At the close of trading on June 21, HPG shares of Hoa Phat Group Corporation were at VND24,600/share. This price has more than doubled compared to the time HPG shares hit bottom in November 2022, and increased by 15% compared to the VND21,400/share of the June 1 session.

Since the beginning of June, billionaire Tran Dinh Long's assets have increased by VND4,851 billion. Billionaire Tran Dinh Long, Chairman of the Board of Directors, is holding more than 1.516 billion HPG shares.

At the Shareholders' Meeting at the end of March, Mr. Tran Dinh Long affirmed that the most difficult and fierce period of the steel industry has passed.

According to the financial report for the first quarter of 2023, Hoa Phat returned to profit after 2 quarters of heavy losses. Specifically, revenue reached VND 26,865 billion, down 39% compared to the same period in 2022. Consolidated profit after tax reached VND 383 billion, reaching 5% of the 2023 plan.

HPG is a “national” stock held by many “sharks”. After suffering heavy losses while holding this stock, the players are “returning to shore”. According to Tri Viet Securities, HPG’s stock price continues to increase, so the company continues to hold it.

Business News

The stock market has a number of other important events of listed companies.

* PNJ : In May 2023, Phu Nhuan Jewelry Joint Stock Company recorded net revenue and after-tax profit of VND 2,223 billion and VND 111 billion, respectively. At the end of the first 5 months of the year, PNJ's net revenue reached VND 14,281 billion, after-tax profit reached VND 970 billion. Thus, PNJ has completed 50.1% of the annual profit plan.

* KDH : Khang Dien House Investment and Trading JSC approved the plan to pay dividends in 2022 and issue ESOP shares. Rate of 10%, shareholders owning 100 shares will receive 10 more shares and expected to be implemented in the third quarter of 2023.

* HQC : Vietnam Securities Depository (VSD) approved the adjustment of foreign room at Hoang Quan Real Estate Trading and Services Consulting JSC from 49% to 50%.

* BCM : Industrial Development Investment Corporation approved the private issuance of bonds in 2023, with a maximum total face value of VND 2,000 billion.

* CEO : CEO Group Corporation approved the plan to issue more than 5.14 million ESOP shares, at a price of VND 10,000/share. The shares will be restricted from transfer within 1 year.

* VNR : Vietnam National Reinsurance Corporation approved the plan to issue more than 15.07 million shares to pay dividends in 2022 at a ratio of 100:10. Expected implementation time is in the third quarter of 2023.

Transaction information

* ADG : FSN ASIA Private Ltd, an organization related to Mr. Lee SangSeok, a member of the Board of Directors of Clever Group JSC (ADG), received a transfer of more than 8.56 million shares from June 23 to July 21 due to a business merger.

* NVL : No Va Real Estate Investment Group Corporation (Novaland) announced a transaction of selling off shares. NovaGroup Corporation had nearly 490,000 NVL shares sold off by a securities company in four trading sessions on June 14, June 15, June 19 and June 20. Diamond Properties Corporation reported a transaction of nearly 1.6 million NVL shares sold off in two sessions on June 14 and 16.

* BIC : Fairfax Asia Ltd, a major shareholder, registered to buy more than 1.42 million BIC shares of BIDV Insurance Corporation from June 22 to June 23, by agreement and order matching.

* NLG : A group of major shareholders managed by Dragon Capital bought 575,000 NLG shares of Nam Long Investment Corporation on June 16. Thereby, increasing the group's total ownership to more than 34.89 million shares, equivalent to 9.08%.

VN-Index

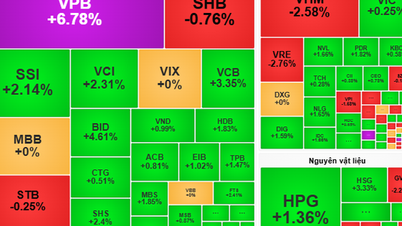

At the end of the session on June 21, VN-Index increased by 6.74 points (+0.61%), to 1,118.46 points. Total trading volume reached more than 875.89 million units, worth VND 17,520.5 billion.

HNX-Index increased 3 points (+1.31%), to 231.77 points. Total matched volume reached 100.62 million units, worth VND1,748.82 billion.

UPCoM-Index increased by 0.63 points (+0.74%), to 85.45 points. Total matched volume reached more than 59.09 million units, worth VND798.92 billion.

According to Yuanta Vietnam Securities, the market is likely to continue its upward momentum in the next session. The VN-Index corrected after approaching the resistance level of 1,125 points.

The market is still in a short-term accumulation phase, so investors should limit buying during the uptrend. Prioritize accumulation during corrections, especially investors should pay attention to the trend in each group of stocks.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)