- FPT – Sustainable through AI, telecommunications and data centers

- VCG – Technical breakthrough, potential to enter the acceleration wave

- REE – Benefiting from renewable energy development strategy

FPT – Sustainable through AI, telecommunications and data centers

FPT shares continue to receive positive assessments from MBS and SSI, although revenue in the first two months of 2025 increased by only 16.4%, lower than planned due to slow growth in the US market and a slowdown in the education sector. However, pre-tax profit still increased by 21% thanks to a cost-cutting strategy and effective application of AI to improve profit margins.

In the context of global instability due to US tax policy, FPT's information technology segment is less directly affected. At the same time, the telecommunications and data center segments have great room for growth. The company plans to open another data center in Ho Chi Minh City this year, in addition to expanding broadband services and digital advertising. In addition, the potential transfer of FOX shares to the Ministry of Public Security is also a long-term supporting factor.

MBS adjusted FPT's target price to VND146,700/share, but recommended keeping the stock in the portfolio and viewing corrections as accumulation opportunities for the medium and long term.

VCG – Technical breakthrough, potential to enter the acceleration wave

Tien Phong Securities Company (TPS) recommends buying VCG shares thanks to positive technical signals. The stock price has surpassed long-term resistance and reconfirmed the support zone, indicating the possibility of entering a new acceleration cycle. Since the third quarter of 2024, VCG has been continuously moving in an uptrend channel, and has now surpassed the channel, a sign that the bullish momentum is expanding.

Technical indicators such as MACD, RSI and MFI all give positive signals with levels >50, reflecting a strong return of cash flow. The price is also above all short- and medium-term MA lines. TPS recommends partial disbursement with small proportions at reasonable price zones to reduce risks in volatile market conditions.

REE – Benefiting from renewable energy development strategy

Vietcap Securities (VCSC) recommends buying REE shares due to expectations of great benefits from the new power plan VIII. According to the assessment, solar power capacity will increase 3 times compared to the old plan, in which floating solar power and the direct power purchase mechanism (DPPA) will help REE take advantage of the energy sector.

In addition, REE is also a stable enterprise in the fields of infrastructure investment and industrial park real estate, and is expected to maintain growth momentum when the economy recovers.

Summary

In the trading session on April 21, investors can pay special attention to three outstanding stocks: FPT with a sustainable growth strategy thanks to AI and telecommunications, VCG is exiting the uptrend channel to enter a new wave, and REE - a stock that benefits from the shift in national energy strategy. These are all opportunities with good potential for both the short and medium term, in the context of a struggling market that requires careful selection.

Source: https://baonghean.vn/stocks-can-quan-tam-21-4-fpt-vung-nen-tang-vcg-tang-toc-ree-don-song-dien-mat-troi-10295574.html

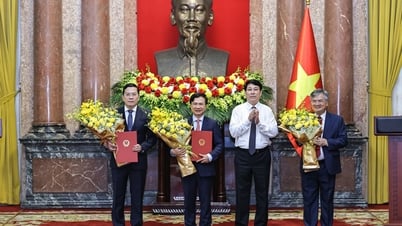

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

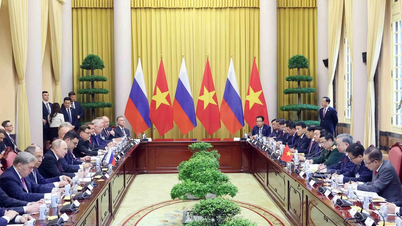

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)