(GLO)- On May 31, the monitoring delegation led by Mr. Truong Van Dat - Member of the Provincial Party Standing Committee, Permanent Vice Chairman of the Gia Lai Provincial People's Council had a working session at the People's Committee of Chu Se district on the management and use of local budget funds entrusted through the Social Policy Bank (CSXH) to lend to the poor and policy beneficiaries in the district in the period of 2016-2022. Accompanying the delegation were members of the monitoring delegation and leaders of relevant units.

|

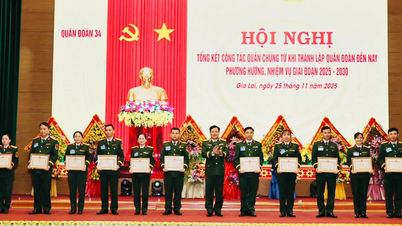

Scene of the working session of the monitoring delegation with the People's Committee of Chu Se district. Photo: Ha Phuong |

According to the report of the People's Committee of Chu Se district, by the end of 2022, the whole district had 31,047 households, the number of ethnic minority households accounted for 44.08%; the rate of poor households accounted for 8.04% (2,497 households), of which poor households were ethnic minorities accounting for 92.55% of the total number of poor households. The management and use of capital entrusted from the provincial budget was implemented by the locality according to Decision No. 28/QD-UBND dated September 6, 2017 of the Provincial People's Committee promulgating regulations on management and use of capital from the local budget entrusted through the Bank for Social Policies to lend to the poor and other policy beneficiaries in the area.

In the period of 2016-2022, the total budget capital entrusted to the District Social Policy Bank Transaction Office is 6.8 billion VND. Specifically: in 2016 it is 600 million VND; in the period of 2017-2021 it is 1 billion VND each year; in 2022 it is 1.2 billion VND. The loan turnover of credit programs in the period of 2016-2022 is 12,341 billion VND with 303 loan customers. The total outstanding debt of credit programs as of December 31, 2022 is 7,202 billion VND, with 187 outstanding customers. The total interest earned from the budget entrusted by the district in the period of 2016-2025 is 1,748 billion VND.

The District Social Policy Bank transaction office has allocated an additional VND 625 million to the district budget from loan interest revenue for the 2016-2022 period.

Through assessment, the local budget capital entrusted through the Social Policy Bank for the period 2016-2022 has been disbursed to the right beneficiaries, the loan capital has been used for the right purpose and effectively. Thereby, the capital has helped 17 poor households, 117 near-poor households, 86 newly escaped poverty households to borrow capital for production, rise out of poverty; create jobs for 773 workers, contributing to the goal of sustainable poverty reduction, job creation, and new rural construction in the district.

|

| Ms. Dinh Thi Giang - Standing Member of the Provincial People's Council, Head of the Provincial People's Council's Ethnic Minority Committee, member of the monitoring delegation gave her opinions at the working session. Photo: Ha Phuong |

At the monitoring session, delegates gave their opinions on a number of issues such as: Chu Se district needs to clarify more about the groups of subjects needing loan support, detailed information on loan programs, loan subjects; priority loans for the poor, groups borrowing from clean water, sanitation and environment programs; labor export subjects supported with loans; how many women members are supported with loans, and what solutions will be implemented for these subjects in the coming time...

Working with the monitoring delegation, the People's Committee of Chu Se district proposed and recommended: According to Decision No. 861/QD-TTg dated June 4, 2021 of the Prime Minister , Chu Se has 2 communes in regions II and III, reducing 12 communes in regions II and III, the subjects in these 12 communes will no longer be able to enjoy credit policies in difficult areas, so people will have difficulty in borrowing capital and repaying bank loans when due. In addition, the demand for loans to support job creation, maintaining and expanding employment is very large, while the Central Government's capital for this credit program is still limited, not meeting the people's borrowing needs.

In addition, implementing Decision No. 05/QD-TTg dated January 4, 2023 of the Prime Minister on approving the Development Strategy of the Social Policy Bank to 2030, in which, every year the local budget entrusts capital sources to lend to the poor and other policy subjects, accounting for about 15-20% of the total credit balance growth of the Social Policy Bank (in 2022, the credit balance growth rate of the district Social Policy Bank is 12.56%, equivalent to VND 42,133 billion; it is expected that in 2023, the credit balance growth will be 10% or more, equivalent to nearly VND 40 billion).

|

The team conducted a field inspection at the coffee garden of Mr. Nguyen Phuc Huy's family (My Phu village, Ia Blang commune, Chu Se district). Photo: Ha Phuong |

At the same time, Chu Se district proposed that the Provincial People's Council and People's Committee annually pay attention to increasing the provincial budget capital entrusted through the Social Policy Bank to expand loans for poor households and other policy beneficiaries, contributing to the implementation of the poverty reduction target, building new rural areas and socio-economic development in ethnic minority and mountainous areas in the area.

Speaking at the working session, Mr. Truong Van Dat - Member of the Provincial Party Standing Committee, Permanent Vice Chairman of the Provincial People's Council, Head of the monitoring delegation acknowledged the efforts and results that Chu Se district has achieved in implementing social policy credit activities in the area, ensuring social security in the locality. The Permanent Vice Chairman of the Provincial People's Council requested that the lending of entrusted capital sources must ensure the right subjects according to regulations; pay attention to prioritizing lending to poor households, near-poor households, households that have just escaped poverty, policy households, especially ethnic minority households in difficult areas to help them have conditions to invest in production and escape poverty sustainably.

Source link

![[Photo] Close-up of Ba Ha River Hydropower Plant operating to regulate water to downstream](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F25%2F1764059721084_image-6486-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Governor of Gunma Prefecture (Japan) and Special Advisor to the Japan-Vietnam Friendship Parliamentary Alliance](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F25%2F1764066321008_dsc-1312-jpg.webp&w=3840&q=75)

![[Answer] Should I install an elevator for an old renovated house?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/25/1764039191595_co-nen-lap-thang-may-cho-nha-cai-tao-cu-khong-04.jpeg)

Comment (0)