Experts advise to carefully consider buying land in the suburbs because it reduces asset diversity when you already have two houses in the inner city and a piece of land in the countryside.

I am 38 years old, my wife is 33 years old, we have a 5-year-old child and she is pregnant with our second child. I am the only one who works in the family, my wife stays at home and does online business, mainly housework. My income from a stable job is about 100-120 million VND per month and the family expenses are about 50 million.

Currently, I have 2 houses in the inner city, each worth about 6-7 billion VND and rent each house for 12 million VND per month, totaling 24 million VND. The whole family is renting an apartment for 13 million VND per month. I also have a piece of land in the countryside worth about 1 billion VND and savings of 2 billion VND.

Savings interest rates are low, so this year I want to withdraw 2 billion in savings to invest. I can borrow more with good interest rates from foreign banks (fixed for 3 years with interest rates of 7-8% per year) and repay the debt based on the remaining amount each month.

I mainly work for a salary, not good at business, can accept risks at a relatively acceptable level, do not know much about the real estate market such as suburban land... Up to now, I mainly save enough money to buy houses in the inner city to rent. I heard that this year is a good time to invest in suburban land, with the condition that it must be long-term 3-5 years. However, I am afraid that the second real estate tax law will be passed soon, people who own many real estates like me will have to pay a lot of tax.

Get expert advice on appropriate investment direction in the near future.

Thien Son

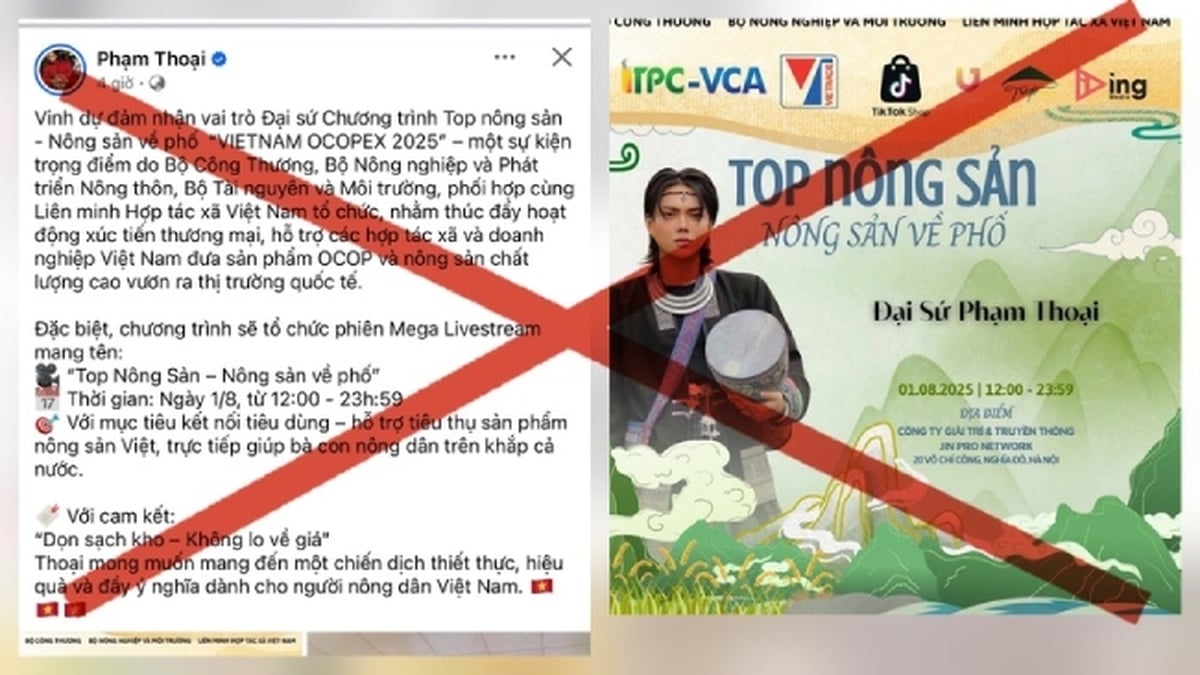

Real estate in the eastern part of Ho Chi Minh City, Thu Duc City, November 2023. Photo: Quynh Tran

Consultant:

With the above information, I will provide some analysis and advice to help you have an overview of your family's financial health. From there, you can make appropriate investment decisions.

