Previously, Mr. Galbraith spent decades as a key leader at Bank Central Asia (BCA - Indonesia), contributing to BCA's successful digital transformation and becoming one of the most valuable banking brands in Southeast Asia, according to Kantar BrandZ.

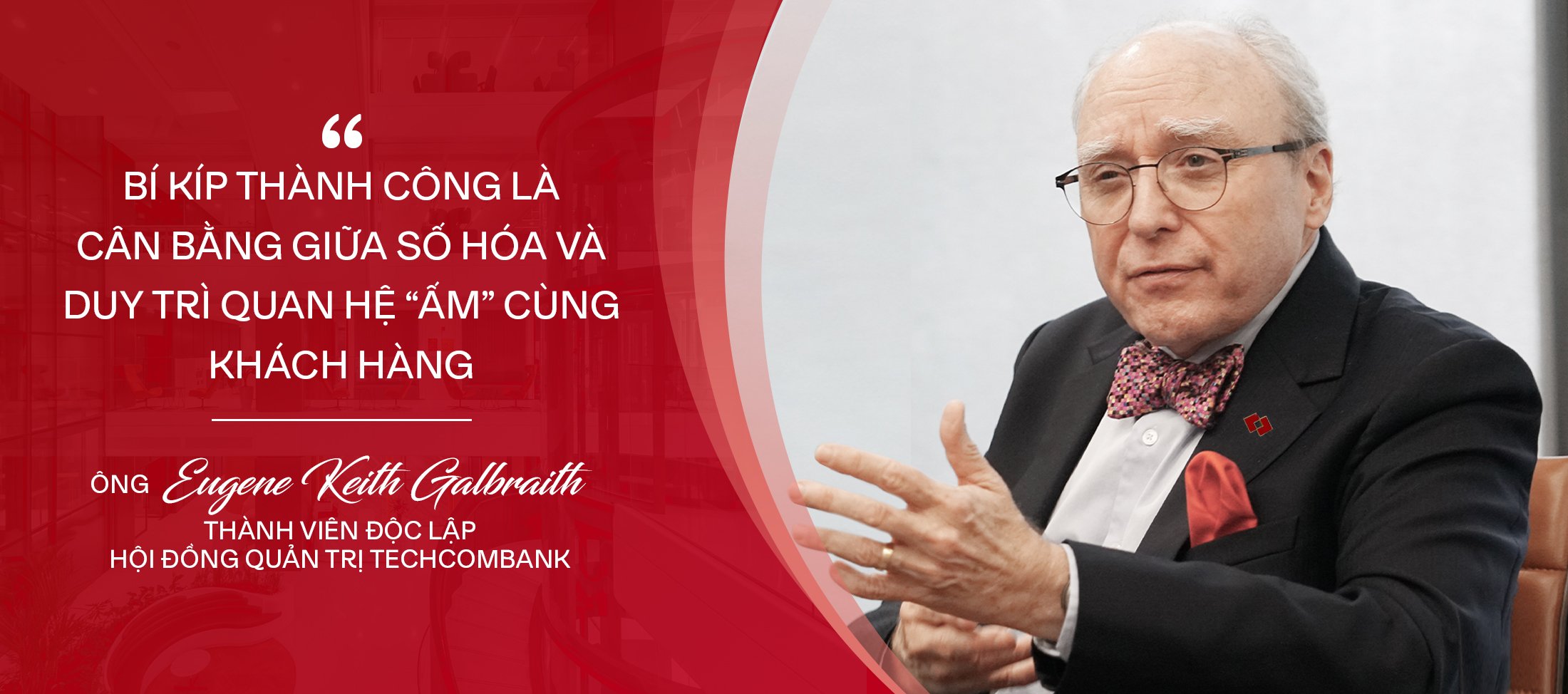

At the end of April 2024, Techcombank's Board of Directors welcomed an independent member: Mr. Galbraith with 40 years of experience in the world's banking and finance sector. Before Techcombank, Mr. Galbraith was the Chairman of the Board of Trustees and Deputy General Director of BCA Bank, a senior advisor to the Indonesian Ministry of Finance, and General Director of ABN AMRO Asia...

