Index

- Closing price of gold today, April 4, 2025 in the domestic market

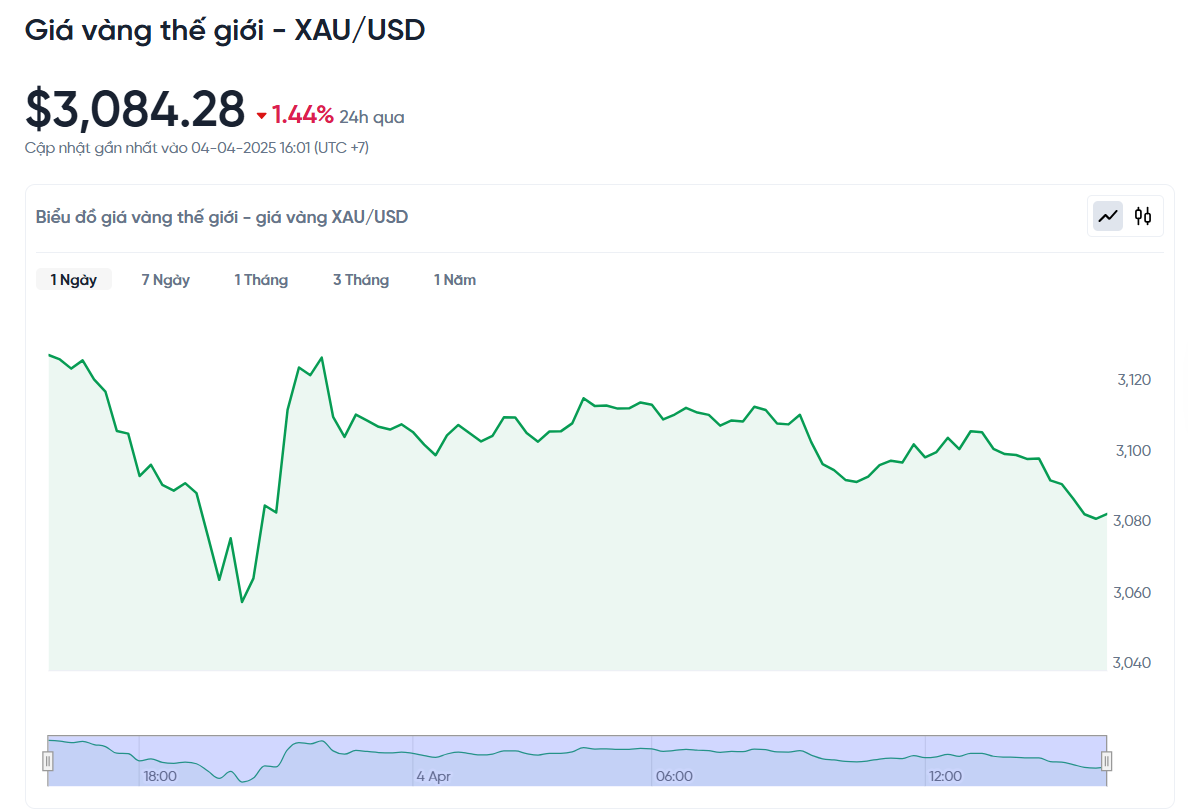

- Closing price of gold today, April 4, 2025, world market

Closing price of gold today, April 4, 2025 in the domestic market

Update gold price today April 4, 2025, the domestic gold market witnessed a volatile trading day with an overwhelming downward trend in both buying and selling directions. From SJC, DOJI to PNJ, major brands all recorded a sharp drop in price compared to yesterday, making investors restless. Let's take a look at the closing price of gold on April 4, 2025 to seize opportunities in this challenging market context!

In Hanoi, the price of SJC gold listed by Saigon Jewelry Company (SJC) was VND98.8 million/tael (buy) and VND101.3 million/tael (sell), down VND700,000 and VND900,000 respectively compared to the previous session. This sharp downward trend was also recorded at branches in Ho Chi Minh City and Da Nang, with similar prices, showing that selling pressure is dominating.

Not only SJC, SJC 99.99% gold rings are also not out of the downward spiral. The buying price reached 98.7 million VND/tael (down 700,000 VND), while the selling price was fixed at 101.2 - 101.3 million VND/tael (down 800,000 - 900,000 VND). Obviously, the gold price today, April 4, 2025, is reflecting a market under great pressure.