First, let's analyze your family's financial health. Your family's total income from salary is about 110 million VND per month (average), the rental income from two houses is 24 million. Total family expenses are about 50 million VND per month (assuming that it includes the apartment rent of 13 million, essential spending needs and benefits). Thus, the family's monthly surplus will be 84 million VND per month.

Your family has a pretty good surplus, with a ratio of up to 63%. However, with the older child about to enter first grade and the family welcoming a new member, financial needs will increase, especially education and health care costs. This requires more flexibility and detailed planning to ensure long-term financial security for the family.

Next, we evaluate the current asset portfolio. Two inner-city houses worth 12 billion, land in the countryside worth 1 billion, savings worth 2 billion. Total assets are currently 15 billion and no debt.

Your family currently holds a significant asset portfolio, mainly concentrated in real estate (87%). Investment performance is not high because savings interest rates are falling to 5-6% per year for 1-year term deposits and the price growth rate of inner-city houses according to FIDT's monitoring data is fluctuating at an average of 8-9% per year. Although real estate usually brings higher returns than savings interest rates, focusing too much on one type of asset also carries risks and can reduce the liquidity of the investment portfolio.

Lending interest rates are currently low, only 5-8% during the preferential period and 9.5-10% a year after the preferential period. This is an opportunity to use financial leverage to increase investment performance.

Next, we discuss the factors to consider when investing in suburban real estate. You intend to withdraw 2 billion from your savings, plus a bank loan to hold suburban real estate for 5 years. With this approach, you will diversify your real estate portfolio, the growth rate of suburban real estate fluctuates at 12-15% per year, but it will reduce the liquidity of the asset class you are holding.

Investing in suburban land when you do not have the knowledge and time, there will be a big risk of not choosing a land with real potential. In addition, you may also encounter risks related to the legality, liquidity and growth potential of that land. Therefore, finding good brokers or entrusting reputable organizations to search for potential suburban real estate is a factor to consider.

The possibility of high taxes on second properties will also be a factor to consider. Currently, according to the roadmap, the proposal to develop a Real Estate Tax Law will be submitted to the National Assembly for comments at the 8th session (October 2024) and approved at the 9th session (May 2025). It is unclear when the law will be implemented and the specific tax schedule for transfers. Diversifying your investment portfolio and allocating an appropriate amount of money in your overall financial picture to suburban land will limit the impact of taxes on assets.

I would like to add more about financial protection solutions. You did not specify whether the whole family has life insurance or not, so my advice is to make sure to have life insurance and health insurance for each family member. Insurance will protect you from unforeseen risks, while maintaining the stability of your income stream. The recommended annual contribution level will be 5-8% of total income in the year.

The next asset class you will need to prepare before continuing to invest is to set aside a reserve for your family to ensure financial security in case of emergency, usually from 3-6 months of spending. Specifically in the case of your family, it will fall to 150-300 million VND. This reserve can be divided into savings packages with terms of 1 month, 6 months and 12 months.

Regarding investment solutions, I have some analysis as follows. Currently, the economy is moving into a new cycle from recovery - growth - saturation - recession. Each phase will have each asset class with suitable characteristics to grow well during that period.

In the recovery phase of the new cycle, securities in general and stocks in particular are expected to grow the best. Therefore, to have good asset growth performance, you should have a stock asset class in the next 2-3 years. If you do not have time, experience and a relatively high risk appetite, you can invest in fund certificates, accumulate stocks or entrust your investment to reputable financial institutions and choose investment segments that suit your risk.

Gold will also be an investment channel suitable for risk appetite. Currently, the precious metal is anchored at a fairly high price and has fluctuations. At suitable gold price stages, you can also consider holding. However, you should not invest more than 10% of the total assets of the family.

Ultimately, every investment decision you make should be considered within the framework of an overall financial plan, designed to take into account your risk tolerance, long-term financial goals, and immediate family needs. Hopefully, the above advice will help you in managing and developing your personal finances.

Vu Thi Huong

Personal Financial Planning Expert

FIDT Investment Consulting and Asset Management Company

Source link

Comment (0)