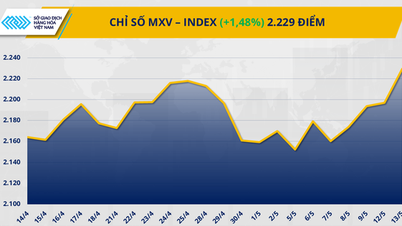

The Vietnamese stock market has just experienced a strong recovery in points after the US election ended. However, liquidity is still quite low.

Vietnam's stock market has just experienced a strong increase - Photo: QUANG DINH

Stocks increase but liquidity is low

Mr. Donald Trump officially won the US presidential election that took place on November 6, Vietnam time.

The news had a strong impact on global financial markets. US stocks rose sharply and closed at record highs. In Asia, indices rose and fell in opposite directions, with green dominating the market.

In Vietnam, the VN-Index closed the session on November 6 with an increase of 1.25% (nearly 16 points). The value of matched transactions reached more than 13,500 billion VND, recovering compared to the previous session, but still down nearly 6% compared to the average of 20 sessions.

Observing in recent months, the index has recovered at many times, but liquidity has not returned to "form".

From an average of over VND20,000 billion in the first quarter of the year, the order matching value on the Ho Chi Minh City Stock Exchange recently has often been at VND13,000 - 14,000 billion.

Even in the session of November 5 - before the US election day - liquidity was less than 9,000 billion VND - the lowest level since mid-May 2023 until now.

Mr. Bui Van Huy - Director of Ho Chi Minh City branch of DSC Securities - said that the market started the first days of November with a very deep decrease in liquidity.

The financial and monetary market can be likened to a connecting vessel between the investment channels of the economy, financial assets, goods, real estate, etc.

"When cash flow is sucked into other investment channels or has to focus on handling different issues, a lack of liquidity in the stock market is natural," said Mr. Huy.

What makes cash flow hesitant?

First, Mr. Huy mentioned that Circular 02 will expire at the end of 2024. It is not difficult to see the impact when many banks have to focus on processing, accounting, and cleaning up their books before this important milestone.

"There will be items that cannot be hidden and will more or less affect the bank's profits in the fourth quarter of 2024 and the whole year of 2025. A certain cash flow must be focused on handling this problem," according to Mr. Huy.

Next is the relatively large amount of bonds maturing at the end of 2024. The DSC Director said that the majority are bonds of real estate and construction businesses...

"A chain reaction risk like in 2022 is unlikely to happen and businesses have more or less different plans.

However, it is undeniable that many places are struggling to balance resources. That is also a big reason why the stock market lacks liquidity as it is now," the expert said.

The capitalization structure is mostly banking, construction real estate... VN-Index will reflect most of the market's expectations for this industry group - Data: VCI

Meanwhile, many other investment channels such as USD, gold, bitcoin... continuously increased in price. Like USD, the Dollar Index (DXY) increased from around 100 to the 105 region. This pressure has forced the State Bank to take intervention measures.

Meanwhile, gold prices have been hitting new highs due to geopolitical stories. "It is not too much to say that the increase in the value of the USD has caused liquidity to be sucked away, and gold prices, competing as an investment channel, also reflect the risk-averse mentality among global investors," the stock expert commented.

Finally, it can be seen that the real estate market has not fully recovered but there is a local land fever.

Mr. Huy pointed out that it was a wave of real estate in the North, from land to apartments, increasing in price. The land wave seemed to be spreading to the South and that was also a channel to attract speculative money.

The financial market, as mentioned, is a communicating vessel and local land fever affects stock liquidity.

Thus, liquidity can only return when the above issues are basically resolved, notably the story of bond maturity and Circular 02 maturity.

"However, a depressed market is sometimes an opportunity to filter out good investment opportunities, at discounted prices, that have been abandoned by cash flow," Mr. Huy stated his opinion.

Foreign money withdrawn

According to Vietcap Securities, in the first 10 months of this year, foreign investors net sold 3.1 billion USD in the entire Vietnamese stock market (a sharp increase compared to the net selling of 362 million USD in the same period).

Foreign investors also net sold 3.4 billion USD in the Thai market, while net buying 2.5 billion USD and 43.9 million USD in the Indonesian and Philippine markets, respectively.

Source: https://tuoitre.vn/chung-khoan-viet-tang-vot-sau-tin-bau-cu-my-vi-sao-dong-tien-van-mat-hut-20241107080923211.htm

Comment (0)