Lesson 3: The State Capital Management Committee at Enterprises must be a professional investor.

The current difficulties in the operation of the state-owned enterprise sector are caused by the lack of clarity in the implementation of the functions and tasks of the State Capital Management Committee in enterprises as the owner of state capital.

According to Dr. Vo Tri Thanh, former Deputy Director of the Central Institute for Economic Management (CIEM) , there needs to be a mechanism for the State Capital Management Committee at Enterprises to “increase the quality” of professional investors. This requires strong reform, restructuring, and capacity building for the Committee.

|

| Dr. Vo Tri Thanh, former Deputy Director of the Central Institute for Economic Management. |

Sir, the 8th Session of the 15th National Assembly will consider and comment on the Draft Law on Management and Investment of State Capital in Enterprises. This is a legal document that will replace the Law on Management and Use of State Capital Invested in Production and Business at Enterprises issued in 2014. There are many opinions that it is necessary to evaluate and consider the model of the State Capital Management Committee at Enterprises. What do you think about this opinion?

The establishment of the State Capital Management Committee at Enterprises (the Committee) stems from a strategic idea. That is to improve the effectiveness of state management, the efficiency of using state capital, state-owned enterprises, and the competitiveness of state-owned enterprises, especially large-scale economic groups and state-owned corporations.

That idea includes improving efficiency in management, how to separate the role of ownership from the role of state management. That is the goal.

These are big and not simple issues, because there are reasons from historical issues, the nature of state capital, state ownership. For example, in the past, we conceived of state-owned enterprises and multi-level management, so there were local enterprises with local representatives owning capital, and central enterprises with ministries representing capital.

The establishment of the Committee is truly a process of great transformation, requiring changes in thinking, apparatus, structure, organization, etc.

Although the Committee was established based on the experience of learning from many models in the world , with the participation of many experts, it is still a very new model for Vietnam. During its recent operation, the Committee's activities have encountered many difficulties and challenges for the Committee itself with its functions and tasks as a powerful representative of the owner.

What exactly is that challenge, sir?

For example, up to now, there is still confusion between the old and the new in state management at 19 corporations and general companies; or in the implementation of the Committee's functions and tasks as an owner, or more specifically as a capital investor.

Of course, it must be affirmed that, over time, with the self-efforts of corporations, general companies and the Committee, the activities of the state-owned enterprise sector have achieved positive results. The most obvious is in the state-owned corporations and general companies. Previously, the activities of these sectors were ineffective, with many weak and loss-making projects. Up to now, not everything has been smooth, but all have been profitable and efficiency has increased. Many corporations and general companies have exceeded their profit plans, making large contributions to the budget. I think this is very important.

Second, many corporations have caught up with the country's new demands, focusing more on research and development (R&D), digital transformation, green transformation, and dual transformation, as seen in projects in the energy, oil and gas, and telecommunications industries.

Third, many weak projects are being overcome and restarted in an operational direction, bringing value to the economy such as Ninh Binh Fertilizer, Ha Bac Fertilizer, Vietnam - China Minerals and Metallurgy, Thai Nguyen Iron and Steel Project Phase 2...

The Committee itself has also made efforts to reform and reorganize itself in personnel and human resources work, thereby having the capacity to grasp and present the difficulties of affiliated enterprises, coordinate with enterprises to propose and build a legal framework for management agencies and the Government to issue promptly and with quality.

For example, the State Capital Investment Corporation (SCIC), a company under the Committee, recently had its operating strategy approved, which we believe has many good ideas. For example, evaluating the overall efficiency rather than individual projects, measuring the efficiency of financial investment by measuring government bond interest rates; separating the “game” with high market value from ordering according to state tasks…

