ANTD.VN - This is the opinion of Prof. Dr. Hoang Van Cuong, member of the National Assembly's Finance and Budget Committee, at the seminar "Solutions for safe and sustainable gold market development" organized by the Government Electronic Information Portal on January 25.

Decree 24 causes many problems

According to Professor, Dr. Hoang Van Cuong, Decree No. 24/2012/ND-CP (Decree 24) on the management of gold trading activities was issued in 2012. At that time, gold was considered a means of payment, almost using gold instead of money; almost any relationship of great value was converted into gold. We say that that period was the period of "goldenization of the economy".

This causes many consequences, the most typical of which is the problem of protecting the value of money, making people lose confidence in the value of money. Along with that, we cannot manage the issue of import and export and foreign exchange, leading to the inability to manage the issue of exchange rates...

In that context, the Government issued Decree No. 24/2012/ND-CP to limit the "goldenization" situation. Mr. Cuong said that the issuance of Decree 24 was very timely and this Decree has been quite effective in recent years. We have almost rectified the situation of using gold as a transaction tool.

However, up to now, the macro economy, financial relations, currency, international relations... have changed a lot. While we are still maintaining Decree No. 24 with very strict regulations such as: The State is the exclusive agency to produce gold bars, the exclusive agency in managing the import and export of raw gold to produce gold bars.

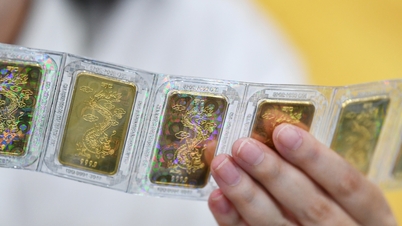

In fact, in recent years, the State has taken the SJC gold brand as the national gold brand and has hardly produced any more gold bars. While the mentality of the Vietnamese people is to hoard gold to ensure safety and avoid risks, and SJC gold is identified as the national gold brand, of course people will choose the most reliable gold. If there is no supply but there is real demand, it will of course lead to an imbalance in supply and demand and the price of SJC gold will increase.

|

Prof. Dr. Hoang Van Cuong, Member of the National Assembly's Finance and Budget Committee |

In addition, Mr. Hoang Van Cuong also said that not importing raw gold leads to no connection with the international market. There were times when domestic gold was 20 million VND/tael higher than the world price, which was very unreasonable.

Along with that, Prof. Dr. Hoang Van Cuong also pointed out the fact that there is inequality between types of gold bars. The quality may be the same as 99.99 gold, but SJC gold is protected by the State, so the price is very high. Other gold that is not protected will of course have a low price.

He also said that the gold monopoly would be harmful not only to the people but also to society. When the domestic gold price and the world gold price differ greatly, it would be profitable to smuggle gold, leading to increased gold smuggling.

“With such an increase in smuggling, it is clear that we cannot manage the gold market well. Tax revenue is lost and we cannot create a transparent and fair competitive market.

Proposal to remove monopoly, allow gold account trading

With the above arguments, Professor Hoang Van Cuong said that there needs to be a change in management methods and amendments to Decree No. 24.

“For example, now it is not necessary to have a state monopoly on a gold brand. Perhaps gold is a fairly common commodity, everyone can use it and the State can manage this item very easily, there is no need to have a monopoly.

We can let more businesses participate in the gold bar production process to meet people's needs. When supply is free and competition is fair, people will have easier access to gold and there will be no more scarcity" - Mr. Hoang Van Cuong proposed.

Besides, he also proposed that it is necessary to remove tools to connect the domestic and international gold markets, such as import and export issues.

“Of course, import and export here must have appropriate management methods. It is not enough to maintain the previous mechanism of granting licenses and quotas in the form of "asking-giving", but it is possible to use financial tools to regulate import and export relations. But it is also necessary to manage to avoid the situation of massively using foreign currency to import gold for other purposes, causing foreign currency imbalance and losing the ability to control exchange rates,” he said.

In addition, the expert also proposed more diverse trading methods.

“Decree 24 also has a provision defining the issue of gold trading on accounts, but the entire content does not open up at all about the issue of account trading, so in the country there is only buying and selling of physical gold.

Meanwhile, the world's trading trend is to open up trading methods on the trading floor through trading contracts, through gold credits. So if we open more forms of gold trading through accounts, then we will not be too dependent on importing a lot or a little gold, but people can use tools such as derivatives, which will immediately balance supply and demand.

That way we will operate very flexibly and especially then there will be no more situation where people buy gold and then store it at home, causing a large amount of money to "die" there.

When we trade gold on an account, people do not necessarily have to bring gold home, do not have to waste time storing it, the gold is circulated on the market, will create profits, create capital for circulation, bring many positive impacts to the economy as well as ensure the interests of each citizen" - the expert suggested.

In many countries, the Central Bank does not directly manage the gold market.

According to Mr. Nguyen The Hung, Vice President of the Vietnam Gold Business Association, according to world practice, there are two types of gold: physical gold and non-physical gold.

|

Mr. Nguyen The Hung |

Physical gold includes gold bars, gold ingots, gold coins, and jewelry. Non-physical gold includes gold accounts and gold certificates that are commonly traded on the market.

At the same time, in many countries, the Central Bank does not directly manage gold trading because they consider gold a common commodity. In countries in the region such as Singapore and Thailand, the Ministry of Commerce or the Ministry of Industry and Trade, the Ministry of Economy manages. The State Bank only manages foreign exchange, regulating foreign currency flows.

Central banks in countries only have the role of national reserves, coordinating gold as an asset for national reserves.

Therefore, the role of the Central Bank in Decree 24 comes into play at a time when the gold market is in turmoil. Currently, the monopoly of SJC will lead to a huge difference in gold prices.

Moreover, the value of Vietnamese currency is currently very stable; the exchange rate is also stable. Therefore, people do not use gold as a means of payment and there is no concept of "goldenization".

“Therefore, if we do not encourage people to hoard gold bars anymore, following the State's policy of focusing on jewelry production to increase surplus value, focusing capital on production and import and export, then we must reconsider the current way of managing the gold market.

If we consider gold as a commodity like other countries in the world, the State Bank will no longer directly manage the gold market" - a representative of the Gold Business Association stated his opinion.

Source link

Comment (0)