Closing price of gold today, April 11, 2025 in the domestic market

At the time of the survey at 4:00 p.m. on April 11, 2025, the domestic gold price today, April 11, 2025, is breaking out strongly, recording a clear upward trend across the market. The price of gold bars and gold jewelry continuously set new peaks, with the common selling price exceeding 105 million VND/tael, reflecting the constant attraction of this precious metal. Below is a detailed update of the closing price of gold on April 11, 2025 from reputable brands, providing a comprehensive view of the current gold fever.

In Hanoi, the price of SJC gold bars was listed at 102.2-105.2 million VND/tael (buy - sell), a sharp increase of 1.6 million VND/tael in both directions compared to yesterday. The difference between buying and selling prices remained at 3 million VND/tael, showing the vibrant buying and selling in the capital. Similarly, DOJI Group also recorded an impressive increase, with the price of gold bars reaching 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling prices remained at 3 million VND/tael, confirming the strong upward trend across the entire system.

At SJC Company, the price of 1L, 10L, 1KG gold bars was listed at 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. For SJC 99.99% gold rings (1 chi, 2 chi, 5 chi), the price reached 101.3-104.4 million VND/tael, an increase of 1.3 million VND/tael in the buying direction and 1.6 million VND/tael in the selling direction. Particularly, 99.99% jewelry gold recorded 101.3-103.9 million VND/tael, an increase of 1.3 million VND/tael in the buying direction and 1.4 million VND/tael in the selling direction, showing the special attraction of this product line on a bustling trading day.

PNJ continues to be the center of attention when announcing today's gold price on April 11, 2025 at 100.8-104.3 million VND/tael (buy - sell) for PNJ gold bars in Ho Chi Minh City, Hanoi , Da Nang and the West, increasing by 900 thousand VND/tael for buying and 1.4 million VND/tael for selling. The difference between buying and selling prices remains at 3.5 million VND/tael, demonstrating the constant heat of gold bars. For 999.9 jewelry gold, PNJ listed the price at 100.8-103.3 million VND/tael, an increase of 900 thousand VND/tael in both directions, while 750 (18K) jewelry gold reached 75.13-77.63 million VND/tael, an increase of 680 thousand VND/tael, highlighting the strong upward trend of jewelry gold.

Bao Tin Minh Chau pushed the price of SJC gold bars to 102.2-105.7 million VND/tael (buying - selling), up 1.6 million VND/tael for buying and 2.1 million VND/tael for selling, respectively. The difference between buying and selling prices was 3.5 million VND/tael, confirming the impressive breakthrough at this unit. Similarly, Phu Quy listed the price of SJC gold bars at 102.2-105.7 million VND/tael, up 2.2 million VND/tael for buying and 2.1 million VND/tael for selling, with the difference between buying and selling prices being 3.5 million VND/tael, reflecting the strong growth in the market.

In Mi Hong alone, the price of SJC gold bars was recorded at 102.8-104.8 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for buying and 1.8 million VND/tael for selling. The difference between buying and selling prices narrowed to 2 million VND/tael, showing the caution of this unit in the context of rising prices. Vietinbank Gold announced the selling price of gold bars at 105.2 million VND/tael, an increase of 1.6 million VND/tael, while the buying price was not specifically updated in this survey.

In general, the closing price of gold on April 11, 2025 is witnessing a strong upward trend across the market, from SJC gold bars, gold rings to jewelry gold. The price of 999 jewelry gold at PNJ reached 99.87-102.37 million VND/tael, an increase of 890 thousand VND/tael in both directions, while 916 gold (22K) reached 92.22-94.72 million VND/tael, an increase of 820 thousand VND/tael, affirming the appeal of jewelry gold. For those who are looking for investment or storage opportunities, today's gold price on April 11, 2025 is a signal that cannot be ignored, especially when the market is feverish with strong growth in all segments.

As of 4:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 102.2 - 105.2 million VND/tael (buy - sell); an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 100.9 - 104.5 million VND/tael (buy - sell); increased by 200 thousand VND/tael for buying and increased by 800 thousand VND for selling.

