Selling pressure spiked early in the afternoon of September 6, causing VNZ shares of VNG Corporation to hit the floor at times, losing 77,000 VND (equivalent to nearly 15%) to 437,800 VND/share.

Thus, VNZ stock price has dropped to a very low level compared to the record price of more than 1.56 million VND/share recorded on the morning of February 16, 2023.

The capitalization of VNG Corporation, of which Mr. Le Hong Minh is the CEO, has dropped to VND12,500 billion. At its peak, VNG's capitalization reached VND55.9 trillion (about USD2.3 billion).

At 1:35 p.m. on September 6, VNZ shares recovered slightly, down 55,000 VND to 460,000 VND/share. During the morning session, VNZ rose to 520,000 VND/share at times.

Vietnamese tech unicorn VNG is one of the stocks with strong fluctuations. VNG hit the ceiling for 11 consecutive sessions in early 2023 when it was first listed on the stock exchange, from the initial reference price of VND240,000 to over VND1.56 million/share - becoming the stock with the highest price of all time on the Vietnamese stock market.

However, the stock then fell sharply, at one point falling as much as 40% from its record price.

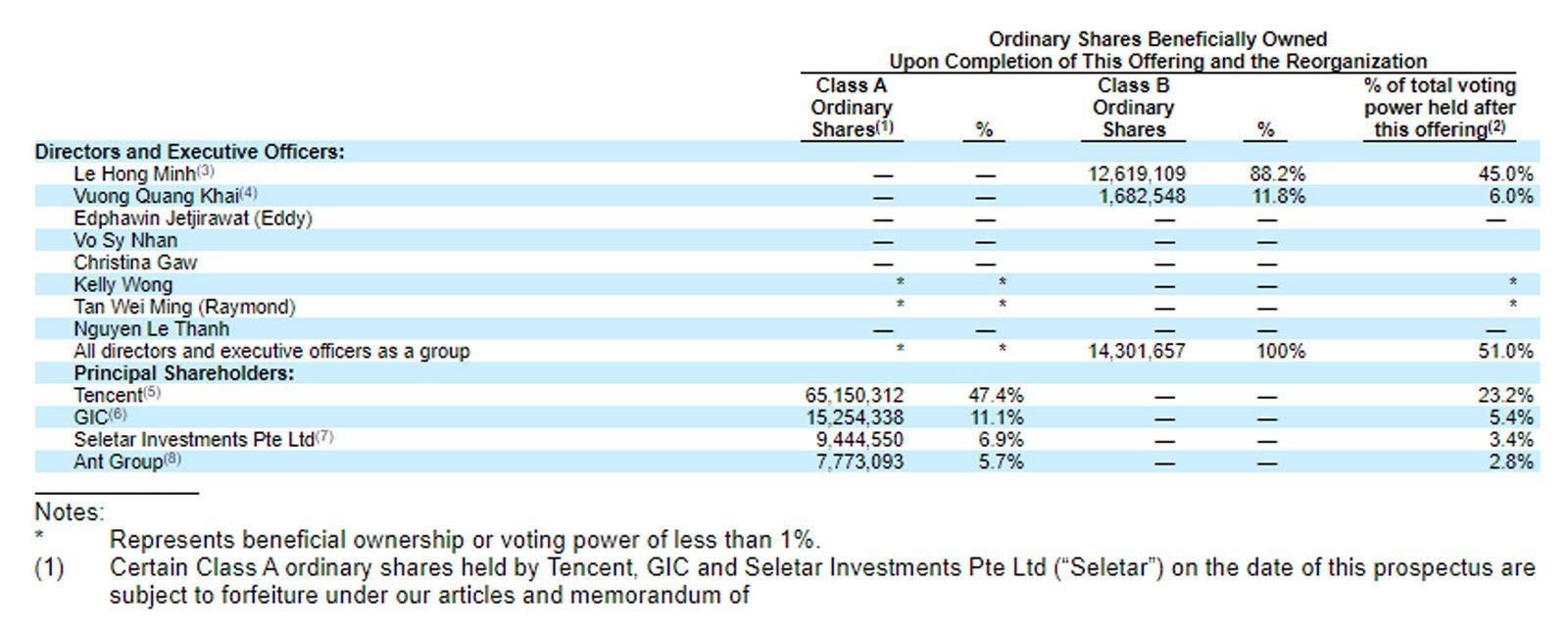

When the stock price was high, Mr. Le Hong Minh was once in the top 30 richest people on the stock exchange and ranked second in the top richest technology entrepreneurs, just behind Mr. Truong Gia Binh ( FPT chairman - who currently has 11,600 billion VND) and above Mr. and Mrs. Bui Quang Ngoc (FPT vice chairman), Truong Thi Thanh Thanh (former member of FPT Board of Directors).

VNZ is considered Vietnam's first "unicorn", a technology startup with a valuation of over 1 billion USD.

Despite a sharp decline, evaporating about 70% from its peak, VNZ is still the stock with the highest market price in the history of the Vietnamese stock market over the past 20 years.

VNZ's current capitalization is around VND12,500 billion, much lower than the valuation of USD1 billion in 2014 and the USD2.2 billion valuation of the Singapore Government 's Temasek Investment Fund in 2019.

Valuation of technology companies is not a conventional calculation. In the world, there are many cases of large losses but still very high valuations.

At the time of listing, VNZ had a concentrated shareholder structure with foreign shareholders holding 49%; Big V Technology JSC (19.8%) and Mr. Le Hong Minh 9.84%.

VNG is currently working on many major projects, including leading the field of online games and advertising. Meanwhile, ZaloPay is oriented to become the number 1 e-wallet in Vietnam. VNG Data Center is also a highly anticipated project.

In 2023, VNG recorded net revenue of VND 7,593 billion, a loss of more than VND 2,100 billion.

In the stock market, liquidity is still quite weak. Pillar stocks are divided. The VN-Index is flat at 1,268 points.

Billionaire Pham Nhat Vuong's stock group also slumped and is no longer a pillar for the market.

Source: https://vietnamnet.vn/co-phieu-vnz-cua-ctcp-vng-lao-doc-mat-bay-15-2319097.html

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

Comment (0)