At the close of trading on June 24, the VN-Index fell 27.9 points (-2.18%), closing at 1,254 points.

Vietnamese stocks continued to show caution at the opening of trading on June 24th. After a brief period of slight gains, the market quickly retreated into negative territory. The weak recovery efforts during the session led to a gradual decline in the market.

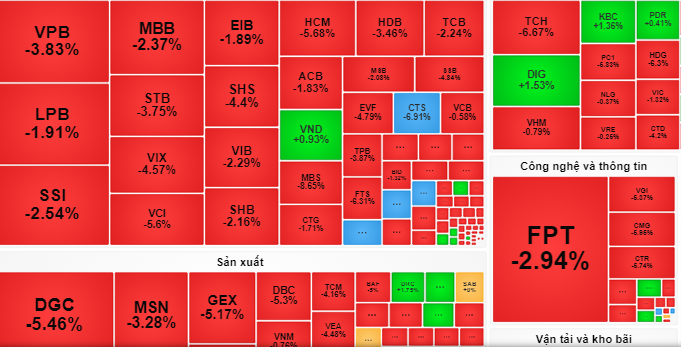

Throughout the trading session, the VN30 index (30 large-cap stocks) experienced heavy selling pressure. As a result, 28 stocks declined, including SSB (-4.8%), GVR (-4.5%), TPB (-3.9%), VPB (-3.8%), STB (-3.8%), etc., and this trend spread to many other stocks.

Accordingly, most sectors were in the red, with a significant number of declining stocks. Technology, securities, banking, and retail sectors were having a negative impact on the market.

Foreign investors continued to be net sellers on the HoSE exchange, with a value of 925 billion VND. Specifically, foreign investors heavily sold shares ofFPT (-589.6 billion VND), NLG (-64.3 billion VND), SSI (-57.9 billion VND), HDB (-57.5 billion VND), VRE (-55.9 billion VND), etc.

At the close of trading, the VN-Index fell 27.9 points (-2.18%), closing at 1,254 points. Liquidity on the HoSE increased with 1.25 billion shares successfully traded.

Rong Viet Securities Company noted that liquidity increased compared to previous sessions, indicating a strong supply of shares, putting significant pressure on the market. Therefore, investors can "watch out" for favorable price levels of some stocks for short-term trading, considering the market's recovery to take profits.

Meanwhile, VCBS Securities Company noted that selling pressure is widespread across many stock groups. "Investors should not use margin trading at this time, limit new purchases, and patiently wait for signs of market recovery," VCBS Securities Company advised.

Source: https://nld.com.vn/chung-khoan-ngay-mai-25-6-co-phieu-lon-con-bi-ban-manh-196240624181522594.htm

![[Photo] General Secretary To Lam receives the Special Envoy of General Secretary and President of China Xi Jinping](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F30%2F1769759383835_a1-bnd-5347-7855-jpg.webp&w=3840&q=75)

![OCOP during Tet season: [Part 3] Ultra-thin rice paper takes off.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F28%2F1769562783429_004-194121_651-081010.jpeg&w=3840&q=75)

![OCOP during Tet season: [Part 2] Hoa Thanh incense village glows red.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F27%2F1769480573807_505139049_683408031333867_2820052735775418136_n-180643_808-092229.jpeg&w=3840&q=75)

Comment (0)