DOJI Group is not out of the general trend when the price of AVPL/SJC gold in Hanoi, Ho Chi Minh City and Da Nang all decreased sharply. Specifically, the buying price was 98.8 million VND/tael (down 700,000 VND), while the selling price was 101.3 million VND/tael (down 900,000 VND). For 9999 raw gold in Hanoi, the buying price decreased to 98.5 million VND/tael, while the selling price remained unchanged at 100.6 million VND/tael, but still down 700,000 VND compared to yesterday. This is a clear signal that the gold market is in a strong adjustment phase.

At PNJ, the closing price of gold on April 4, 2025 continued to record a widespread downward trend. PNJ gold prices in Ho Chi Minh City, Hanoi, Da Nang and the West all decreased sharply, with buying at 98.7 million VND/tael (down 800,000 VND) and selling at 101.3 million VND/tael (down 900,000 VND). In particular, PNJ jewelry gold could not avoid the decline, from 999.9 gold (down 600,000 VND) to 14K gold (down 350,000 VND), showing that the influence of this trend spread across all segments.

With gold prices today, April 4, 2025, falling sharply across the board, from several hundred thousand to nearly 1 million VND/tael depending on the brand, the market is opening up opportunities for those who want to "buy the bottom". However, the sharp downward trend also poses risks if prices continue to plummet in the coming sessions. Investors need to closely monitor fluctuations to make the right decisions.

Closing price of gold on April 4, 2025: Domestic gold price decreased overwhelmingly in both directions, close to 1 million VND

In general, the closing price of gold on April 4, 2025 showed a strong downward trend covering the entire market, from SJC gold bars, gold rings to jewelry gold. SJC gold price in Hanoi plummeted to 98.8-101.3 million VND/tael (down 700,000-900,000 VND), while 999.9 jewelry gold at PNJ could not escape the decline, reaching 98.9-101.4 million VND/tael (down 600,000 VND). This is a clear signal that the gold market is adjusting strongly, opening up "bottom fishing" opportunities for astute investors. Today's gold price on April 4, 2025 is truly the center of attention in the context of constant fluctuations!

As of 4:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 98.7 - 101.5 million VND/tael (buy - sell);

Bao Tin Minh Chau listed the price of gold rings at 99.0 - 101.6 million VND tael (buy - sell); down 100 thousand VND/tael for buying and down 700 thousand VND/tael for selling.

The latest gold price update table today, April 4, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

