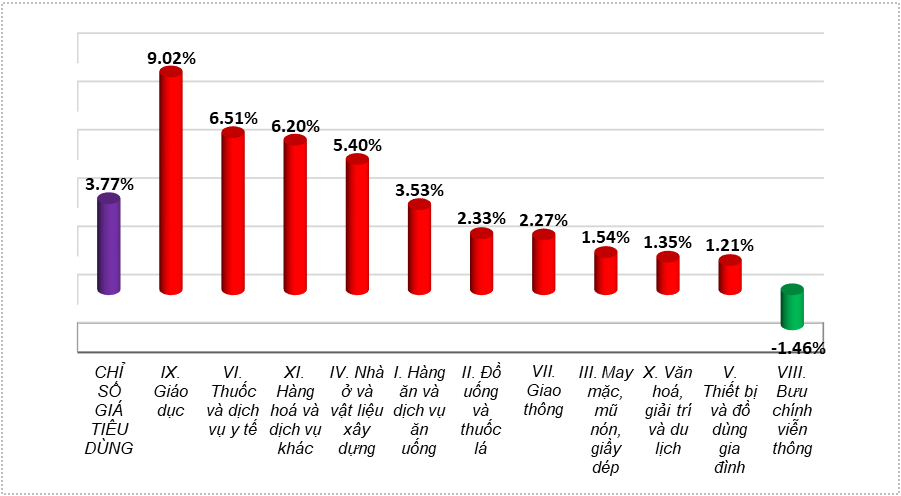

Opportunities from the market Vietnam's economy and consumer market are on the path to a strong recovery from the low base in 2023. Accordingly, the group of manufacturing and retail stocks will benefit directly, attracting cash flow from investors, creating momentum for stock prices to increase. This is one of the reasons for the positive impact on Masan (MSN) stock price. In 2024, financial institutions have a common forecast for Vietnam's economic recovery. The International Monetary Fund, the World Bank and the Asian Development Bank forecast that Vietnam's economy will grow by 6.9%, 5.5% and 6% in 2024. Accordingly, Vietnam continues to be one of the fastest growing countries in the world. Compared to some countries in the region, Thailand's growth is expected to be from 2.7% to 3.7%, Indonesia from 4.9% to 5%, Singapore from 2.1% to 4.8% and Malaysia from 4% to 4.9%,... Vietnam shows a stronger recovery momentum and the bright spot may come from the consumer and retail sectors. According to recent data from the General Statistics Office, the consumer price index (CPI) in the first quarter of 2024 increased by 3.77% over the same period in 2023. Of the 11 main consumer goods groups, 10 groups increased in price and 1 group decreased in price.

Source: https://www.masangroup.com/vi/news/invest-in-vietnam/With-abundant-liquidity-Masan-stock-is-a-quality-investment-in-2024.html

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Video] 24-hour news on May 9, 2025: General Secretary To Lam officially visits the Russian Federation and attends the 80th anniversary of Victory Day in the Great Patriotic War](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5eaa6504a96747708f2cb7b1a7471fb9)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

Comment (0)