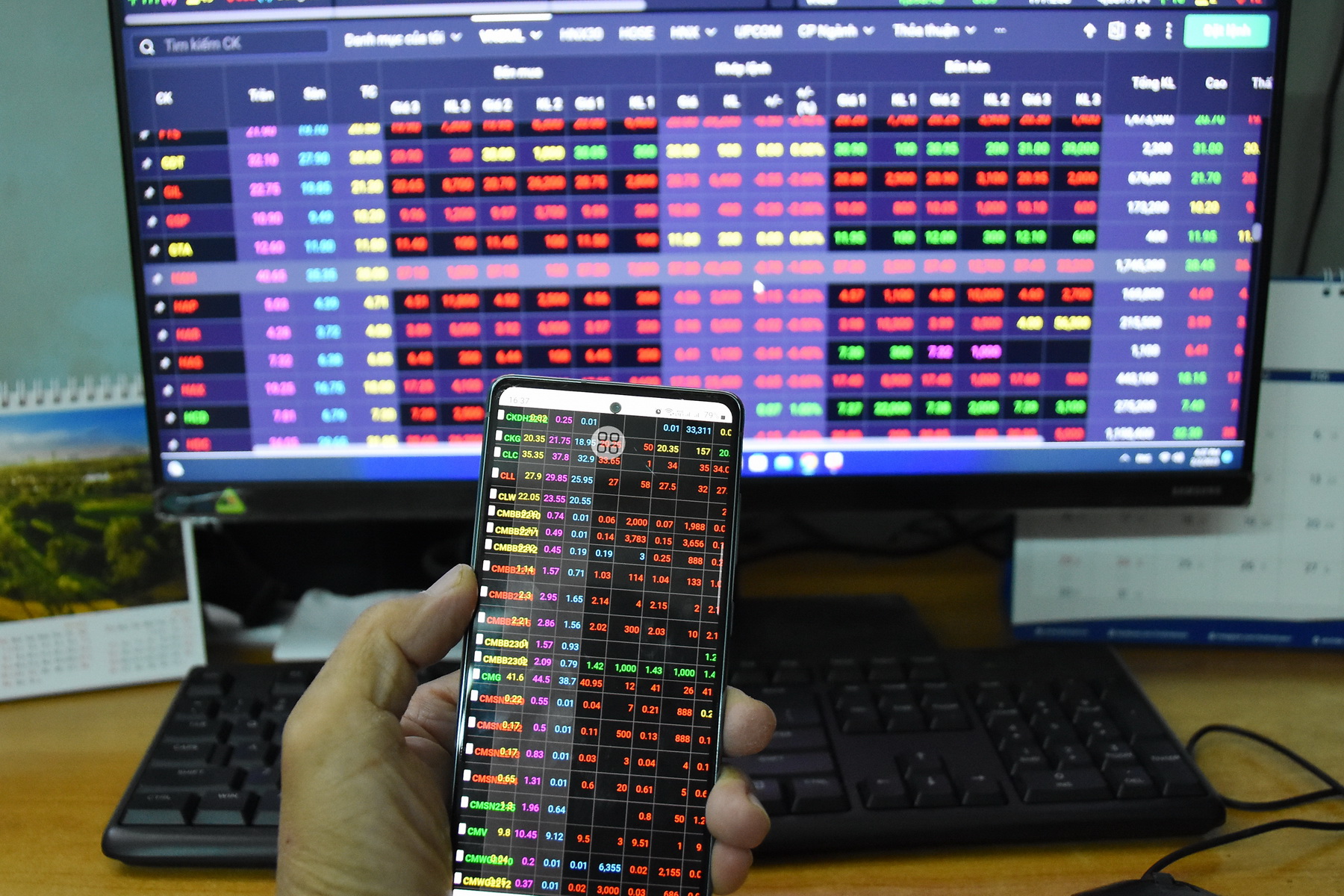

At the close of trading on September 5th, the VN-Index closed at 1,268 points, down 7.5 points (Photo courtesy).

Early buying pressure helped the market open in positive territory on September 5th. The VN-Index recovered well in the first half of the morning session, thanks to the contributions of two large-cap stocks, VIC and VHM.

However, in the latter half of the morning session, the general indices showed signs of fluctuation, narrowing their range due to hesitant capital flows as foreign investors continuously sold off shares.

Increased selling pressure in the afternoon session caused the VN-Index to gradually decline. In particular, large-cap stocks, most notably banking stocks, were heavily sold off.

Specifically, MBB shares fell 1.8%, VCB nearly 1%,ACB 0.6%, CTG 0.8%, STB 1.6%, etc., dragging down many other stock groups. Therefore, many investors believe that the volatility of banking stocks will have a strong impact on the market in the upcoming trading session.

At the close of trading, the VN-Index settled at 1,268 points, down 7.5 points, or 0.59%. However, a bright spot in the session was the surge in Vingroup stocks, with VHM rising nearly 3% and VIC increasing nearly 2.4%, helping to limit the market's decline.

Rong Viet Securities (VDSC) noted that liquidity on September 5th increased compared to the previous session, indicating that supply is still putting pressure on the market while capital flows remain cautious. A reversal signal and a drop below the 1,270 point level could put downward pressure on the market in the next trading session.

However, VCBS Securities Company stated that while the market continues to correct, the pressure is not yet too great because demand for stocks remains. Therefore, investors should remain calm, maintain their stock holdings, closely monitor market developments, and wait for clearer signals to buy stocks at good prices during volatile sessions.

Source: https://nld.com.vn/chung-khoan-ngay-mai-6-9-co-phieu-nao-chi-phoi-thi-truong-196240905173516776.htm

![[Photo] General Secretary To Lam works and extends New Year greetings to the Party Committee, government and people of Dak Lak province.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/02/11/1770808701306_ndo_tl_img-4099-5201-jpg.webp)

Comment (0)