Clearly define the acts of late payment and evasion of social insurance payment

The Law on Social Insurance (amended) clearly defines the acts of late payment and evasion of social insurance payment.

Photo is for illustration purposes only

Accordingly, the Law stipulates that late payment of compulsory social insurance and unemployment insurance is an act of an employer in one of the following cases:

Not paying or not paying in full the amount required to be paid according to the registered compulsory social insurance and unemployment insurance registration dossiers since the latest date of social insurance payment as prescribed in Clause 4, Article 34 of this Law or since the latest date of unemployment insurance payment as prescribed by the law on unemployment insurance, except for the cases prescribed in Points d and e, Clause 1, Article 39.

Failure to register or incomplete registration of the number of people required to participate in compulsory social insurance within 60 days from the date of expiry of the deadline specified in Clause 1, Article 28 of this Law.

Failure to register or incomplete registration of the number of people required to participate in unemployment insurance within 60 days from the date of expiry of the period for participation in unemployment insurance as prescribed by the law on unemployment insurance.

Belonging to cases that are not considered as evading compulsory social insurance and unemployment insurance payments as prescribed in Clause 2, Article 39 of this Law.

Evading compulsory social insurance and unemployment insurance is the act of an employer in one of the following cases of not paying or not fully paying social insurance and unemployment insurance for employees:

After 60 days from the date of expiry of the period prescribed in Clause 1, Article 28 of this Law, if the employer fails to register or fails to fully register the number of employees required to participate in compulsory social insurance;

After 60 days from the date of expiry of the period for participation in unemployment insurance as prescribed by the law on unemployment insurance, the employer does not register or does not fully register the number of employees required to participate in unemployment insurance;

Registering salary as the basis for compulsory social insurance payment lower than the provisions in Clause 1, Article 31 of this Law;

Registering salary as the basis for unemployment insurance payment lower than the provisions of the law on unemployment insurance;

Failure to pay or incomplete payment of the registered compulsory social insurance amount after 60 days from the date of payment of compulsory social insurance at the latest as prescribed in Clause 4, Article 34 of this Law and having been urged by a competent authority as prescribed in Article 35 of this Law;

Failure to pay or incomplete payment of the registered amount of unemployment insurance after 60 days from the date of payment of unemployment insurance at the latest as prescribed by the law on unemployment insurance and has been urged by a competent authority as prescribed in Article 35 of this Law;

Other cases are considered as evasion of compulsory social insurance and unemployment insurance according to Government regulations.

The Law also assigns the Government to detail this Article; stipulates that cases falling under Clause 1 of this Article but with legitimate reasons are not considered as evasion of compulsory social insurance and unemployment insurance.

Measures to handle late payment and evasion of social insurance payment

The Law on Social Insurance (amended) specifically stipulates measures to deal with acts of late payment and evasion of social insurance payment.

That is, it is mandatory to pay the full amount of late or evaded social insurance; pay an amount equal to 0.03%/day calculated on the amount of late or evaded social insurance and unemployment insurance, and the number of days of late or evaded payment.

Penalize administrative violations according to the provisions of law; do not consider awarding emulation titles or forms of commendation.

As for the act of tax evasion, there are also strong measures to prosecute criminal liability according to the provisions of law.

On the other hand, to ensure the rights of employees, the Law on Social Insurance (amended) has added the responsibility of employers to compensate employees if they do not participate or participate incompletely or untimely in compulsory social insurance, causing damage to the legitimate rights and interests of employees.

In addition, the Law stipulates that the social insurance agency shall publicize on the social insurance agency's electronic information portal the cases of employers who are late in paying or evading compulsory social insurance and unemployment insurance. The social insurance agency shall send information on employers who are late in paying or evading compulsory social insurance and unemployment insurance to the state management agency of social insurance and unemployment insurance and relevant inspection agencies for consideration and handling according to their authority.

Source: https://www.congluan.vn/chinh-thuc-quy-dinh-xu-ly-hinh-su-hanh-vi-tron-dong-bao-hiem-xa-hoi-post306137.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

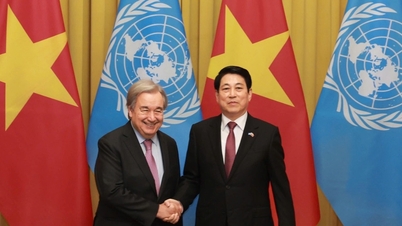

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

Comment (0)