(NLDO) – Although there is unlikely to be a breakthrough, the price of SJC gold bars and gold rings is forecast to remain high or increase near the Lunar New Year 2025.

[embed]https://www.youtube.com/watch?v=x0lpAlEJklk[/embed]

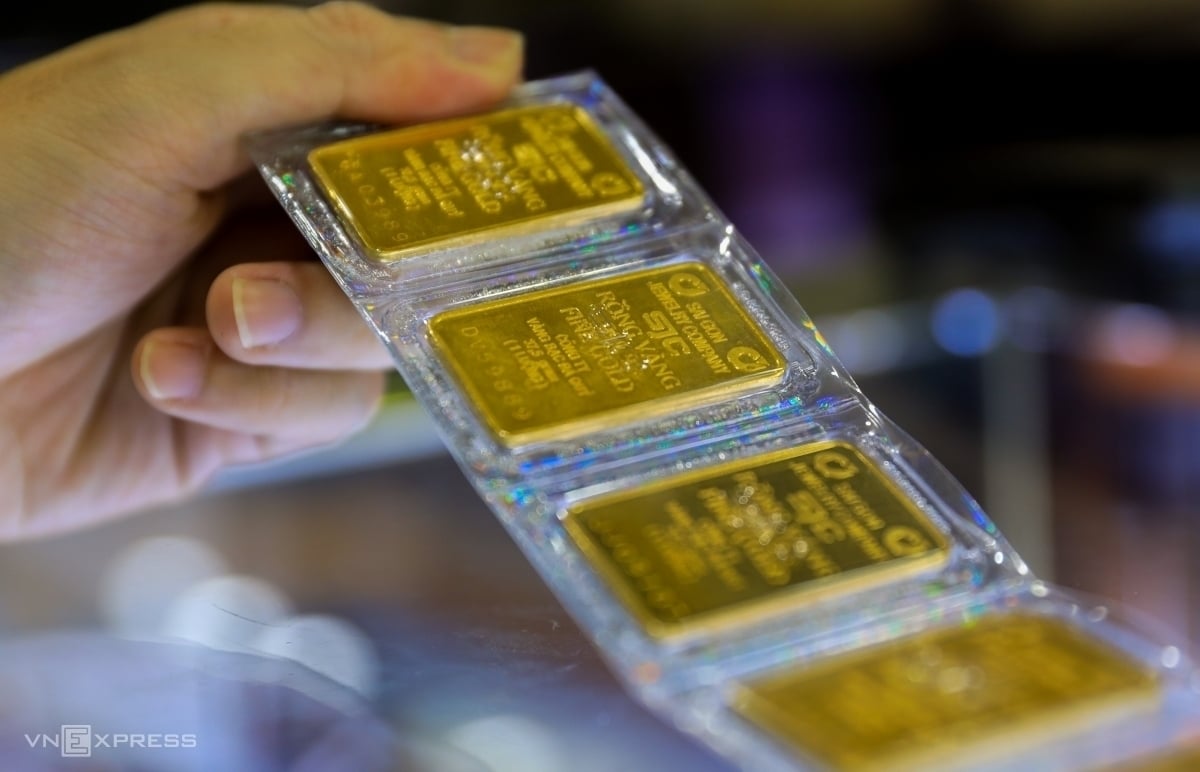

On the morning of January 6, the price of SJC gold bars listed by businesses was around 84 million VND/tael for buying and 85.5 million VND/tael for selling, maintaining the highest level in the past 3 weeks.

Similarly, businesses listed the buying price of plain gold rings at VND84 million/tael and the selling price at VND85.3 million/tael, remaining stable compared to the end of last week.

Regarding the gold price trend at the end of the Lunar New Year, a reporter from Nguoi Lao Dong Newspaper talked with gold expert Tran Duy Phuong.

* Reporter: Many opinions say that the world gold price is "holding its breath" waiting for Mr. Donald Trump's policy after taking office at the end of January 2025?

- Gold expert Tran Duy Phuong : It is true that gold prices have been "holding their breath" in recent days, but I think the precious metal will continue to break out in the next few months. Because there are many factors that positively support gold prices such as the low interest rate environment when the US Federal Reserve (FED) continues to reduce interest rates; the geopolitical tension in the Middle East has not been completely resolved. In particular, when Mr. Trump officially returns to the White House, there will be policy changes in the first half of 2025 related to tax policy, immigration policy, etc.

Gold prices will benefit and are forecast to increase by about 200-250 USD/ounce in the first half of this year.

Gold expert Tran Duy Phuong

* Is there a forecast that gold prices will exceed $3,000/ounce?

- Gold prices may increase to 2,800 - 2,900 USD/ounce, but to reach the 3,000 USD/ounce mark this year is very difficult, in my personal opinion. Because the precious metal has had a very strong breakthrough year, the time of reaching a historical peak at 2,790 USD/ounce (up about 40%) compared to last year and closing 2024 with an increase of about 30% are already very high milestones.

Therefore, gold prices will continue to increase this year, but it will be difficult to repeat history because most of the supporting factors have been reflected in the recent increase. The increase in gold prices this year may be around 5% - 7%, but to increase to a new peak of 3,000 USD/ounce is too difficult.

The demand for gold often increases at the end of the year, especially during the Lunar New Year until God of Wealth Day (January 10 of the lunar calendar).

* In fact, the price of SJC gold bars and gold rings has been increasing faster than the world in recent weeks. Is it forecasted that it will continue to increase from now until the Lunar New Year 2025, sir?

- Domestic gold prices increase faster than world prices for two reasons.

Firstly, people's demand for buying gold to save and accumulate at the end of the year in Vietnam in particular, and Asian countries such as China, India... often increases.

Second, domestic supply is scarce, there is not enough raw material for businesses to produce gold rings and jewelry of all kinds. Buying according to demand, which may be 5-10 taels of 99.99 plain gold rings, is not easy.

Businesses that buy raw gold to produce gold rings and jewelry on the market must now comply with strict regulations on input invoices and documents.

Even though the supply of SJC gold bars is not lacking, people still have to register online through state-owned commercial banks, each person can buy a maximum of 1 tael/time...

* As you said, gold prices may continue to increase, so should we buy gold at the end of the year?

- In fact, the psychology and habits of many people still like to buy gold to save after receiving Tet bonuses, income from production, business, trading... at the end of the year. Therefore, even if the world gold price decreases, the domestic gold price will remain the same or increase and will hardly decrease further in the final period of the year from now until the God of Wealth (January 10 of the Lunar calendar).

However, in the current economic context, I think the demand for SJC gold bars and gold rings on the occasion of God of Wealth will not be too sudden - if people buy gold, it is for good luck at the beginning of the year, and it is unlikely that there will be scenes of lining up or buying large quantities of gold.

Not to mention, the price of SJC gold bars is still strictly controlled by the State Bank to maintain a not too large difference compared to the world gold price. Therefore, in case the world gold price decreases or remains stable around the 2,700 USD/ounce range, the domestic gold price will also find it difficult to break out.

Source: https://nld.com.vn/chuyen-gia-du-bao-moi-nhat-ve-gia-vang-mieng-sjc-vang-nhan-dip-can-tet-19625010610082158.htm

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)