Bank stocks cannot "carry" the market, a series of stocks are sold off

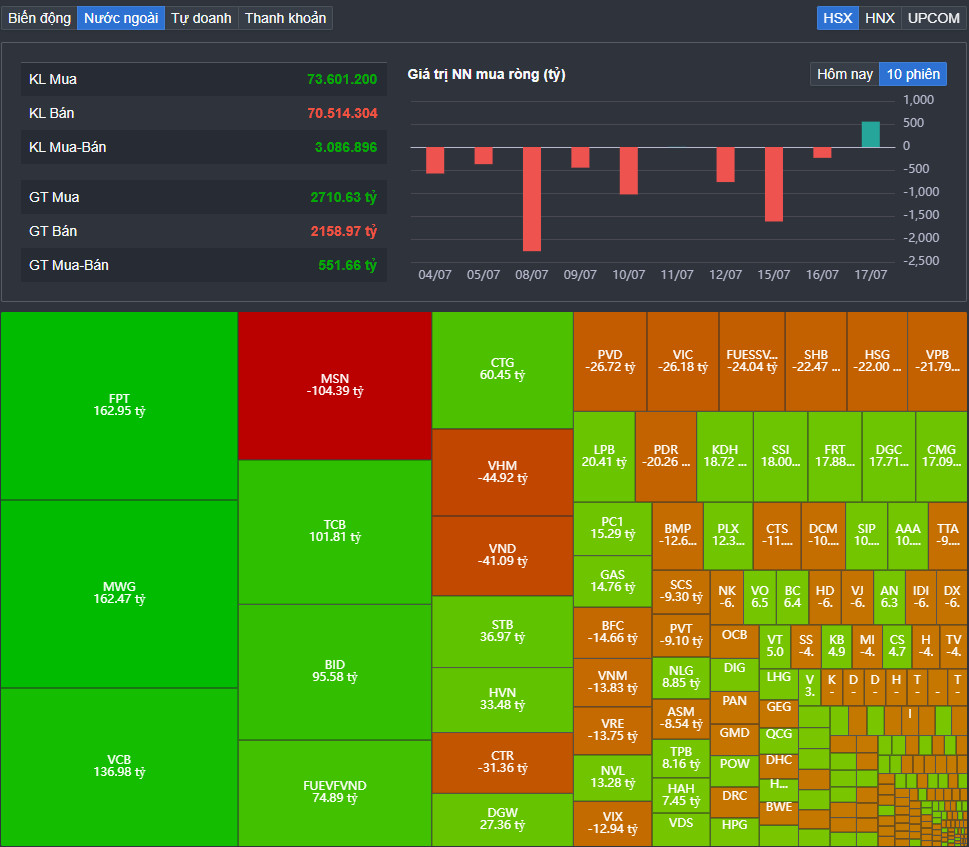

In the mid-afternoon session, a series of stocks were sold off despite the "king" stocks going up. VN-Index "fell" 30 points in less than 30 minutes. The bright spot of today's session was that foreign investors returned to net buying.

After a session of recovery in both points and liquidity, on July 17, the market performance remained relatively cautious as the differentiation was very strong. In particular, the strong breakthrough of many banking stocks contributed to maintaining the green color of the VN-Index.

However, unexpected developments occurred at the end of the session when selling pressure in many stock sectors increased sharply, causing the indices to plummet. Despite the support of the "king" stocks, the VN-Index still closed with a sharp decline.

Regarding the banking group, stocks such as TCB, MBB, BID, STB, ACB and CTG all increased in price today. MBB was at one point the bank stock with the strongest increase when it was pulled up to the ceiling price, but due to the strong fluctuations of the general market, this stock cooled down and only increased by 4.03%. TCB surprised everyone when it increased by 4.41% to 23,700 VND/share and was the stock that contributed the most positively to the VN-Index with 1.71 points. MBB contributed 1.22 points. BID and CTG contributed 1.18 points and 0.65 points respectively. BID closed up 1.8% and 1.54%. In the VN30 group, there were only 9 stocks that increased in price and all were bank stocks.

In the whole market, banking stocks were the rare stocks that traded actively, while most of them were "dumped" heavily in today's session. Not only midcap stocks, even bluechip stocks like POW and GVR also plummeted. Both stocks closed at the floor price. GVR took away 2.58 points from the VN-Index. HVN had its second consecutive floor price drop and took away 1.16 points from the VN-Index.

Midcap stocks such as DIG, TCH, CSV and ELC were all pulled down to the floor price. PDR fell 6.5%, DCM fell 5.4%, VGS fell 9.05%. The crash at the end of the session was too fast and strong, along with being blinded by the increase in banking flows, so many investors were unable to react in time, causing a sell-off at the end of the session. Tomorrow (July 18) is also the expiration date of the VN30 index futures contract for July, so strong fluctuations in the previous sessions were predicted by many investors, but being "surprised" at the end of the session like today is almost out of the scenario.

|

| GVR contributed 2.58 points of decrease in the session on July 17. |

At the end of the trading session, VN-Index decreased by 12.52 points (-0.98%) to 1,268.66 points. The entire floor had 109 stocks increasing, 369 stocks decreasing and 33 stocks remaining unchanged. HNX-Index decreased by 4.01 points (-1.64%) to 240.9 points. The entire floor had 33 stocks increasing, 150 stocks decreasing and 45 stocks remaining unchanged. UPCoM-Index decreased by 0.99 points (-1.01%) to 97.27 points.

Total trading volume on HoSE reached 1.23 billion shares, up 79% compared to yesterday's session, equivalent to a trading value of VND29,327 billion. Trading value on HNX and UPCoM reached VND2,152 billion and VND1,601 billion, respectively.

MBB topped the market's order matching list with 72 million units. SHB and DIG matched 48 million units and 35.5 million units, respectively.

|

| Foreign transactions became the bright spot in today's session. |

Foreign investors returned to net buying VND550 billion on HoSE, while net buying VND16 billion on HNX and VND57 billion on UPCoM. FPT was the stock that foreign investors bought the most in the market with VND163 billion. MWG was also net bought VND162 billion. VCB and TCB were both net bought over VND100 billion. In the opposite direction, MSN was the most net sold with VND104 billion. VHM and VND were both net sold over VND40 billion.

Source: https://baodautu.vn/bank-stocks-cannot-gain-market-stocks-are-disputed-d220242.html

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)