In recent years, the business activities of Techcom Securities Corporation (TCBS) have depended heavily on the excitement of the bond market. The hot development of the bond market in previous years was a lever that helped TCBS compete with long-standing securities companies when the securities brokerage sector had almost "no chance".

Mr. Nguyen Xuan Minh, Chairman of the Board of Directors of TCBS, shared many years ago: “At the beginning, TCBS was more than ten years behind other securities companies in the securities brokerage sector. Already behind, now continuing to jump into that market without any competitive advantage to catch up with others, we will be a follower for life”. This forced TCBS to find a niche market, where other securities companies had not paid attention.

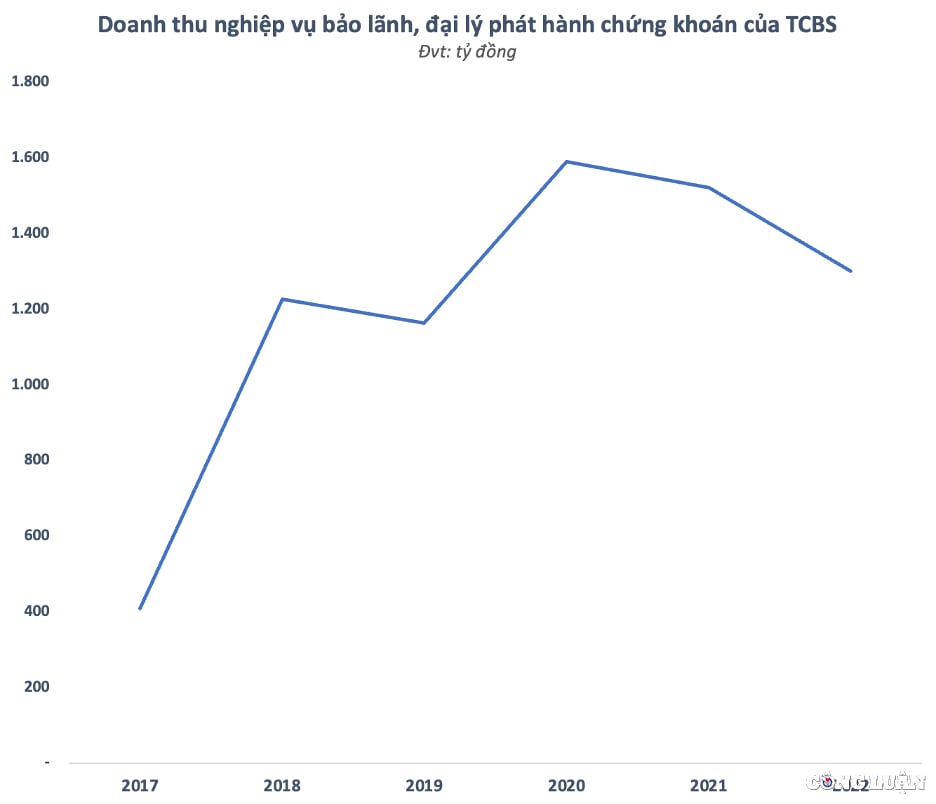

Since 2016, TCBS has always been the leader in bond trading market share on the Ho Chi Minh City Stock Exchange (HoSE). The underwriting and issuance agency business has also regularly brought this securities company hundreds or even thousands of billions each year and often accounts for the highest proportion in the operating revenue structure.

Bond crisis

After a period of hot growth, difficulties have begun to appear after the management agency tightened bond issuance activities, especially private corporate bonds. Decree 65/2022/ND-CP amending and supplementing Decree 153/2020/ND-CP on private bond offerings, issued on September 16, 2022, is expected to have a strong impact on the bond market.

For securities companies, revenue from bond issuance consultancy activities is at risk of shrinking in this area due to tightening management policies. The prospect of revenue growth from redistributing corporate bonds will be an uncertain point after Decree 65.

In fact, TCBS's revenue from underwriting and issuance agency services in 2022 decreased by nearly 15% compared to the same period last year. 2022 is a difficult year for the bond market, especially individual corporate bonds. A year earlier, TCBS's revenue from this business segment also showed signs of slowing down.

In 2022, the corporate bond market was affected by information related to a series of large corporations, especially those operating in the real estate sector, with tens of thousands of billions of VND in bonds circulating on the market. In addition, a series of warnings issued by ministries and branches made investors more cautious and careful.

The primary market was almost frozen in the third quarter, and the trend is expected to continue to be gloomy until 2023. Enterprises cannot issue bonds due to few buyers. Similarly, the secondary market is congested due to lack of demand. A series of sell orders are issued while there are no buyers.