The latest gold price update table today, April 11, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 102.2 | ▲1600 | 105.2 | ▲1600 |

| DOJI Group | 102.2 | ▲1600 | 105.2 | ▲1600 |

| Red Eyelashes | 102.8 | ▲1100 | 104.8 | ▲1800 |

| PNJ | 100.8 | ▲900 | 104.3 | ▲1400 |

| Vietinbank Gold | 105.2 | ▲1600 | ||

| Bao Tin Minh Chau | 102.2 | ▲1600 | 105.7 | ▲2100 |

| Phu Quy | 102.2 | ▲2200 | 105.7 | ▲2100 |

| 1. DOJI - Updated: April 11, 2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 102,200 ▲1600 | 105,200 ▲1600 |

| AVPL/SJC HCM | 102,200 ▲1600 | 105,200 ▲1600 |

| AVPL/SJC DN | 102,200 ▲1600 | 102,200 ▲1600 |

| Raw material 9999 - HN | 100,500 ▲500 | 103,400 ▲1100 |

| Raw material 999 - HN | 100,400 ▲500 | 103,300 ▲1100 |

| 2. PNJ - Updated: April 11, 2025 16:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| HCMC - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Hanoi - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Hanoi - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Da Nang - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Da Nang - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Western Region - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Western Region - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Jewelry gold price - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Jewelry gold price - Southeast | PNJ | 100,800 ▲900K |

| Jewelry gold price - SJC | 102,200 ▲1600 | 105,200 ▲1600 |

| Jewelry gold price - PNJ 999.9 Plain Ring | 100,800 ▲900K | |

| Jewelry gold price - Kim Bao Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Jewelry gold 999.9 | 100,800 ▲900K | 103,300 ▲900K |

| Jewelry gold price - Jewelry gold 999 | 100,700 ▲900K | 103,200 ▲900K |

| Jewelry gold price - Jewelry gold 9920 | 100,070 ▲890K | 102,570 ▲890K |

| Jewelry gold price - Jewelry gold 99 | 99,870 ▲890K | 102,370 ▲890K |

| Jewelry gold price - 750 gold (18K) | 75,130 ▲680K | 77,630 ▲680K |

| Jewelry gold price - 585 gold (14K) | 58,080 ▲530K | 60,580 ▲530K |

| Jewelry gold price - 416 gold (10K) | 40,620 ▲370K | 43,120 ▲370K |

| Jewelry gold price - 916 gold (22K) | 92,220 ▲820K | 94,720 ▲820K |

| Jewelry gold price - 610 gold (14.6K) | 60,660 ▲550K | 63,160 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 64,800 ▲590K | 67,300 ▲590K |

| Jewelry gold price - 680 gold (16.3K) | 67,890 ▲610K | 70,390 ▲610K |

| Jewelry gold price - 375 gold (9K) | 36,390 ▲340K | 38,890 ▲340K |

| Jewelry gold price - 333 gold (8K) | 31,740 ▲300K | 34,240 ▲300K |

| 3. SJC - Updated: 11/04/2025 16:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 102,200 ▲1600 | 105,200 ▲1600 |

| SJC gold 5 chi | 102,200 ▲1600 | 105,220 ▲1600 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 102,200 ▲1600 | 105,230 ▲1600 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,300 ▲1300 | 104,400 ▲1600 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,300 ▲1300 | 104,500 ▲1600 |

