SGGPO

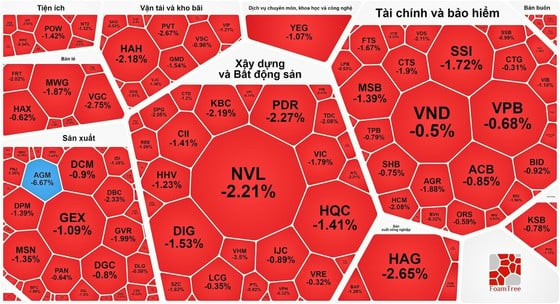

Pillar stocks fell sharply, causing the VN-Index to correct sharply. The market was covered in red except for steel stocks.

|

| The market is full of red |

The stock market on August 9 was adjusted after the VN-Index struggled to maintain its highest peak in 2023 in the previous session thanks to some pillar stocks such as VIC, VRE...

Not only midcap stocks continued to be sold off, large-cap stocks also fell under strong selling pressure. Up to 27/30 stocks in the VN30-Index basket fell, contributing to the sharp decline of the VN-Index. Of which, VHM fell 3.5%, VIC fell 1.79%, VNM fell 1.88%, MWG fell 1.87%, GVR fell 1.9%...

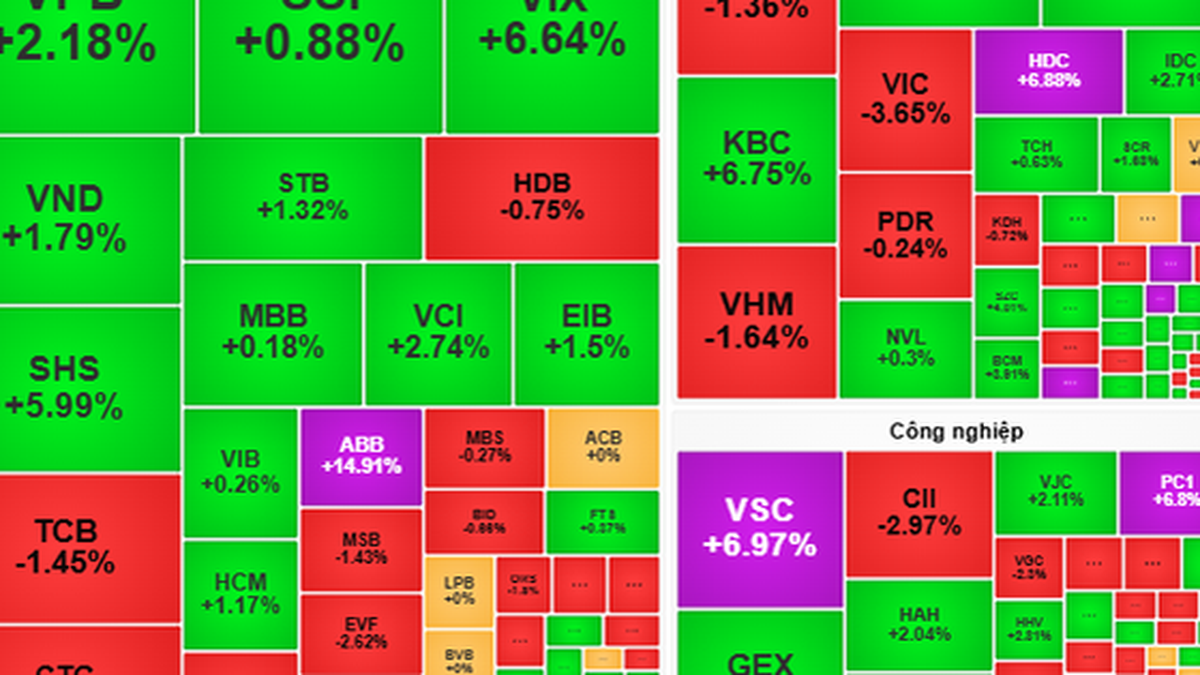

Steel stocks in particular went against the market trend and increased strongly, in which HPG increased by 2.2%, HSG increased by 2.2%, POM increased by 2.4%, NKG increased by 1.6%... In addition, some real estate stocks also kept the green color such as HDC, BCG, DXG, VCG, NLG... The group of large bank stocks, except STB, increased strongly by 4.7%, the rest decreased by nearly 1% such as SSB, ACB , CTG, BID, VCB, VBB, MBB... causing the VN-Index to decrease by nearly 9 points at the end of the session.

While domestic investors sold off, foreign investors returned to net buy nearly 340 billion VND on the HOSE floor.

At the end of the trading session, VN-Index decreased by 8.34 points (0.66%) to 1,233.99 points with 215 stocks increasing, 276 stocks decreasing and 62 stocks remaining unchanged.

At the end of the session at Hanoi Stock Exchange, HNX-Index also decreased by 0.19 points (0.08%) to 245.88 points with 83 stocks decreasing, 120 stocks increasing and 129 stocks remaining unchanged.

Market liquidity decreased sharply, with total transaction value at nearly VND24,600 billion compared to nearly VND27,000 billion in the previous session.

Source

Comment (0)