Opening the last trading session of the week on September 6, the Vietnamese stock market was hovering below the reference level, at one point falling sharply to nearly 1,260 points. However, in the afternoon session, strong demand helped the market regain green.

At the end of the session, VN-Index increased by 5.75 points to 1,273 points. HOSE floor had 192 stocks increased and 212 stocks decreased.

The VN30 basket of large-cap stocks increased by 6 points, closing at 1,315 points. In the group, 22 stocks increased in price such as MSN (+2.6%), VRE (+2%)... On the contrary, 6 stocks closed in red, including SSB (-2.7%), VIC (-0.9%), HDB (-0.7%)...

With the market’s late-session recovery, many stock groups have turned from red to green, but the level of volatility is still quite narrow. Oil and gas, steel, food, technology stocks, etc. are the groups supporting the market.

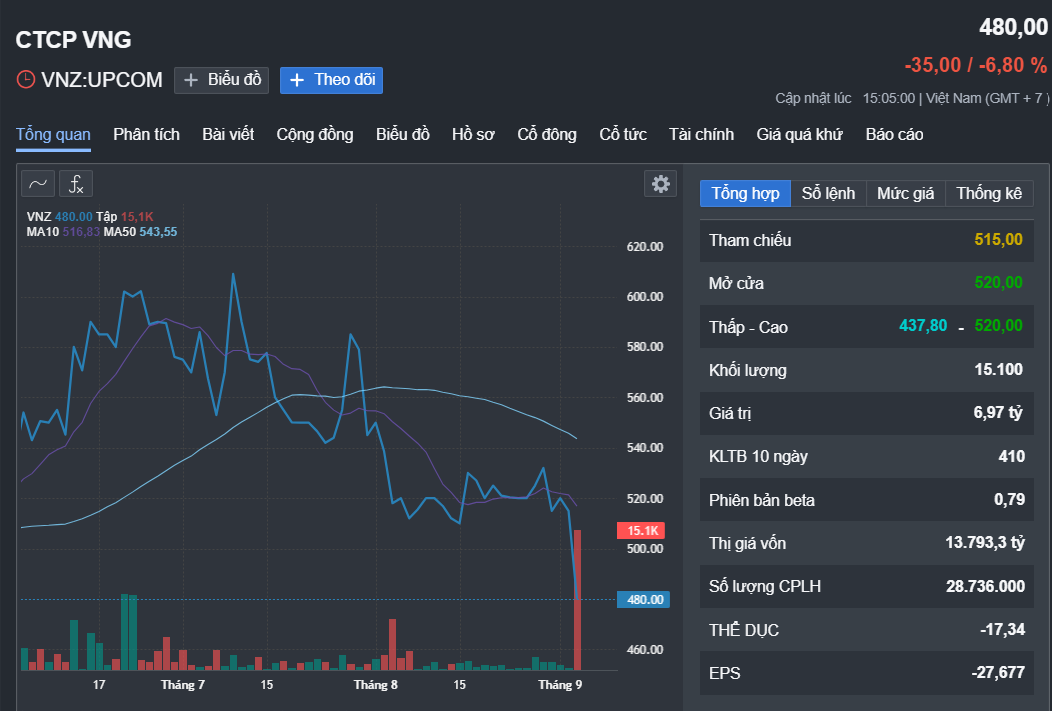

VNZ stock fluctuations in recent times Source: Fireant

In the trading session on September 6, VNZ shares of VNG Corporation attracted investors' attention when they decreased to 437,800 VND/share.

In the afternoon session, the decline narrowed and VNZ shares closed at VND480,000/share, down 6.8% compared to the reference price. Compared to the beginning of the year, this stock decreased by nearly 24%.

Notably, VNZ stock liquidity also increased dramatically with more than 16,000 shares matched, equivalent to a transaction value of more than 7 billion VND.

VNZ shares officially traded on the UpCoM floor in early 2023 at VND 240,000/share, then increased to a record price of VND 1.4 million/share, then continuously decreased.

VNG once planned to list on the US stock exchange but later announced that it would postpone this plan.

Regarding business performance, in the first 6 months of 2024, VNG achieved net revenue of VND 4,314 billion, up nearly 30% over the same period. After deducting expenses, VNG reported a loss after tax of VND 585.7 billion, while in the same period last year, it lost more than VND 1,205 billion. Notably, this is the 11th consecutive quarter of loss for this company.

As of the end of June 2024, VNG's cash and cash equivalents portfolio was worth about VND 3,340 billion, down nearly VND 500 billion compared to the end of 2023, mainly due to bank deposits.

VNG is a large online gaming business and service provider in Vietnam. This company is famous for releasing popular games such as Vo Lam Truyen Ky, Kiem The...

In addition, VNG also operates in many other technology fields such as computer programming, software production, commercial advertising...

In particular, VNG is also the owner of the Zalo platform - the most popular messaging and calling application in Vietnam, the ZaloPay e-wallet application, and has also entered the field of artificial intelligence.

Source: https://nld.com.vn/co-phieu-vnz-cua-cong-ty-cp-vng-lao-doc-manh-196240906181408801.htm

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)