Vietnamese bank stocks are considered "king stocks," but their valuations remain relatively low compared to regional averages due to limitations that are not easily overcome.

The importance of corporate market capitalization

As a business leader, imagine a good market opportunity arises to acquire another business to complete your ecosystem, but it requires a significant amount of capital. What would you do? The common solution is to issue additional shares and raise new investors to fund the transaction.

But to raise capital, you must demonstrate to investors that the investment will be profitable, or simply put, that buying newly issued shares will be profitable in the long term. From an investment perspective, the long-term increase in the company's market capitalization in the past will be an important metric for raising additional funds, proving that existing investors are benefiting significantly, thus making it easier to attract new capital.

A company's market capitalization is the multiplier between the number of outstanding shares and the share price. For a company to have a large market capitalization, it needs a large registered capital and a high share price. In practice, a high share price offers more benefits to shareholders than a company with a large registered capital. A high share price also makes it easier for a company to raise capital at a good price (by issuing new shares at a high market price), and allows for a rapid increase in registered capital through stock splits…

Therefore, it would be a serious mistake for business leaders to say, "stock prices are determined by the market; we only focus on doing business." Each business leader needs a strategy to increase the attractiveness of their company's stock. Stock prices may fluctuate in the short term, but in the long term, there must be growth to ensure the company's market capitalization increases.

This analysis provides readers with important information and personal perspectives on measures to increase corporate market capitalization by analyzing the characteristics of high-valued banks in the region, aiming to draw practical lessons for Vietnamese banks.

|

Comparing the stock valuations of banks in the region.

When comparing the valuations of banks in the region, it's easy to see that the share prices of regional banks are significantly higher than those of banks in Vietnam. From 2017 to the present, the average P/E and P/B ratios of Vietnamese banks have consistently been lower than those of the banks in the comparison basket, especially the P/E ratio. This means that investors are always paying a higher price for each dollar of earnings at regional banks.

On average over the past six years, investors in the Indonesian market have been willing to pay the highest amount, at 19 dong for every dong of income, while investors in the Vietnamese market are only willing to pay 11 dong for every dong of income.

The high trading volume indicates a higher level of investor interest in bank stocks in the region. Particularly in Thailand, the daily trading volume of large bank stocks is nearly 8-10 times higher than the average in Vietnam. The upward/downward price trends are clearer, with fewer sudden fluctuations, and stock prices fairly accurately reflect signals in business operations.

So what are the reasons? Although there are differences in business operations, history, culture, management, etc., according to the author's research, these banks all share three characteristics that contribute to high stock prices: a favorable macroeconomic environment for securities investment, efficient banking operations, and an effective communication strategy.

|

The attractiveness of the stock market

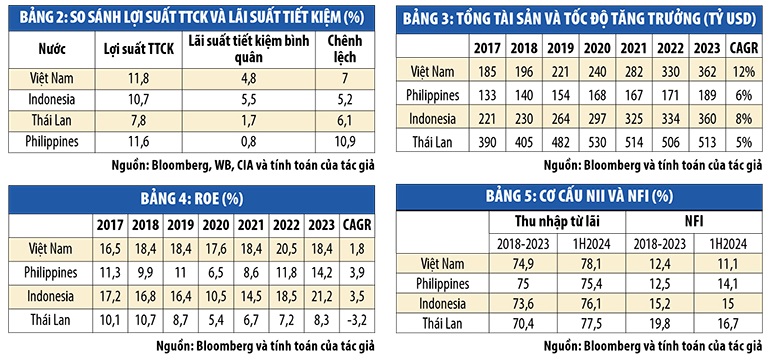

First and foremost, it must be acknowledged that in recent years, the Vietnamese stock market has seen significant improvements and has become an effective investment channel for investors. However, the difference between the return on stock investments and the average 12-month savings interest rate in Vietnam is lower than that of the Philippines and comparable to Thailand. This indicates that the attractiveness of the Vietnamese stock market is only average compared to other countries in the region.

The data in Tables 1 and 2 indicate that the difference between investment yields and savings interest rates in the Indonesian market is lower than in Vietnam, Thailand, and the Philippines. However, investors are willing to pay the highest prices (i.e., the highest P/E and P/B ratios) to own bank securities. This suggests that the Indonesian stock market is more attractive to investors than other comparable countries.

