According to the General Department of Taxation, entering 2024, it is forecasted that the economy will still face many difficulties due to fluctuations in the world's political and economic situation, which will continue to have significant impacts on the domestic economy. Therefore, there may be businesses leaving the market and losing their ability to pay, which will lead to more difficulties in tax debt enforcement.

Deputy Director General of the General Department of Taxation Dang Ngoc Minh suggested that the Department of Debt Management and Tax Debt Enforcement should pay attention to directing tax agencies to focus on a number of groups of tasks including: Resolutely implementing and fully applying tax debt enforcement measures to taxpayers who are subject to enforcement measures.

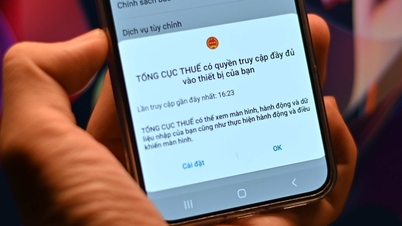

Strengthen the dissemination of legal policy documents to taxpayers as well as enforcement measures to improve compliance, voluntary tax payment, and tax debt prevention.

Publicly disclose information about taxpayers who are procrastinating in paying tax debts on newspapers, radio, and tax authority websites.

Continue to closely coordinate with local Party committees, authorities, relevant ministries and branches such as: Public Security, State Bank, Court, Market Management, Investment Planning, Natural Resources and Environment... in collecting tax arrears, especially handling and recovering arrears related to land, mineral exploitation rights fees,...

Focus on reviewing cases of abandoning business addresses, coordinate in transferring files of cases of intentional tax debt delay to the police to have strong sanctions for these cases to increase deterrence for tax debtors.

The Directors of the Tax Departments of provinces and centrally run cities must pay attention to improving the quality of the debt management team, and at the same time direct departments within the tax agency (legal, declaration, inspection - examination, household management, land management, etc.) to closely coordinate with the debt management department to ensure the implementation of debt management and tax debt enforcement is highly effective.

In addition, after receiving comments from tax departments, Deputy General Director Dang Ngoc Minh requested the Department of Debt Management and Tax Enforcement to preside over the collection and synthesis of recommendations, especially those related to the functions of investigation, asset seizure, etc., to soon submit to the General Department to submit to the Ministry of Finance to continue perfecting the policy mechanism in the coming time.

For the contents that need to be amended and supplemented in the Law on Tax Administration, it is necessary to comprehensively evaluate them to propose amendments and supplements to ensure they are suitable to the actual situation.

Source

![[Photo] General Secretary To Lam meets with General Secretary and President of Laos Thongloun Sisoulith](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761380913135_a1-bnd-4751-1374-7632-jpg.webp)

![[Photo] President Luong Cuong receives heads of delegations attending the signing ceremony of the Hanoi Convention](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761377309951_ndo_br_1-7006-jpg.webp)

![[Photo] President Luong Cuong and United Nations Secretary-General Antonio Guterres chaired the signing ceremony of the Hanoi Convention.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761370409249_ndo_br_1-1794-jpg.webp)

![[Photo] General Secretary To Lam receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/25/1761379090768_image.jpeg)

Comment (0)