|

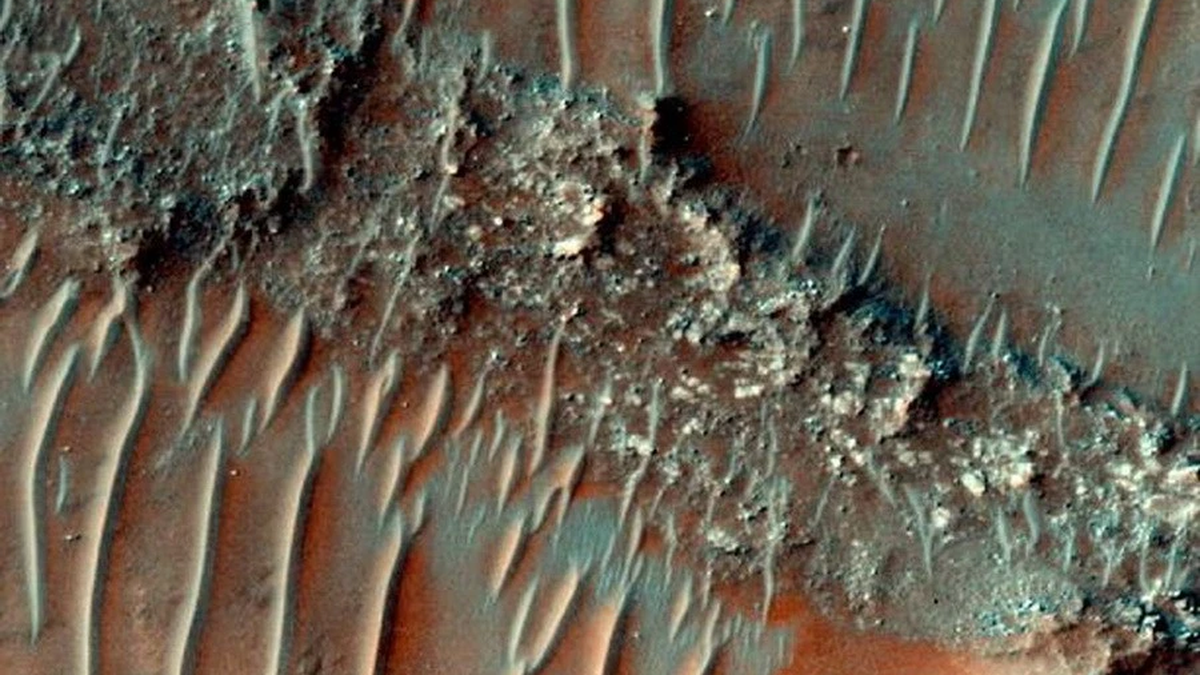

| Many state economic groups, such as PVN, have caught up with the country's new demands. |

With such initial results, in your opinion, how should the State capital representation model of the Committee be promoted in the coming time?

As mentioned, the operation of the Commission and this model of a specialized state capital representative agency have many difficulties.

Firstly, separation is not truly representative, overlapping with other state management agencies, so the decision-making process of the Committee is very difficult.

Second, state ownership always has representative characteristics, so the right to make decisions as the owner's representative between the Committee and corporations and general companies is still problematic.

Third, how to improve the quality of professional investors in the Commission requires reform, restructuring, and strong capacity building for the Commission.

Fourth, about 3-4 years ago, we had a pilot project to form large corporations (leading cranes) from state-owned enterprises.

The reality is that for a long time, large corporations have not had any truly outstanding investment projects. They need pilot policies on autonomy, salary and bonus policies, risk investment, innovation, etc.

Most recently, last year, the Politburo issued Resolution No. 41-NQ/TW on building and promoting the role of Vietnamese entrepreneurs in the new era, with the requirement to build pilot policy mechanisms to support the development of national enterprises and leading enterprises, regardless of whether they are state-owned or private enterprises.

As the representative agency of the owner, manager and investor of state capital, the Commission will contribute to this process. Both in the sense of contributing to the mechanism and contributing to the use of capital.

There are many expectations that the Committee will truly be a professional investor as you have just mentioned. In your opinion, what mechanisms and policies are needed for the State Capital Management Committee at Enterprises to best assume this role?

Simply think of the Commission as an investor with money and a controlling stake in a company. So what does this investor do and what rights does he have?

As a controlling shareholder, the investor will participate in strategic orientation, decide on personnel selection, and monitor whether the strategic goals set by the investor are achieved. To do this, clear and decentralized regulations are needed to determine where the Committee is represented and what issues it decides.

It should be noted that, due to the complexity of the state capital restructuring process, state ownership has many levels of representation. In addition to clear decentralization and minimizing decision-making costs, connection, coordination and sharing are very important.

Therefore, mechanisms are also needed for investors to improve their decision-making capacity, such as attracting talented human resources and improving the quality of staff.

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)