| Jewelry 99.99% | 101,300 ▲1300 | 103,900 ▲1400 |

| Jewelry 99% | 99,071 ▲586 | 102,871 ▲1386 |

| Jewelry 68% | 67,009 ▲152 | 70,809 ▲952 |

| Jewelry 41.7% | 39,680 ▼216 | 43,480 ▲583 |

Closing price of gold today, April 11, 2025, world market

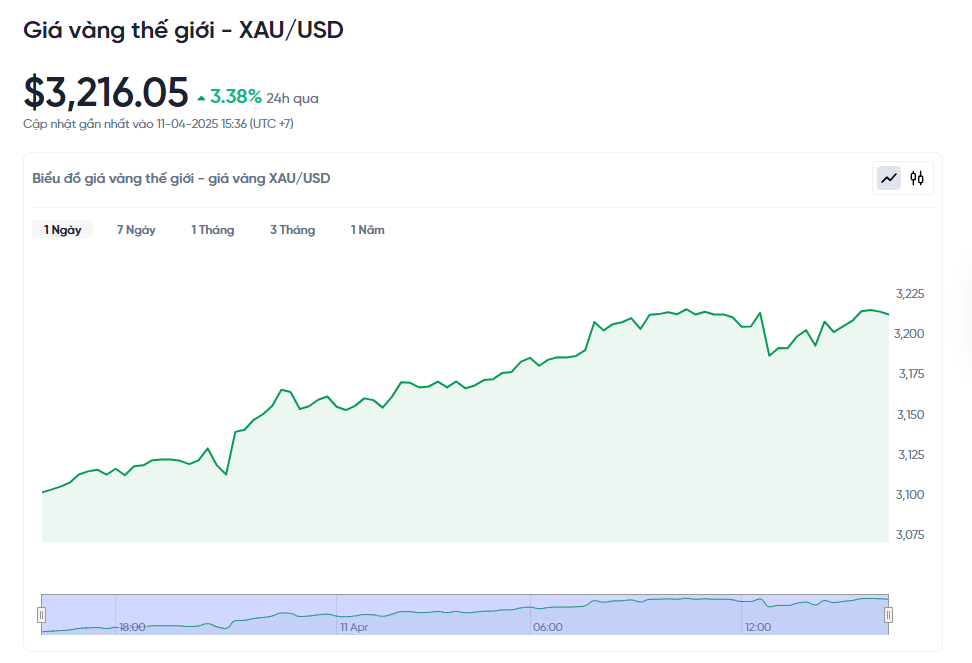

At the time of trading at 4:00 p.m. on April 3, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,216.05 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 101.75 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (102.2-105.2 million VND/tael), the SJC gold price is currently about 3.45 million VND/tael higher than the international gold price.

Gold prices are rising sharply and reached an all-time high on April 11. The main reason is that many people are looking to gold as a safe place to protect their assets. As the US and China continue to impose tariffs on each other's goods, trade tensions between the two countries are escalating. This makes people worried about the global economic situation, and gold becomes an attractive option to keep money.

Gold is currently trading at $3,216.05 per ounce, up more than 22% since the beginning of the year. This shows that gold is attracting a lot of attention. Typically, large gold buyers, such as professional investors, will deal with large banks. The price of gold is determined by the supply and demand at that time, much like a market where prices change constantly depending on the number of buyers and sellers.

London is one of the most important places to trade gold. There is an organization called the London Bullion Market Association, which helps set the rules and facilitates the buying and selling of gold by banks, companies, or organizations. In addition to London, countries such as China, India, the Middle East, and the United States are also active gold trading locations.

In addition to buying gold directly, some people choose to invest in gold through the futures market. This is where people agree to buy or sell gold at a fixed price, but take delivery at a future date. For example, you could agree to buy gold at today's price, but only receive it a few months later. This market is popular in the United States, especially on the COMEX in New York. China and Japan also have similar exchanges, such as the Shanghai Futures Exchange and the Tokyo Commodity Exchange.

Another way to invest in gold without actually holding the metal is through gold exchange-traded funds, or ETFs. These funds hold physical gold and issue securities for you to buy, just like stocks. This year, these funds have attracted $3.4 billion, showing that many people are looking to invest in gold without having to worry about storing it.

For retail buyers like us, gold is usually purchased in the form of gold bars or coins in stores or online. This is a simple way to own gold, and both are good options if you want to invest in real gold.

The reason gold is getting more attention is because large investment funds are pouring money into this market. In addition, economic news or global events, such as tensions between countries, also cause many people to buy gold as a hedge against risks. When market sentiment changes, the price of gold can rise or fall sharply depending on whether people feel safe or worried.

Interestingly, gold is often linked to the value of the US dollar. When the dollar weakens, gold becomes cheaper for people using other currencies, so they buy more of it, pushing the price up. Conversely, when the dollar strengthens, the price of gold can fall. So gold is seen as a way to protect money when the currency markets are volatile.

Finally, gold is a favorite in times of global uncertainty, such as when there is a threat of a trade war. Currently, US President Trump has increased tariffs on Chinese goods, bringing the effective import tax to 145%. China has responded by raising tariffs on US goods from 84% to 125%. These moves have worried financial markets, with many fearing a recession and rising inflation. In such a context, gold has become a safe haven, giving people more peace of mind when holding their assets.

Source: https://baoquangnam.vn/chot-phien-gia-vang-ngay-11-4-2025-gia-vang-trong-nuoc-tiep-tuc-tao-dinh-moi-hon-105-trieu-3152565.html

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)