Organizations "massively" sold assets with a large total value, making it difficult to execute bond sale orders. Some funds had to sell assets at a large discount, leading to a decrease in NAV/CCQ value. The largest bond fund in the market, TCBF - Techcom Capital, of course could not escape the crisis when its total assets decreased by 16% in October, equivalent to more than VND 3,100 billion. Some other funds recorded a cumulative decrease in total assets since the beginning of October of 22 - 34% or a net withdrawal of VND 100 - 300 billion per week.

Profits plummet

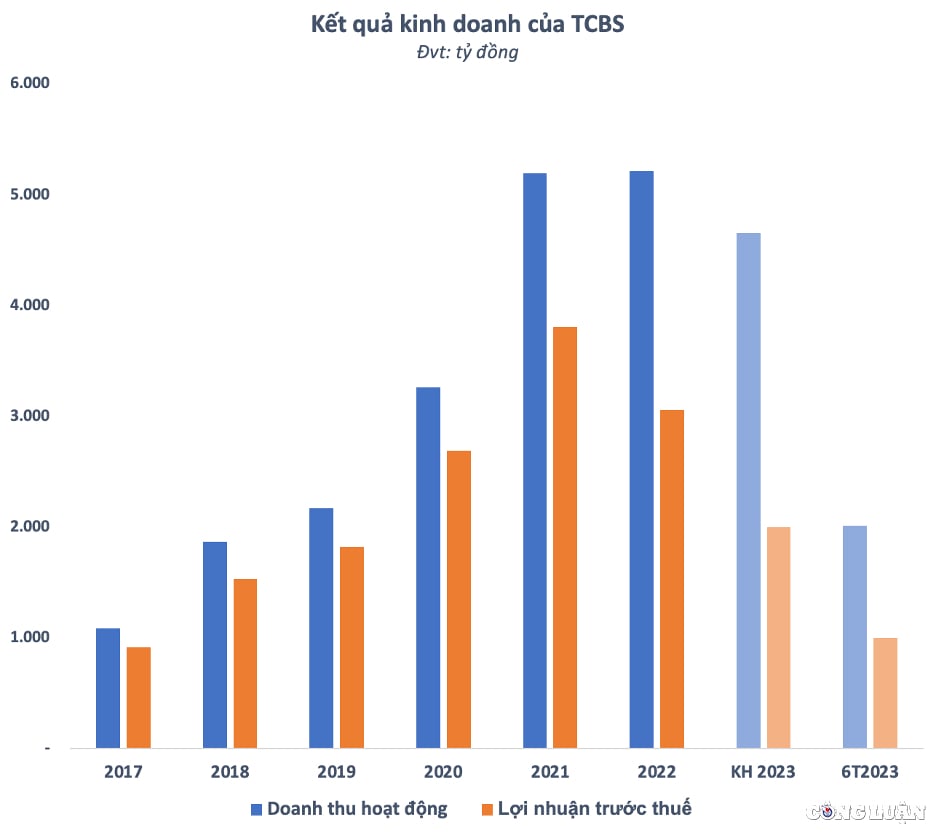

The regular business segment, which contributes the largest part to the revenue structure, has been affected, causing TCBS's business results to plummet. In 2022, the securities company's pre-tax profit decreased by nearly 20% compared to the same period, down to VND3,058 billion. This figure is forecast to continue to decrease sharply as TCBS only targets a pre-tax profit of VND2,000 billion in 2023, nearly 35% lower than the previous year. The expected operating revenue target is also expected to decrease by 11% to VND4,654 billion.

According to the audited 2023 semi-annual financial report, TCBS recorded operating revenue of VND2,015 billion in the first 6 months of the year, down 34% year-on-year. After deducting expenses, TCBS's pre-tax profit in the first 6 months of the year was nearly VND1,000 billion, down half compared to the same period last year and completing 50% of the annual profit plan.

The reason for the decline in business performance, according to TCBS, is that the corporate bond market has not yet fully recovered. In the first 6 months of the year, revenue from underwriting and securities issuance agency, mainly bonds, decreased sharply by 53% compared to the same period, down to less than 450 billion VND.

At the end of the second quarter, TCBS's total assets were VND 34,775 billion, up 33% compared to the beginning of the year, including VND 5,761 billion in cash and cash equivalents, VND 10,182.5 billion in loans, etc. Notably, TCBS also owned VND 12,750 billion in unlisted bonds at the end of the second quarter, equivalent to 36.6% of its asset structure. This figure is nearly double that of the beginning of the year and up 91.6% compared to the end of the first quarter of 2023.

In the context of a clear decline in business, at the end of last year, TCBS unexpectedly wanted to raise more than VND10,000 billion from a bank through a private offering of 105 million shares at an expected issuance price of VND95,600/share. The purpose of the offering is to maintain its position in core areas including stocks, bonds, investment and asset management.

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)