A series of real estate stocks plummeted, causing investor sentiment to become negative. Vinhomes shares, after a breakout session thanks to supportive information yesterday, have fallen sharply again.

After a decline with recovering liquidity at the beginning of the week, on October 15, the market performance was similar to the previous session. The market rebounded well from the beginning of the session. However, the market lost steam immediately after that, pushing the indices below the reference level. The psychological zone of 1,290 - 1,300 points continued to cause great resistance to the market when selling pressure continuously increased as the VN - Index gradually approached.

At the end of the trading session, VN - Index decreased by 5.26 points ( -0.41%), down to 1,281.08 points. The entire floor had 280 stocks decreasing, 105 stocks increasing and 51 stocks remaining unchanged. HNX - Index decreased by 1.76 points ( -0.76%), down to 228.95 points. The entire floor had 48 stocks increasing, 93 stocks decreasing and 74 stocks remaining unchanged. UPCoM - Index decreased by 0.22 points ( -0.23%), down to 92.17 points.

Total trading volume on HoSE reached more than 712 million shares, worth VND16,629 billion, up 8% compared to the previous session, of which negotiated transactions contributed VND1,063 billion. Trading value on HNX and UPCoM reached VND990 billion and VND826 billion, respectively.

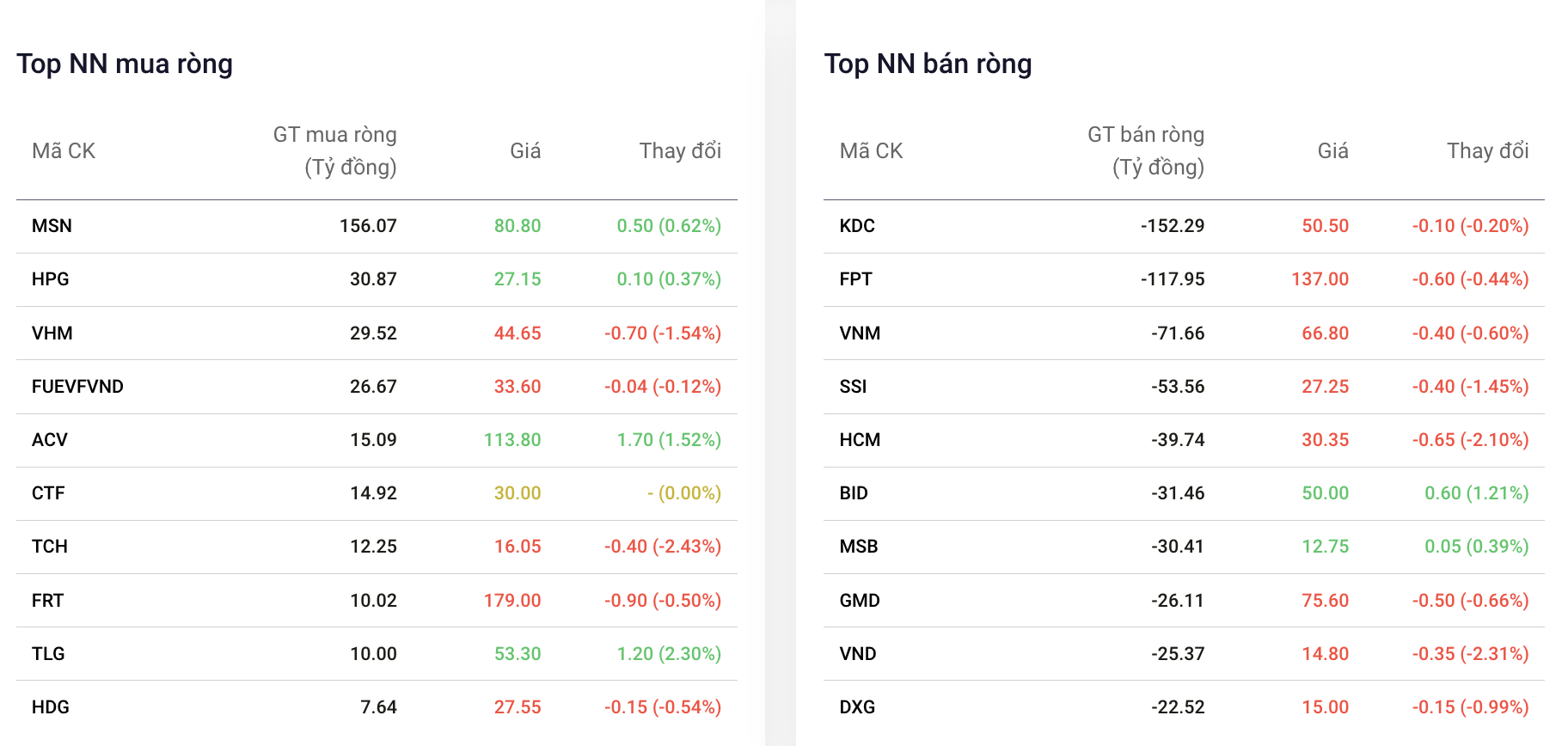

Foreign investors continued to net sell VND576 billion on HoSE and more than VND585 billion on the three exchanges. Of which, this capital flow net sold the most KDC code with VND152 billion. FPT and VNM were net sold VND118 billion and VND72 billion respectively. In the opposite direction, MSN was net bought the most with VND156 billion. HPG was behind but the net buying value was only VND31 billion.

|

| Foreign block transactions on October 15 |

The focus of today's session was on real estate stocks, of which DIG was the "culprit" that made investor sentiment negative. DIG suddenly plummeted despite the fact that no information about this company appeared. At one point, DIG fell by 6.6% and triggered selling pressure in many other stocks, especially those in the real estate group. DIG closed the session down 4.24% to VND20,350/share. Other real estate stocks such as PDR, TCH, NVL, NLG... were also in the red.

After yesterday's breakout session, VHM fell sharply again by 1.54% and took away 0.74 points from the VN - Index.

Not only the stocks of the "big guys" in the real estate industry, the VN30 group had 18 stocks decrease. Meanwhile, only 8 stocks increased and 4 stocks remained unchanged. PLX decreased sharply by 3.6% and was one of the stocks with the most negative impact on the VN - Index when it took away 0.49 points from the index. GVR also decreased by 1.52% and took away 0.53 points. A series of other stocks such as VIC, MBB, FPT, VNM... also decreased in price and negatively affected investor sentiment.

The securities group also recorded a negative trading session when red dominated. APG decreased by 3.94%, MBS decreased by 2.34%, VND decreased by 2.16%, HCM decreased by 2.1%, VCI decreased by 1.9%, SSI decreased by 1.45%.

On the other hand, BID attracted attention when it increased by 1.2% and was the most important factor in helping to restrain the decline of VN - Index. BID contributed 0.83 points to this index. Besides, some banking stocks such as VPB, CTG or VIB also kept the green color.

Some stocks that hit the ceiling are in the mid- and small-cap group such as QCG, VPH or HAR. Of which, QCG hit the ceiling for the second consecutive session. This stock has increased by about 25.4% after the last 5 trading sessions.

Source: https://baodautu.vn/co-phieu-bat-dong-san-lao-doc-vn-index-mat-moc-1290-diem-d227515.html

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)