At the gala celebrating the 30th anniversary of Asia Commercial Bank (ACB), the Chairman, born in 1978, appeared playing the guitar, singing and dancing. Mr. Huy's performance was quite elaborate, with rain, smoke, and a dance troupe accompanying him.

The performance excited everyone in the audience. The video clip became a hot topic on the internet, especially among bankers.

Previously, at the 25th anniversary celebration (2018), Mr. Huy made his first "extremely cool" appearance with a singing and dancing performance and immediately caused a "storm" on the internet.

That "hot" character is Mr. Tran Hung Huy (born in 1978). Mr. Huy is currently the Chairman of the Board of Directors of ACB Bank.

In 2012, Mr. Huy succeeded his father (Mr. Tran Mong Hung) as Chairman of the Board of Directors of ACB. At that time, Mr. Huy was the youngest chairman of a bank at the age of 34. To date, no one has broken Mr. Huy's record as the youngest person elected as chairman of a bank.

Chairman Tran Hung Huy is holding 115.73 million shares, worth around 2,900 billion VND.

Meanwhile, Mr. Tran Mong Hung is no longer a member of the Board of Directors of ACB. However, Ms. Dang Thu Thuy (born in 1955, Mr. Hung's wife) has been a member of the Board of Directors since 2011. Ms. Thuy owns 40.34 million ACB shares, worth about 1,000 billion VND.

Regarding ACB's business results under Mr. Huy, in the last 5 years (from 2017 to 2022), consolidated pre-tax profit has always increased every year.

Specifically, in 2017 ACB reached 2,656 billion VND, in 2018 the bank's consolidated pre-tax profit increased by 140%, reaching 6,389 billion VND.

By 2018, profit growth was 17.6%, reaching 7,516 billion VND, in 2020 profit growth reached 27% to 9,596 billion VND.

In 2021, ACB's consolidated pre-tax profit exceeded VND10,000 billion for the first time, reaching VND11,998 billion, up 25% over the same period.

Notably, in 2022, ACB achieved consolidated pre-tax profit of VND17,114 billion, a sharp increase of 42.6% thanks to no longer having to spend a large part of its profits on risk provisions.

ACB is also one of the few banks that has maintained a low bad debt ratio of less than 1% in the past two years. The bank's bad debt has decreased from 0.78% in 2021 to 0.74% in 2022.

(Source: Vietnamnet)

Useful

Emotion

Creative

Unique

Source

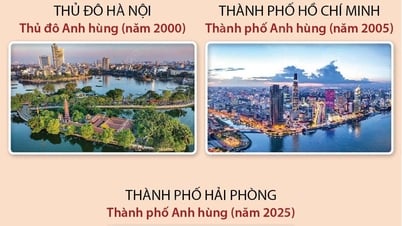

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

Comment (0)