At the close of trading on May 27, the VN Index closed at 1267 points, an increase of 5.7 points.

At the opening of trading, although many stocks saw slight gains, selling pressure soon emerged, causing the market to fluctuate around the VN-Index reference point.

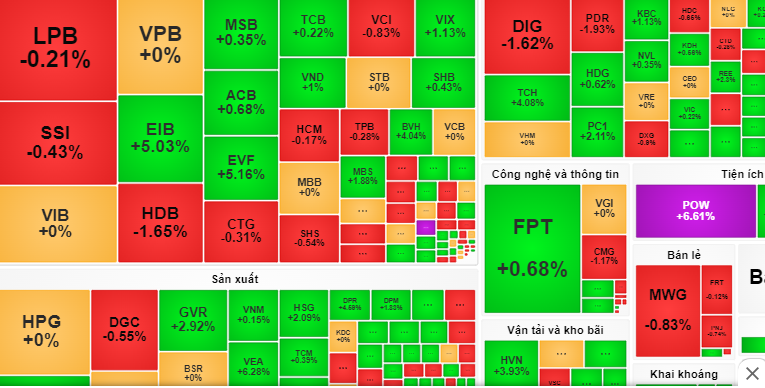

During the morning session, while banking stocks declined, the VN30 index (30 largest stocks) saw impressive gains.

Entering the afternoon session, active selling pressure continued to increase, causing the overall indices to turn red. Some stocks that had risen in the morning session, belonging to the rubber and banking sectors such as GVR, PHR, andACB, all narrowed their gains.

In this context, electricity sector stocks maintained their upward momentum, with POW rising 6.6% and TV2 increasing 5.5%...

Towards the end of the session, a sudden surge in buying pressure helped the market rebound. At the close, the VN Index stood at 1267 points, up 5.7 points.

VCBS Securities Company believes that the sharp increase in active buying liquidity near the end of the trading session is a necessary factor for the stock price to gain upward momentum.

"The market is showing signs of stabilization, and investors can take advantage of the fluctuations in each trading session to gradually disburse funds into stocks that attract capital in the electricity and rubber sectors..." - advised Mr. Nguyen Quoc Bao, senior analyst at VCBS Securities Company.

Meanwhile, Rong Viet Securities Company (VDSC) reported that liquidity on May 27th decreased sharply, with only over 726 million shares successfully traded. This indicates that buying and selling activity in the stock market is cooling down.

"The market will continue to explore the supply and demand of stocks in the next trading session. Investors need to carefully observe market developments and should avoid falling into an overbought state," VDSC forecasts and recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-28-5-co-phieu-con-giao-dich-giang-co-196240527173441133.htm

![[Photo] General Secretary To Lam attends the inauguration ceremony of Si Pa Phin multi-level boarding school.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F31%2F1769840655651_ndo_br_z7486540481209-f37c7e00a962aec2a061c64b7db569ef-jpg.webp&w=3840&q=75)

![OCOP during Tet season: [Part 3] Ultra-thin rice paper takes off.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F28%2F1769562783429_004-194121_651-081010.jpeg&w=3840&q=75)

![OCOP during Tet season: [Part 2] Hoa Thanh incense village glows red.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F27%2F1769480573807_505139049_683408031333867_2820052735775418136_n-180643_808-092229.jpeg&w=3840&q=75)

Comment (0)