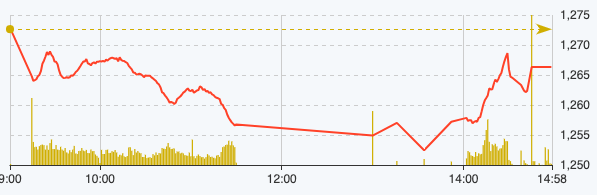

The aftershocks from yesterday's session still lingered, causing the market to quickly drop nearly ten points after opening. Widespread selling pressure caused the market to hover around the 1,265 point mark, but the selling pressure was not too strong, so the stocks did not fall too much.

After a period of strong growth since the beginning of the year,FPT has been adjusted and is one of the reasons for the market decline. PSH also fell to the floor after the news that 4 individuals were fined 6 billion VND for manipulating the stock market for this stock.

At the end of the morning session on May 30, VN-Index decreased by 15.81 points, equivalent to 1.24% to 1,256.83 points. The entire floor had 77 stocks increasing and 345 stocks decreasing.

VN-Index performance on May 30 (Source: FireAnt).

In the afternoon session, investor sentiment was less negative, helping the general index narrow its decline. Green also appeared more on the electronic board.

At the end of trading on May 30, VN-Index decreased by 6.32 points, equivalent to 0.5% to 1,266.32 points. The entire floor had 156 stocks increasing, 277 stocks decreasing, and 70 stocks remaining unchanged.

HNX-Index decreased 0.14 points to 244.01 points. The entire floor had 78 stocks increasing, 87 stocks decreasing and 65 stocks remaining unchanged. UPCoM-Index decreased 0.12 points to 95.8 points.

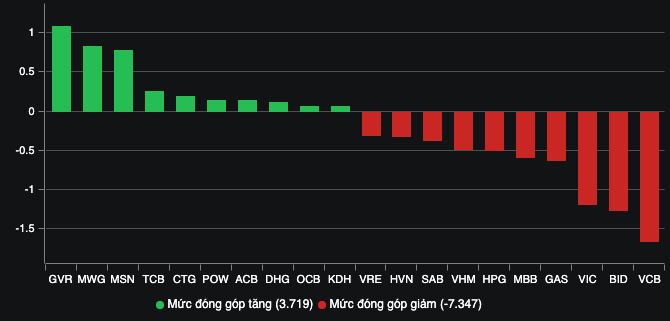

The pair VCB and BID led the market decline, taking away a total of 2.9 points. MBB and SAB were also in the top 10 negatively affecting the market, taking away 1 point. On the contrary, TCB, CTG,ACB , and OCB were in the top 10, pulling up the market with a total contribution of 0.7 points.

The trio of Vingroup stocks negatively affected the market by taking away a total of 1.9 points, with VIC alone taking away nearly 1.2 points. In the same direction in the real estate group, DIG, PDR, KBC, HPX, SZC, IJC, and IDC also ended the session in red. Meanwhile, TCB, HQC, HDG, CEO, ASM, LDG, ITA, DXS, BCR, and HDC ended the session with gains.

After yesterday's strong correction session, Apec stocks regained their "form" when IDJ increased to the ceiling price of 8,000 VND/share, APS increased to the ceiling price of 8,800 VND/share, API increased by 7.84% to 11,000 VND/share. Before ending the session positively, these three also decreased sharply in the morning session, with API at one point hitting the floor.

Vietnam Airlines' HVN stock has reversed its decline after hitting a peak and having a series of 6 consecutive sessions of increase from the price range of 22,600 VND/share. At the end of the session on May 30, HVN decreased by 2.12% to 27,700 VND/share and took away more than 0.3 points from the market. Vietjet Airlines' rival VJC also decreased by 0.83% to 107,000 VND/share.

Codes that affect the market.

The total value of matched orders in today's session was VND31,631 billion, up 9% compared to yesterday, of which the value of matched orders on HoSE reached VND25,853 billion. In the VN30 group, liquidity reached VND9,846 billion.

Foreign investors continued to net sell for the 5th session with a value of 1,353 billion VND today, of which this group disbursed 1,514 billion VND and sold 2,867 billion VND.

The codes that were sold heavily were MSR 1,627 billion VND, MBB 219 billion VND, FPT 203 billion VND, VND 177 billion VND, VCB 113 billion VND,... On the contrary, the codes that were mainly bought were PVT 45 billion VND, TCB 42 billion VND, HVN 37 billion VND, DBC 37 billion VND, BAF 28 billion VND,... .

Source: https://www.nguoiduatin.vn/co-phieu-ngan-hang-hut-hoi-ho-apec-lay-lai-phong-do-a666095.html

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765253019536_a1-bnd-0983-4829-jpg.webp&w=3840&q=75)

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

Comment (0)