maintain competitiveness, serviced apartment chains have continuously expanded with supply growth of up to 18% per year to nearly 3,000 units and accounting for 38% of the total supply in the city by the third quarter of 2023.

New brands mostly develop in the C-segment and target the mass market. Chain-operated projects have synchronous marketing and leasing policies. Most of these projects have good operating performance with occupancy rates reaching over 90% and rental prices up to 20% higher than the market.

Villas and townhouses still have potential in the future

Unlike the above types, the villa/townhouse market continued to record no new supply quarterly, which led to the primary supply of this segment reaching its lowest level in the past 10 years with 766 units, down 24% quarterly and 5% annually.

Of which, projects in Thu Duc City account for 88% of the total primary supply. Products priced above 30 billion VND/unit account for 86% of the supply.

The number of transactions in the third quarter of 2023 of this type reached only 64 units, the lowest since 2018, down 43% quarter-on-quarter and 82% year-on-year, due to declining demand, no new supply and expensive inventory. The absorption rate was only 8%, down 3% quarter-on-quarter and 36% year-on-year.

The market for villas and townhouses is quite gloomy but is considered to have a lot of potential in the coming time.

In this context, investors continue to be cautious and even stop selling, limit marketing activities and delay plans to launch new projects until next year. Some investors continue to apply diverse sales and lending policies, rental commitment policies to attract buyers.

However, when commenting on this type in Ho Chi Minh City, Mr. Neil MacGregor, General Director, Savills Vietnam said: "The villa/townhouse market still maintains growth potential despite current challenges. The development of infrastructure creates conditions for investors to access more land funds to solve the current shortage of supply."

Savills forecasts that in the fourth quarter of 2023, there will be about 200 new units offered for sale on the market. And by 2026, the market is expected to welcome an additional 4,600 units offered for sale as well as many key infrastructure projects being completed.

Source

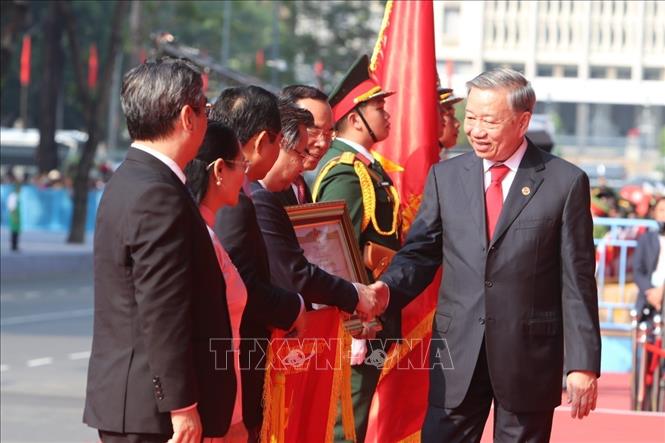

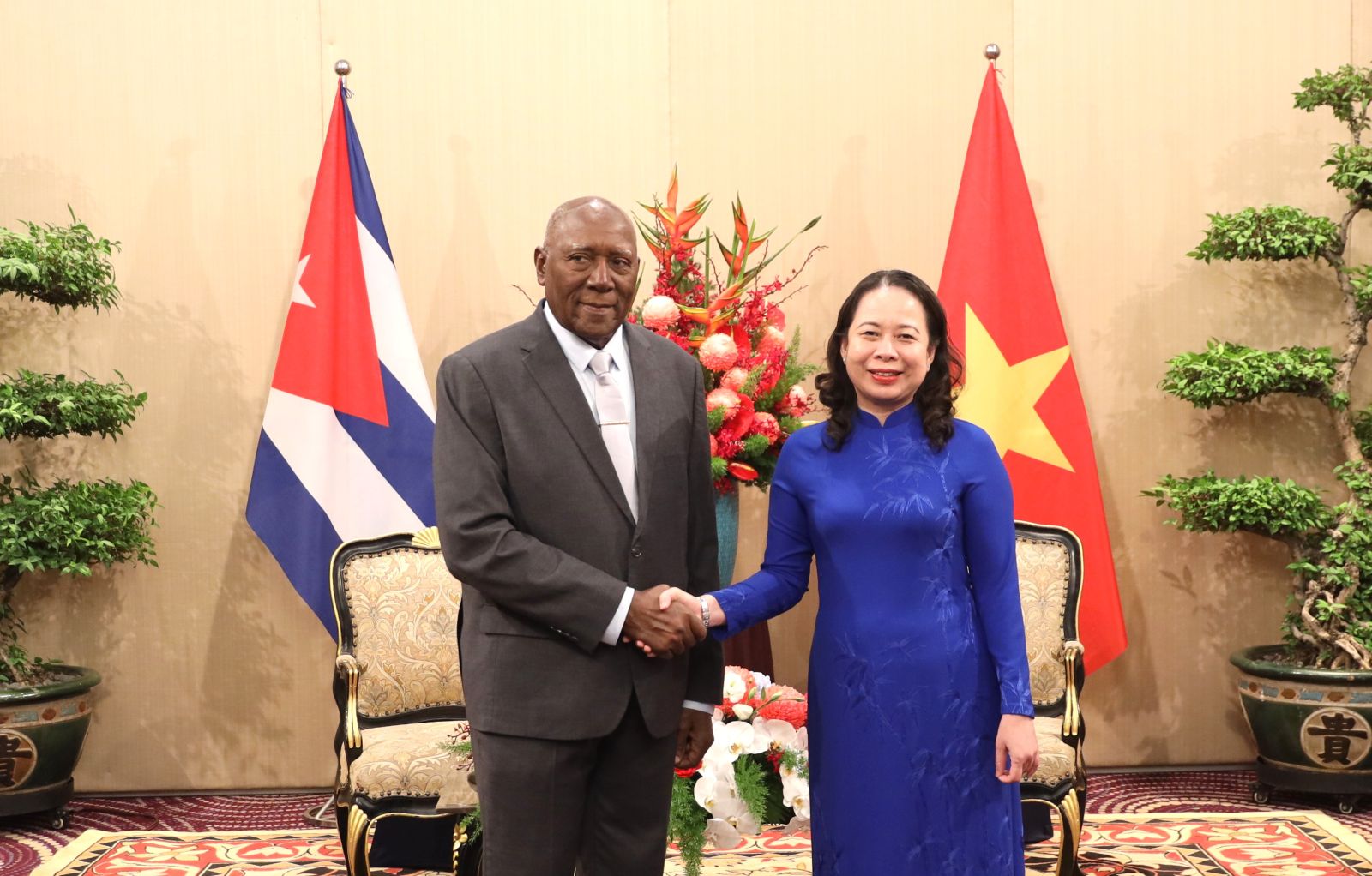

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

Comment (0)