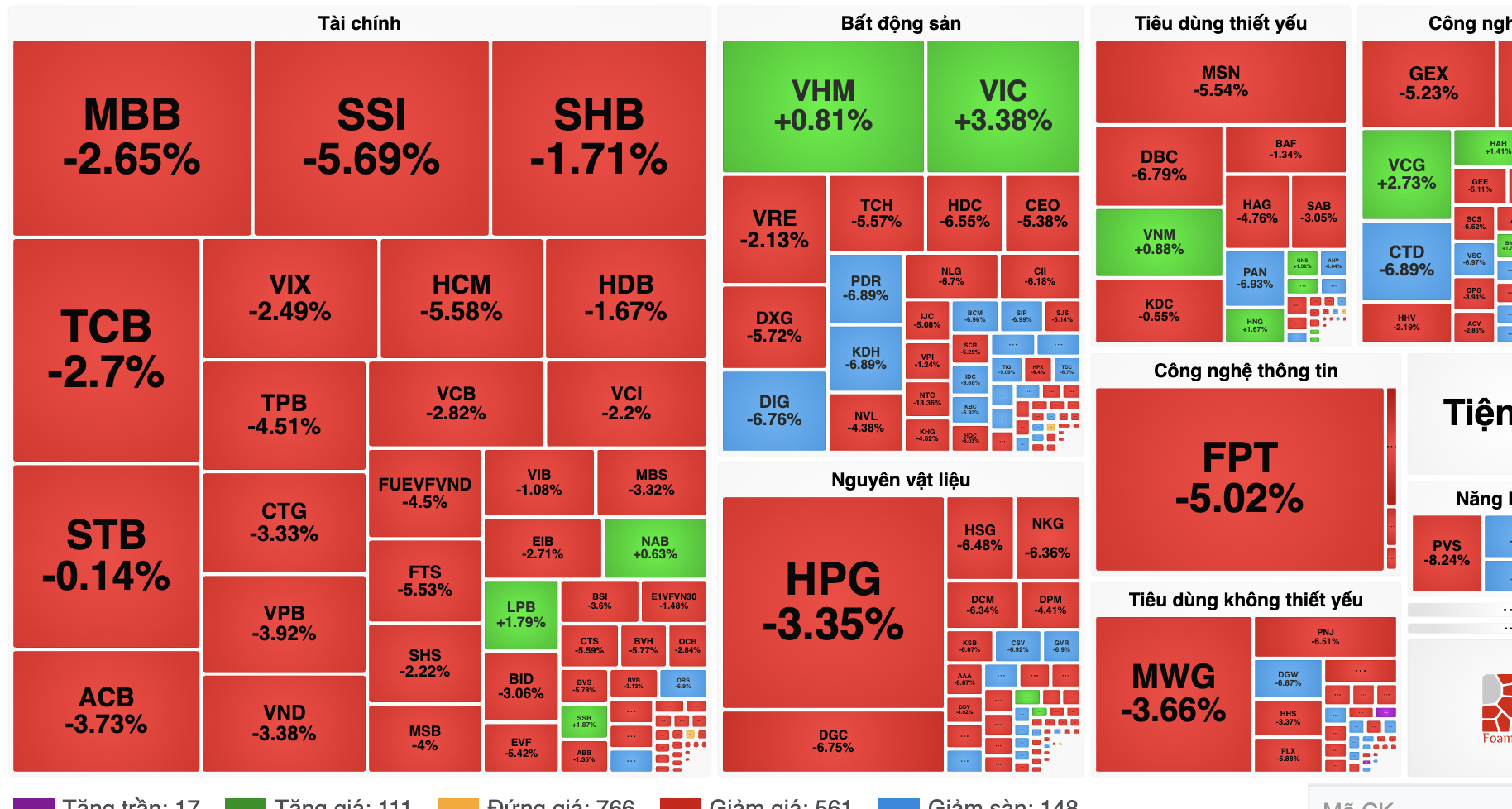

After yesterday's historic drop, April 3, the Vietnamese stock market opened with a series of stocks waiting for the floor price right at the ATO session. VN-Index dropped more than 75 points, close to 1,154 points after only the first 10 minutes. After 15 minutes, the market edged up to nearly 1,170 points. More than 93% of stocks fell, including 160 stocks that fell to the limit.

Strong selling pressure then caused the stock price and index to continue to fall deeply to 1,150 points. The main reason came from the US's decision to impose reciprocal tariffs and the negative impact from the US stock market when Dow Jones evaporated 1,700 points; S&P dropped the most in nearly 5 years.

A series of stocks in banking, securities, real estate, oil and gas, seaports, textiles, etc. fell to their lowest levels. A glimmer of light was the Vingroup group of stocks including VIC, VHM, and VRE, which traded in light green, helping to support the market. In investment groups and associations, many investors were worried as the VN-Index continued to fall, not stopping its upward trend.

Liquidity skyrocketed when the transaction value on HOSE in less than 1 hour of the morning session was approximately 20,000 billion VND.

At around 10:00 a.m. this morning, April 4, VN-Index recovered to 1,195.99 points but still decreased by 33.85 points compared to the previous session; HNX Index decreased by 9.44 points to 211.56 points due to bottom-fishing demand from investors.

Mr. Michael Kokalari, Director of Macroeconomic Analysis and Market Research, VinaCapital, commented that after the announcement of US tariffs on countries, including Vietnam at 46%, the VN-Index decreased by nearly 7% in the session on April 3.

With selling pressure spread across the market, it shows that investors still need more time and information to assess the real impact of this policy on the economy and profit growth of listed enterprises.

For example, shares of FPT – a software outsourcing service provider – fell by 7% (floor price) even though the US tax rate had no impact on the company's products.

VN-Index continues to shine in red

“We are assessing the impact of tariffs on established scenarios for various portfolios. And are looking for buying opportunities on short-term stock price declines given the potential longer-term impact on both the Vietnamese and global economies.

This sell-off creates an opportunity for active fund managers to buy stocks with good fundamentals and less direct impact from tax policy, at more attractive valuations," said Mr. Michael Kokalari.

According to VinaCapital experts, the businesses that can benefit most clearly are those that will be supported by the Government's efforts to offset the impact of tariffs on GDP growth.

In February, the government announced an increase in its already ambitious public investment spending plan for this year – and news of US tariffs will further strengthen its resolve to push ahead with these domestic stimulus measures.

Financial expert Phan Dung Khanh also said that investors need to closely monitor the trading session on April 4 because it is the last session of the week - the first week of the month and the second quarter of 2025. The market is also approaching the VN-Index area of 1,200-1,220 points. If the support zone is maintained, the medium-term trend is still stable, but if not, the situation may get worse.

Source: https://nld.com.vn/chung-khoan-viet-lai-giam-soc-hon-70-diem-chuyen-gia-noi-co-hoi-mua-vao-196250404102335436.htm

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)