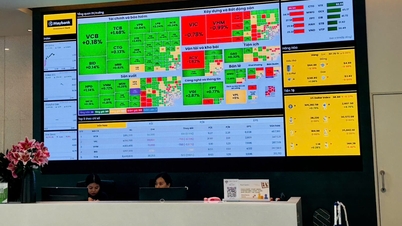

The key issue is that KRX hasn't been implemented yet.

According to Dr. Nguyen Son, Chairman of the Vietnam Securities Depository and Clearing Corporation (VSDC), the fundamental and long-term solution to the issue of requiring margin deposits before transactions is to implement a securities clearing and settlement mechanism based on the Central Counterparty Clearing (CCP) model. Under this model, legal documents would no longer require investors to deposit margin before trading. Simultaneously, VSDC would be the entity ultimately responsible for the settlement of investor transactions (with the CCP mechanism, there would be no cancellation of transactions when investors become unable to pay).

Furthermore, there are some inconsistencies between securities law and banking law that need to be supplemented and amended, such as: Commercial banks and branches of foreign banks providing securities custody services should be allowed to become clearing members, connecting to VSDC's clearing and settlement system to receive notifications about investors' payment obligations. They should also process transaction settlements for their investor clients directly with VSDC.

If an investor does not have sufficient funds or securities to settle their transaction, the responsibility for settling the securities transaction will transfer to the securities company where the investor placed the order.

"VSDC is working with the State Securities Commission (SSC), the Ministry of Finance, and the State Bank of Vietnam to propose to the Government and the National Assembly amendments to legal documents (Law on Credit Institutions, Law on Securities, and guiding decrees). However, this work will take a lot of time," Mr. Son said.

Securities companies can make their own decisions regarding margin requirements.

As an immediate solution and to ensure the goal of upgrading the market by 2025, Dr. Nguyen Son said that VSDC is working with the State Securities Commission to propose and recommend that the Ministry of Finance consider amending Circular 120 to remove the regulation requiring investors to deposit 100% of the money before buying securities. Instead, it would allow securities companies to proactively determine whether or not their investors need to deposit.

The margin requirement for each investor is based on the securities company's credit rating assessment of each investor (KYC assessment) and the risk level of each security. If the investor does not have sufficient funds to settle the transaction, the securities company will have to make the payment to the investor. This applies even if the investor opens a custody account at a custodian bank and only places orders with the securities company (a common case for foreign financial institutions).

To enable securities companies to control risks when applying this mechanism, Mr. Son said that VSDC is working with the State Securities Commission and custodian banks and securities companies to find solutions to help securities companies control risks. The Chairman of VSDC proposed that the Ministry of Finance add a regulation: In cases where investors do not have enough money and securities companies have to use their own funds to pay for the investor's purchase transaction, those securities will be transferred to the securities company's proprietary trading account, and the securities company has the right to sell the aforementioned securities to recover the debt.

He also advised investors, securities companies, and custodian banks to sign a tripartite agreement. This agreement should stipulate that the securities company must sell securities to recover the debt. If the debt is not fully recovered, the securities company is allowed to sell a portion of the investor's securities held at the custodian bank.

At the same time, we recommend that the Ministry of Finance impose penalties on investors who fail to fulfill their payment obligations, such as prohibiting them from trading.

Source

![[Infographic] Vietnam's stock market exceeds 11 million trading accounts](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/09/1762677474332_chungkhoanhomnay0-17599399693831269195438.jpeg)

Comment (0)