In 2018-2019, when he first had the opportunity to visit Vietnam, he fell in love with the "S-shaped land". "It was also a coincidence that, through working sessions with partners, including McKinsey, I learned about Techcombank as a very successful Vietnamese private bank, always looking for new directions and models, and especially, having a talented workforce that respects dissenting opinions" - Mr. Galbraith shared.

His long-term relationship with Vietnam has come when he became a new independent member of Techcombank's Board of Directors. The veteran banker expressed: "This is a valuable opportunity for me to learn about the dynamic country of Vietnam, while contributing to Techcombank's successful journey to reach the regional level."

Building trust

As a book lover, Mr. Eugene is very fond of the author Marshall McLuhan's sharing in the book "Understanding Media", when he said that there is a strong similarity between the new generation media philosophy and the development orientation of banking services. "Understanding Media" pointed out that in the new media world, "The medium is the message".

Mr. Galbraith believes that the goal of both sides is to "build trust". "That philosophy is very true in the context of the explosion of financial digital transformation, because "the medium is the message" to customers. When it comes to digitalization, people often think of cost savings and efficiency, but in fact, banking is a business of trust. Therefore, it is necessary to focus on maintaining "warm medium" to engage customers, instead of just promoting "digital medium" that is fast, convenient but lacks engagement", he shared.

This is also the motto of Techcombank's Board of Directors, when pioneering digital solutions are all aimed at enhancing the experience and personalizing customer touchpoints.

The numbers prove it! In 2023, Techcombank attracted 2.6 million new customers, an increase of about 2.3 times compared to the previous year, and nearly 50% of these customers came from online channels. In particular, since 2016, the Bank has promoted the "customer-centric" philosophy with digital interactions playing an important role. According to the end of 2023 data, up to 94% of personal transactions were conducted on digital channels, and 88% of corporate customers were active on digital platforms.

New value propositions and a series of digital innovations introduced in 2023 have helped Techcombank become the primary transaction bank for many customers.

By maximizing innovation and modern technology, Techcombank has built a proprietary data platform 'Data Lake' - described by Mr. Eugene as "classy, modern and commendable" - to bring better experiences to customers.

He was also impressed that Techcombank has integrated deep data analytics to build a more comprehensive understanding of customers, provide appropriate value propositions, and link data with the latest AI technologies to deliver hyper-personalized experiences.

Formula for success

When joining Techcombank, Mr. Galbraith was extremely impressed with the openness and willingness to accept new ideas of the Bank's Board of Directors, which is probably what created Techcombank's spectacular growth in recent years.

In addition to a large number of talented domestic personnel, Techcombank also recruits many foreign experts and overseas Vietnamese communities to return to contribute to the country. For example, in 2022 and 2023, the Bank organized a series of recruitment roadshows in Singapore, London (UK), San Francisco (USA) and Sydney (Australia) with the aim of attracting Vietnamese talents working in the world's leading financial markets, possessing rare professional capabilities.

“When you bring together talent with experience and insight both domestically and internationally, you have a recipe for success,” said Mr. Galbraith.

