According to some real estate forums, many investors expressed their frustration and disappointment with the resort real estate market, especially condotels. This used to be a type of investment that many people sought after because of its affordable price, promising good profitability, being able to send the investor to do business on their behalf and also receiving a specific number of vacation days in a year.

In 2019, the profit commitment level at some condotel projects was considered appropriate at 6% for projects with foreign management and 10% for projects operated by the investor himself.

But in reality, most condotel investors are currently in a difficult situation when stuck with this type of real estate. Many people said that, unlike the promise of profits when inviting to buy condotels at the time when the market is "hot", in some projects that do not attract customers, the recorded profit rate is only 1-2%/year.

Meanwhile, investors using leverage are still having to "bend their backs" to pay bank interest when interest rates are still quite high. Some people who are no longer able to pay interest have had to sell condotels at a loss, some products have had to be cut by up to 50% but still cannot find buyers because confidence in this market is at a very low level.

Condotel used to be a type of investment sought after by many investors.

In particular, according to an investor who owns a condotel worth more than 4 billion VND in a project in the Northern region, because the rental revenue is lower than the management and cleaning costs, etc., in the first 6 months of 2023, the condotel owner will lose 18 million VND. This negative amount of 3 million VND per month will be debited to the apartment owner.

In addition, some condotel projects have also caused many conflicts between owners and investors in recent times. Many people buy condotels but do not actually own the apartments, and running their own business also faces many difficulties due to problems in operation and management with investors.

These problems make it increasingly difficult for this type of investment to regain the trust of investors. Therefore, many people have more difficulty selling at a loss to reduce financial pressure from the bank or wanting to recover capital to invest in other types.

In the current situation, many experts believe that the problems that condotels face will not stop at the above stories. Although the Government has issued many policies to remove difficulties and obstacles, condotels in particular and the resort real estate market in general are still facing many other objective problems, making it more difficult for this market to recover. Including the fact that supply is exceeding demand too much, leading to a decrease in the profit margin of this type.

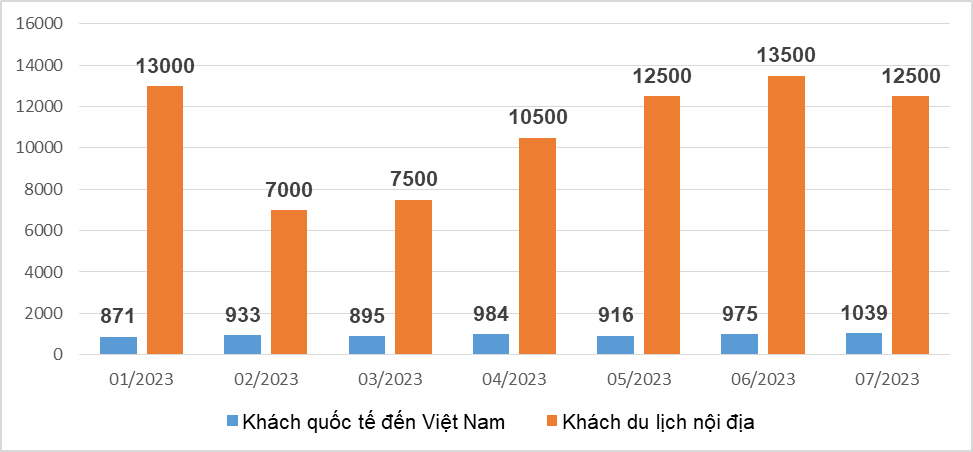

The incomplete recovery of tourism combined with oversupply has dragged down the profit margin of resort real estate.

According to a recent report by DKRA Group, the cumulative condotel inventory by June has increased to 42,364 units. Of which, the total inventory of coastal townhouses has increased to approximately 30,000 products. For coastal villas alone, the cumulative inventory by the end of the second quarter of 2023 is up to 15,000 units in both the North and the South.

According to research by the Market Research Department of BHS Group, from 2020 to now, the whole country has 81 resort real estate projects that have been and are in the process of handing over, providing the market with more than 44,000 products, including high-rise and low-rise. Of which, 67/81 projects have been put into operation, equivalent to nearly 20,000 products. With the number of projects remaining and products of operating projects that have not been brought to the market, the supply of resort real estate is still very large.

In addition, Vietnam's tourism industry has not yet fully recovered, so the occupancy rate at resort and hotel projects is still not high. Especially for investors who "accidentally" entrust their apartments to developers with high management costs, it is obvious that they have to record negative profits.

Source

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)