SJC in Hanoi | 98.8 | ▼700 | 101.3 | ▼900 |

DOJI Group | 98.8 | ▼700 | 101.3 | ▼900 |

Red Eyelashes | 99,500 | ▼200 | 101.2 | ▼200 |

PNJ | 98.7 | ▼800 | 101.3 | ▼900 |

Vietinbank Gold | 101.3 | ▼900 | ||

Bao Tin Minh Chau | 98.8 | ▼200 | 101.3 | ▼900 |

Phu Quy | 98.6 | ▼400 | 101.3 | ▼900 |

1. DOJI - Updated: 04/04/2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

Type | Buy | Sell |

AVPL/SJC HN | 98,800 ▼700 | 101,300 ▼900 |

AVPL/SJC HCM | 98,800 ▼700 | 101,300 ▼900 |

AVPL/SJC DN | 98,800 ▼700 | 101,300 ▼900 |

Raw material 9999 - HN | 98,500 | 100,600 ▼700 |

Raw material 999 - HN | 98,400 | 100,500 ▼700 |

2. PNJ - Updated: 04/04/2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

Type | Buy | Sell |

HCMC - PNJ | 98,700 ▼800K | 101,300 ▼900K |

HCMC - SJC | 98,800 ▼700K | 101,300 ▼900K |

Hanoi - PNJ | 98,700 ▼800K | 101,300 ▼900K |

Hanoi - SJC | 98,800 ▼700K | 101,300 ▼900K |

Da Nang - PNJ | 98,700 ▼800K | 101,300 ▼900K |

Da Nang - SJC | 98,800 ▼700K | 101,300 ▼900K |

Western Region - PNJ | 98,700 ▼800K | 101,300 ▼900K |

Western Region - SJC | 98,800 ▼700K | 101,300 ▼900K |

Jewelry gold price - PNJ | 98,700 ▼800K | 101,300 ▼900K |

Jewelry gold price - SJC | 99,000 ▼500K | 101,500 ▼700K |

Jewelry gold price - Southeast | 98,900 ▼600K | |

Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,900 ▼600K |

Jewelry gold price - Jewelry gold 999.9 | 98,900 ▼600K | 101,400 ▼600K |

Jewelry gold price - Jewelry gold 999 | 98,800 ▼600K | 101,300 ▼600K |

Jewelry gold price - Jewelry gold 99 | 97,990 ▼590K | 100,490 ▼590K |

Jewelry gold price - 916 gold (22K) | 90,480 ▼550K | 92,980 ▼550K |

Jewelry gold price - 750 gold (18K) | 73,700 ▼450K | 76,200 ▼450K |

Jewelry gold price - 680 gold (16.3K) | 66,600 ▼410K | 69,100 ▼410K |

Jewelry gold price - 650 gold (15.6K) | 63,560 ▼390K | 66,060 ▼390K |

Jewelry gold price - 610 gold (14.6K) | 59,500 ▼370K | 62,000 ▼370K |

Jewelry gold price - 585 gold (14K) | 56,970 ▼350K | 59,470 ▼350K |

Jewelry gold price - 416 gold (10K) | 39,830 ▼250K | 42,330 ▼250K |

Jewelry gold price - 375 gold (9K) | 35,680 ▼220K | 38,180 ▼220K |

Jewelry gold price - 333 gold (8K) | 31,110 ▼200K | 33,610 ▼200K |

3. SJC - Updated: 04/04/2025 16:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

SJC Gold 1L, 10L, 1KG | 98,800 ▼700K | 101,300 ▼900K |

SJC gold 5 chi | 98,800 ▼700K | 101,320 ▼900K |

SJC gold 0.5 chi, 1 chi, 2 chi | 98,800 ▼700K | 101,330 ▼900K |

SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,700 ▼700K | 101,200 ▼800K |

SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,700 ▼700K | 101,300 ▼800K |

Jewelry 99.99% | 98,700 ▼700K | 100,900 ▼200K |

Jewelry 99% | 96,900 ▼792K | 99,900 ▼792K |

Jewelry 68% | 65,768 ▼544K | 68,768 ▼544K |

Jewelry 41.7% | 39,229 ▼333K | 42,229 ▼333K |

Closing price of gold today, April 4, 2025, world market

At the time of trading at 4:00 p.m. on April 4, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,084.28 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 97.58 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (98.8-101.3 million VND/tael), the SJC gold price is currently about 3.7 million higher than the international gold price.

Demand for physical gold in China rose this week on trade war concerns, prompting many to seek gold as a safe investment. However, in India, buyers were less likely to buy as they expect prices to fall in the near future.

In China, dealers are selling gold at a premium of $6 to $13 per ounce above the global benchmark, a sharp change from last week when gold was sold at a discount of $4 or just $1 above. According to independent analyst Ross Norman, the market is currently divided between two opposing trends: on one side are new investors pouring money into gold due to concerns about instability, while on the other side are sellers taking profits from record prices.

Central banks are also expected to continue buying gold this year due to the risks posed by US President Donald Trump’s policies. Trump recently announced a tariff plan that includes a minimum 10% tax on most goods imported into the US, along with significantly higher tariffs on goods from dozens of other countries.

In India, dealers are selling gold at discounts of up to $20 per ounce below the official domestic price, including a 6 percent import duty and a 3 percent sales tax. The discounts are lower than last week, when they were as much as $33. A gold dealer in Mumbai said the continued volatility in gold prices has made buyers nervous and they are waiting for the market to stabilize.

Domestic gold prices in India were trading around 89,700 rupees per 10 grams on Friday, after hitting a record high of 91,696 rupees in the previous session. Gold prices have risen nearly 15% so far in 2025. Another dealer in Mumbai said the decline was narrowing as gold imports have fallen in recent months.

In other markets such as Hong Kong, gold was selling at or above $2, while in Singapore, the premium ranged from $2 to $2. In Japan, gold was selling at or above $0.50. A trader in Tokyo said some people were selling gold to lock in profits, but as prices eased, more buyers came in.

Overall, the gold market is witnessing strong volatility due to global economic and political factors, creating both opportunities and challenges for investors.

Source: https://baoquangnam.vn/chot-phien-gia-vang-ngay-4-4-2025-gia-vang-trong-nuoc-giam-ap-dao-o-2-chieu-sat-1-trieu-dong-3152140.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)