The scale and operational efficiency of the business.

A second major group of reasons explaining the difference in P/E and P/B ratios could be related to the size, operational efficiency, and income structure of the banks. If Vietnamese banks are compared to the largest banks in Singapore or Malaysia, it is clear that Vietnamese commercial banks are still relatively small in both size and market capitalization.

Specifically, based on stock prices and exchange rates as of June 2024, the total assets of Singapore's largest bank, DBS, were 5.6 times greater than those of Vietnam's largest commercial bank , BIDV . Maybank of Malaysia was also 2.4 times larger than BIDV. DBS's market capitalization was nearly 4 times greater than Vietcombank's, and Maybank's was 1.4 times larger than Vietcombank's.

However, compared to the large banks of Thailand, Indonesia, and the Philippines in the study group, the largest commercial banks in Vietnam are not far behind in terms of size. Although the total assets of Vietnamese commercial banks are only about 60% of the total assets of Thai commercial banks, they are on par with Indonesian commercial banks and larger than those of Philippine commercial banks (Table 3).

In terms of total asset structure, there is not much difference among banks, with customer loans (excluding corporate bonds) accounting for approximately 65-70% and bond investments accounting for 12-18% of total assets.

In terms of operational efficiency indicators such as ROA and ROE, Vietnamese banks are not inferior to banks in other countries in the region. The average ROE of the three largest commercial banks in Vietnam is on par with banks in the region, and even higher than the average of the three largest banks in Thailand.

Although the average Net Interest Margin (NIM) of banks in the region is much higher than that of Vietnamese banks. Specifically, the three largest banks in Indonesia have the highest average NIM at 6.5%, followed by the Philippines at 4.0% and Thailand at 3.0%. The three largest commercial banks in Vietnam have an average NIM of 2.9%.

Looking solely at those figures, one might mistakenly assume that banks in the region have a higher proportion of interest income in their revenue structure. However, a more detailed analysis reveals that banks in the region are not overly reliant on interest income. In Thailand, the average proportion of interest income is only 70.4%, in Indonesia it is 73.6%, while in the Philippines and Vietnam, this ratio is close to 75%. Furthermore, the proportion of non-interest income in the revenue structure of Vietnamese banks is larger than that of banks in the region.

The above analysis shows that the biggest difference between Vietnamese banks and regional banks is the structure of their income sources. Although large banks in other countries in the region are similar in size, they have a higher proportion of non-interest income (primarily from fees) compared to Vietnamese banks, which can give investors a sense of security regarding the bank's sustainability.

Investor relations activities

Aside from lower non-interest income, Vietnamese banks are not inferior to banks in other countries in the region, when looking at ROE and NIM. Therefore, if a product is good but the price is not commensurate, the reason may lie in the market, in sales, and in marketing. Here, if we liken the product to a stock, then investor relations (IR) is the sales process.

And indeed, banks in the region have had effective IR strategies from a very early stage, contributing to their stock prices outperforming those of Vietnamese banks. According to surveys by the Asian Securities Brokers Group and research by Standard and Poor's, all the banks studied in Thailand, Indonesia, and the Philippines have adopted proactive IR strategies.

In Vietnam, several organizations operating in the financial media field also have reports quantifying the media credibility of banks (Tenor Media, Vietnam Report, etc.), and many banks have mainly only completed mandatory IR activities such as information disclosure and organizing legally mandated events; proactive IR activities are still at an initial stage.

Thus, Vietnamese banks are continuously improving the quality and efficiency of their operations as well as investor relations. It is hoped that regulatory agencies will expedite the necessary activities to upgrade the Vietnamese stock market soon, thereby increasing its attractiveness to both domestic and foreign investors. This will create conditions for banks in particular, and Vietnamese businesses in general, to be revalued in relation to banks and businesses in the region, helping to increase market capitalization and benefits for shareholders and investors.

Source: https://baodautu.vn/co-phieu-vua-va-nhung-co-hoi-d225579.html

![OCOP during Tet season: [Part 3] Ultra-thin rice paper takes off.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F28%2F1769562783429_004-194121_651-081010.jpeg&w=3840&q=75)

Comment (0)