SGGPO

The VN-Index briefly rose 10 points due to strong buying interest at the bottom, reclaiming the 1,150-point mark. However, in the final minutes of the trading session, the VN-Index reversed sharply, catching investors off guard.

|

| VN-Index reversed course and fell sharply in the last few minutes of the trading session. |

The Vietnamese stock market experienced low liquidity on September 26th due to lingering investor concerns following three consecutive days of declines. The market fluctuated throughout the session, with the VN-Index opening 6 points higher but closing 8 points lower.

In the afternoon session, the market maintained a fairly good upward trend, with the VN-Index rising 10 points by around 2:20 PM. However, in the final few minutes of the session, the VN-Index reversed course and fell nearly 16 points by the close.

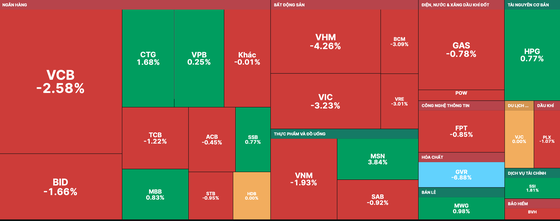

Real estate and securities stocks rebounded strongly during the session due to strong capital inflows, but many stocks reversed course and fell towards the end of the session. Specifically, in the real estate sector, LCG, TCH, SGR, and DXS all hit their lower limit; the Vingroup trio also experienced significant declines, with VHM down 4.26%, VIC down 3.23%, and VRE down 3.01%; NVL down 6.48%, PDR down 3.73%, NBB down 6.44%, TDC down 4.65%, SZC down 5.42%, DXG down 6.48%, CII down 5.34%, and BCM down 3.09%... A few stocks in this group managed to stay in positive territory, such as DIG up 2.73% and TDH up 0.39%.

Although the securities sector did not maintain the highest gains of the session, some stocks still managed to stay in positive territory, including MBS (up 5.08%), HCM (up 1.18%), FTS (up 0.53%), CTS (up 0.19%), and SSI (up 1.81%).

Many other stocks continued to fall sharply, such as: APG hitting the floor limit, VIX down 5.14%, AGR down 3.28%, VDS down 3.47%, SBS down 1.2%, VND down 1.67%...

The banking sector stocks showed mixed performance, but were mostly in the red. Specifically, CTG rose 1.68%, VPB 0.25%, MBB 0.83%, SSB 0.77%, and VIB 1.05%, while VCB fell 2.58%, BID 1.66%, TCB 1.22%,SHB 1.82%, TPB 1.67%, LPB 2.94%, and EIB 4.11%. Additionally, many stocks in the energy and retail sectors also declined.

At the close of trading, the VN-Index fell 15.24 points (1.32%) to 1,137.96 points, with 317 stocks declining, 180 stocks rising, and 62 stocks remaining unchanged.

At the close of trading on the Hanoi Stock Exchange, the HNX-Index also decreased by 1.75 points (0.76%) to 229.75 points, with 130 stocks declining, 65 stocks rising, and 49 stocks remaining unchanged. Liquidity decreased, with the total trading value across the market at approximately 24,600 billion VND.

Foreign investors continued to be net buyers of nearly 652 billion VND on the HOSE exchange, focusing heavily on accumulating blue-chip stocks such as SSI, HPG, and VCB…

Source

![[Photo] General Secretary To Lam working with Ambassadors and Heads of Vietnamese representative offices abroad attending the 14th National Congress of the Party](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F25%2F1769334314499_image.jpeg&w=3840&q=75)

Comment (0)