DNVN - Financial expert Pham Xuan Hoe - General Secretary of the Vietnam Financial Leasing Association said that financial leasing in Vietnam is facing many challenges regarding legality, credit risks and operational risks.

Speaking at the workshop "Digital ecosystem and sustainable development for the financial leasing industry in Vietnam" on the morning of May 10, Mr. Nguyen Thieu Son - Chairman of the Vietnam Financial Leasing Association said that, having appeared in the Vietnamese market since 1998, financial leasing has now become popular with convenient features such as no need to mortgage collateral, high funding rate, and diverse financing products.

In particular, this form is suitable for corporate customers who need capital to focus on production. Because, through financial leasing, businesses can quickly put machinery and equipment into operation. Thereby, promptly respond to urgent orders with large quantities without too much cost.

However, in reality, the financial leasing market is still developing modestly. By the end of 2023, the total outstanding financial leasing debt reached about 45 - 46 trillion VND, accounting for 0.34% of the total outstanding debt. The number of enterprises using this service is only 15,000, out of a total of 800,000 operating enterprises, accounting for 1.5%.

Due to modest development, financial leasing products are currently mostly similar to credit loans. New products and new ideas have not been developed much in the market.

Explaining the above situation, Mr. Pham Xuan Hoe - General Secretary of the Vietnam Financial Leasing Association said that the major challenges of financial leasing are legal, credit risk and operational risk.

This is an inherent risk from the policy adjustment of the transitional economy . The legal framework for this activity is combined with commercial banks, so it is very limited in terms of customers and rental assets.

Along with that, rapid changes in technology, combined with limitations in customers' business and management capacity, are creating credit and operational risks.

However, Mr. Hoe said that the financial leasing market in Vietnam still has a lot of potential for development because Vietnam is in the developing group with GDP growth among the top in the world . This leads to a huge demand for asset leasing.

The digital transformation process and the development of green economy and circular economy are creating a great demand for medium and long-term credit, especially financial leasing. The limit on the ratio of short-term capital to medium and long-term lending of commercial banks opens up opportunities for asset leasing to develop.

“To help financial leasing activities grow in both breadth and depth, it is recommended that the State Bank soon hold a conference to discuss in depth the guiding circular. It is necessary to clearly analyze the difference between financial leasing and commercial banking activities, especially in the context of the Law on Credit Institutions 2024 coming into effect on July 1,” Mr. Hoe recommended.

Galaxy

Source: https://doanhnghiepvn.vn/kinh-te/tai-chinh-ngan-hang/cho-thue-tai-chinh-nhieu-thach-thuc-ve-phap-ly-va-rui-ro-tin-dung/20240510025316045

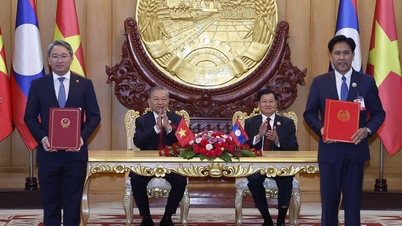

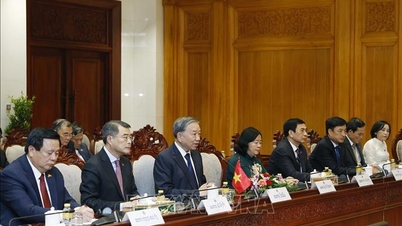

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

Comment (0)