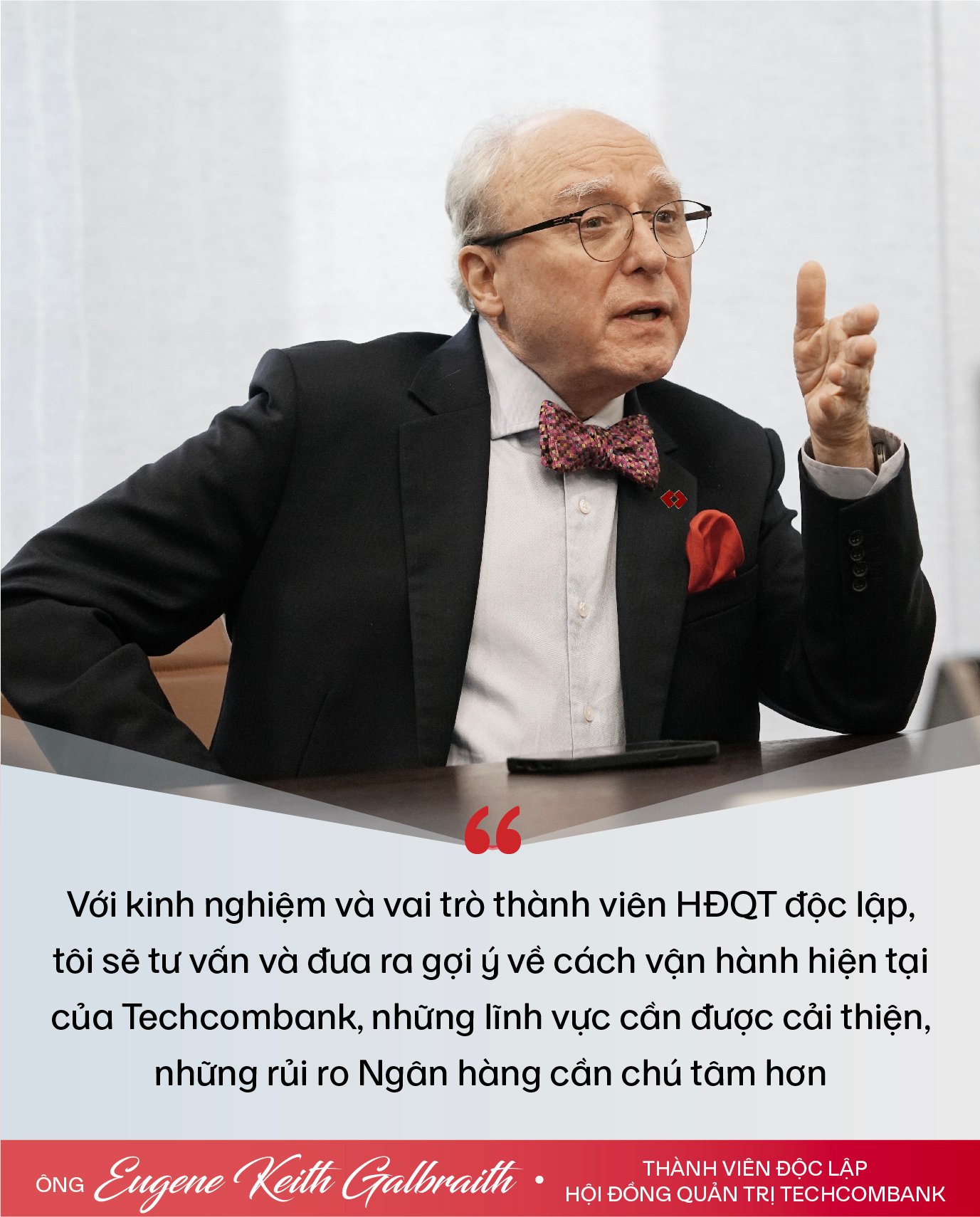

For his part, Mr. Galbraith believes that his decades of experience in the international and regional banking and financial markets will add the "ingredients" to create success for Techcombank's breakthrough goals. "For me, success is like a delicious dish, made from unique and attractive ingredients and spices. My contribution, therefore, is like the necessary ingredients. I will maintain an independent voice and perspective, to add international experience to realize the ambitious business and strategic goals set by the Board of Directors and the Management Board of Techcombank" - he shared.

In addition, thanks to its good debt structure, Techcombank has abundant capital to lend. This means that the bank can lend to customers at cheaper rates, thanks to its market-leading demand deposits (CASA) - just like how BCA has won over customers. These similarities will help his experience accumulated during his time at BCA to be very useful for Techcombank.

Mr. Eugene Keith Galbraith joins Techcombank's Board of Directors with extensive experience and knowledge in the banking sector. He has 17 years of experience at BCA - one of the largest banks in Southeast Asia - as Deputy General Director, and Chairman of the Board of Commissioners. Before that, he was a senior advisor to the Indonesian Ministry of Finance, and General Director of ABN AMRO Asia. With similarities between Techcombank and BCA in terms of business model, strategy of focusing on the middle and high-income customer segment, maintaining the leading CASA position in the industry as well as leading digital transformation, Mr. Eugene is expected to help Techcombank strengthen corporate governance and accelerate the digitalization process, to become a top bank in the region.

Source: https://thanhnien.vn/co-duyen-viet-nam-va-hanh-trinh-dinh-vi-gia-tri-moi-cung-techcombank-185240510172412234.htm

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)