Experts recommend delaying the tax increase on alcoholic beverages to stabilize the market.

At the seminar "Revising Taxes to Promote Business Activities" organized by Investment Newspaper on August 14th, experts argued that proposals to increase taxes need to be studied in practice, with a feasible roadmap and consideration of the businesses' ability to withstand the changes.

Policy stability is needed.

The draft Law on Special Consumption Tax (amended) is being prepared by the Ministry of Finance and is expected to be reviewed by the 15th National Assembly at its 8th session (October 2024) and passed at its 9th session (May 2025).

In particular, the Ministry of Finance proposed increasing the excise tax rate on alcoholic beverages and adding sugary soft drinks to the list of products subject to excise tax.

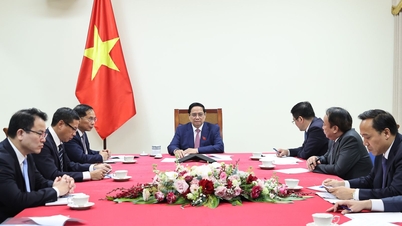

|

| The seminar "Revising Taxes to Boost Business Activities" was organized by Investment Newspaper on August 14th. (Photo: Chi Cuong) |

Speaking on this issue at the seminar, Ms. Nguyen Thi Cuc, President of the Vietnam Tax Consulting Association and former Deputy Director General of the General Department of Taxation, stated that it is necessary to carefully study the extent of the increase in tax rates as well as a reasonable increase roadmap to ensure the maintenance of production and business activities and the employment of workers in the supply chain from raw materials, production, trade, and food services.

At the same time, according to Ms. Cúc, carefully studying the extent and roadmap for increasing excise tax will also create conditions for market stability, helping businesses and consumers adapt to the gradual tax increase until 2030, avoiding shock from a rapid and sudden increase.

"Adjusting tax rates on alcoholic beverages should aim for a special consumption tax policy that harmonizes with objectives and is appropriate to the specific context. Increasing special consumption taxes at high and continuous levels is unlikely to achieve the stated goals. While tax increases may raise prices and limit alcohol production, they may not necessarily achieve the objective of reducing alcohol consumption."

For example, high tax increases lead to an increase in smuggled goods, and high-income consumers turn to smuggled alcohol and beer. Consumers in rural areas with low incomes switch to a self-sufficient, self-sufficient system, selling their own alcohol and blending products for profit, avoiding excise tax, and failing to guarantee product quality, thus affecting people's health,” Ms. Cúc analyzed.

Excise tax is an indirect tax, included in the selling price of alcoholic beverages. In principle, an increase in this tax will lead to a corresponding increase in the selling price of the product. However, curbing consumption does not depend solely on increasing the excise tax; many other measures are needed to ensure that goal is achieved.

"The implementation of Government Decree 100/2019/ND-CP on administrative penalties for traffic violations has significantly reduced the number of drivers operating vehicles while under the influence of alcohol, which is a testament to this," said the Chairman of the Vietnam Tax Consulting Association.

|

| Ms. Huong Vu, General Director of EY Vietnam Consulting Joint Stock Company. (Photo: Chi Cuong) |

Similarly, according to Ms. Huong Vu, General Director of EY Vietnam Consulting Joint Stock Company, for the alcoholic beverage industry, she supports the relative tax calculation method – which is also the method that Vietnam committed to when joining the WTO. “This method is not only suitable for the Vietnamese market but also ensures fairness between market segments, given the significant price difference between premium and mainstream beers,” Ms. Huong Vu said.

Regarding tax rates, Ms. Huong Vu emphasized the need for thorough research to harmonize the interests of producers, the government, and consumers. She argued that if regulatory agencies focus solely on increasing revenue without considering the rights of producers and consumers, it could lead to undesirable consequences such as reduced competitiveness of businesses, even the risk of bankruptcy, thereby reducing tax revenue.

"Tax rates should be gradually increased instead of suddenly rising to 70% or 80% as in the current draft. This would not only give manufacturers time to adjust but also ensure that it doesn't create a 'shock' for businesses and consumers," Ms. Huong Vu stated frankly.

Ensuring consumer interests

The sudden increase in taxes is one of the reasons consumers are switching to cheaper, lower-quality, domestically produced products. In fact, besides the official beer and liquor market, there is also an informal beer and liquor market that has flourished for many decades.

An estimate by the Central Institute for Economic Management Research (CIEM) in early 2022 showed that alcohol from the informal sector, specifically homemade and smuggled alcohol, amounted to approximately 385 million liters per year, with homemade alcohol accounting for 70 to 90% of this figure. And of course, with over 380 million liters of this alcohol, the State collects not a single penny in taxes.

When taxes on officially licensed alcoholic beverages are increased too rapidly, consumers tend to switch to more unofficial alcoholic products. Furthermore, historical data shows that sharp increases in excise taxes do not necessarily change consumer behavior.

|

| Mr. Nguyen Van Phung, former Director of the Department of Large Enterprise Tax Management (General Department of Taxation, Ministry of Finance). (Photo: Chi Cuong) |

At the seminar, Mr. Nguyen Van Phung, former Director of the Department of Large Enterprise Tax Management (General Department of Taxation, Ministry of Finance), provided information and statistics from 2003 to 2016 based on data from the Beverage Association, the Beer and Wine Association, and the General Department of Taxation. This shows that over the past 13 years, the average per capita consumption of beer/wine increased from 3.8 liters/person/year to 6.6 liters/person/year in the period from 2008 to 2010.

By 2016, the peak of the recent economic growth period, this consumption reached 8.3 liters per person per year. Thus, from 2003 to 2016, it is clear that the average per capita consumption of beer and alcohol has more than doubled.

"From that, it can be seen that increasing excise tax does not help change consumer behavior. Consumer behavior actually changed because of Decree 100. Thus, it is clear that administrative measures have a greater effect than taxes," Mr. Phung said, and suggested that administrative measures should be continued, because these measures have a much stronger impact than using tax tools.

Speaking on the sidelines of the seminar, Mr. Phung said that businesses and individuals are the entities that generate income, so tax collection must be appropriate for the people, in line with their income levels and consumption patterns.

In Vietnam, immediately applying an absolute or mixed approach would cause a shock and damage to businesses and consumers alike, because the majority of us have average incomes and lack the financial means to consume products priced at millions of dong per bottle of wine or hundreds of thousands of dong per bottle of beer.

"We can only consume products at a moderate and modest level, for example, 15,000 - 20,000 VND per can of beer. Therefore, applying a percentage-based tax is reasonable," Mr. Phung said.

Furthermore, Mr. Phung emphasized that when increasing excise tax, authorities need to conduct communication campaigns to help consumers accept the price increase. At the same time, this is to help businesses accept the impact on their production and business processes.

Source: https://baodautu.vn/chuyen-gia-kien-nghi-gian-lo-trinh-tang-thue-ruou-bia-de-on-dinh-thi-truong-d222415.html

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)