Workshop “Supporting economic growth - Perspective from enterprises subject to special consumption tax”

These are the opinions discussed at the Workshop "Supporting economic growth - Perspective from enterprises subject to special consumption tax" co-organized by Nhan Dan Newspaper on April 22.

Dual challenges from domestic and foreign economic developments

Speaking at the opening of the workshop, Mr. Le Quoc Minh, Editor-in-Chief of Nhan Dan Newspaper, Deputy Head of the Central Propaganda and Mass Mobilization Commission, Chairman of the Vietnam Journalists Association, said that in the context of the world economy still facing many difficulties and challenges, the socio-economic situation in the first quarter of 2025 of our country continued to maintain a positive trend: The macro economy was stable, inflation was under control, major balances were ensured, and many industries and fields achieved many important results, creating momentum for growth in the following quarters.

The GDP growth rate in the first quarter of this year reached 6.93% compared to the same period last year, reflecting the positive recovery of the economy. It can be said that this is the initial result of the persistent efforts of the entire political system in implementing solutions to remove difficulties and create favorable conditions for economic sectors to develop production and business activities.

However, Mr. Le Quoc Minh also said that this growth rate has not yet reached the target as set in the operating scenario that has been adjusted by the Government to suit the new situation of the country, towards the aspiration of becoming a prosperous nation by 2045.

Currently, the world situation continues to have complex and unpredictable developments, especially the US announcement of high reciprocal tax policies against Vietnam and many other trading partners. Although President Donald Trump has suspended the plan to impose reciprocal taxes for 90 days against more than 75 countries, including Vietnam, escalating trade tensions could disrupt the production and supply chains of many economies around the world.

Domestically, the business community is still facing many difficulties since the COVID-19 pandemic.

In that context, the target of striving for GDP growth of 8% or more, creating a solid foundation for double-digit growth in the following years, is becoming more challenging, requiring ministries, sectors and localities to implement many synchronous solutions. In particular, improving the endogenous capacity of the economy through supporting production and business, helping enterprises recover and develop sustainably is an urgent requirement.

"This is also the time when we need to focus on solutions to increase domestic production and have policies to support domestic consumption to become an important driving force for economic growth," comrade Le Quoc Minh emphasized.

Enhancing the endogenous capacity of the economy through supporting production and business, helping enterprises recover and develop sustainably is an urgent requirement.

Mr. Le Quoc Minh said that the draft Law on Special Consumption Tax (amended) will be submitted by the Government to the National Assembly for consideration and approval at the 9th Session of the 15th National Assembly, scheduled to open in May 2025, with the goal of orienting production, adjusting social consumption behavior, and restricting the import, production, and consumption of products harmful to health and the environment.

However, through proposals to add more taxable items, increase tax rates, tax increase roadmap, etc., the contents of the amendments to the Law on Special Consumption Tax this time will have a huge impact on the production chain of many industries, from manufacturing and trading enterprises to distribution and services.

In particular, changing the tax calculation method at the present time will greatly impact the production and business activities of the beer and alcohol industry, which is facing many difficulties after the pandemic.

Associate Professor, Dr. Tran Dinh Thien speaks at the Workshop - Photo: VGP/HT

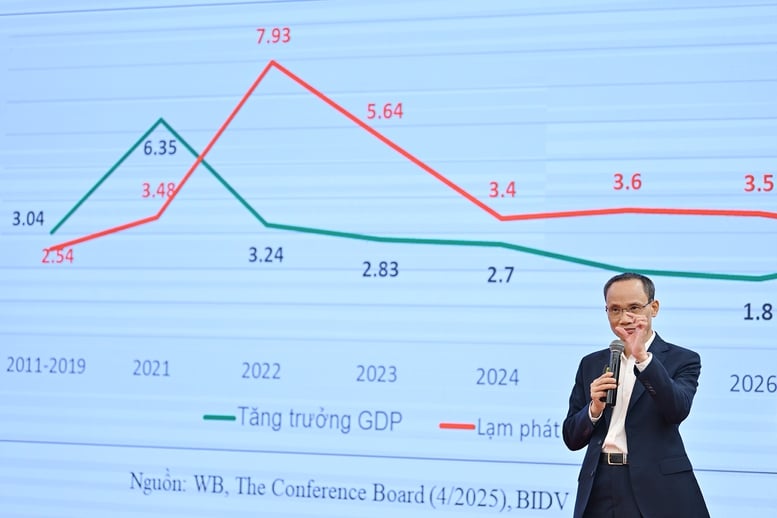

Associate Professor Dr. Tran Dinh Thien commented: Vietnamese enterprises are... lacking and thirsty for capital. Mr. Thien also gave figures showing that the internal growth momentum of the economy is being affected.

From the above situation, the former Director of the Vietnam Economic Institute commented: In the future, to ensure the target of double-digit growth, Vietnam needs to consider the basis for "reversing the growth momentum"; in which, it is necessary to set out an "unusual" approach, placing the role of the Vietnamese business sector at the center of the development momentum.

Associate Professor, Dr. Tran Dinh Thien said: In the future, Vietnam needs to change its development structure to ensure the achievement of the target of double-digit growth in a sustainable manner; in which Vietnamese enterprises must "become the true driving force of economic development".

"This is a key issue and will still face many difficulties; it requires us to focus special efforts on the private economic sector. We must consider enterprises as a valuable asset of the nation," Mr. Tran Dinh Thien affirmed.

Nurturing revenue sources must go hand in hand with stimulating consumption.

Dr. Nguyen Van Phung, a tax policy consultant, said: Tax solutions in the coming time must continue to play a role in creating and nurturing revenue sources through stimulating domestic consumption. Reducing value-added tax from 10% to 8% has supported many groups of goods, but it does not apply to goods subject to special consumption tax such as alcohol, beer and cigarettes.

Therefore, Dr. Nguyen Van Phung proposed that the policy of reducing value added tax should first be expanded to include goods subject to special consumption tax, to ensure fairness and at the same time remove difficulties for manufacturing enterprises.

Dr. Nguyen Van Phung, tax policy consultant - Photo: VGP/HT

In addition, this expert also proposed comprehensive amendments to the Law on Personal Income Tax and Corporate Income Tax. Accordingly, new policies need to be consistent with the current recovery context, both supporting people and ensuring sustainable revenue sources.

In particular, Dr. Nguyen Van Phung noted that the tax increase options in the draft Law on Special Consumption Tax need to be carefully evaluated. If choosing between options, priority should be given to option 1, which has a more reasonable increase level, to avoid causing a "shock" to the market and the beverage industry production chain.

From a legislative perspective, Mr. Pham Van Hoa, National Assembly Delegate of Dong Thap Province, affirmed that tax policy needs to harmonize the goal of protecting public health and supporting economic development. Meanwhile, according to him, the negative impact on the alcohol, beer and beverage industry in recent times is very obvious.

"Children are not obese because of sugary soft drinks but also due to many other reasons such as fast food, milk tea, lack of exercise...", said Mr. Phan Van Hoa. Therefore, taxing soft drinks needs to be studied further to avoid creating unnecessary burdens for businesses and consumers.

Dr. Can Van Luc, chief economist of BIDV, member of the National Financial and Monetary Policy Advisory Council - Photo: VGP/HT

Dr. Can Van Luc, chief economist of BIDV and member of the National Financial and Monetary Policy Advisory Council, emphasized that special consumption tax is a tool to regulate consumer behavior, but if not designed properly, it will have the opposite effect, causing the official beverage market to decline, increasing smuggled and floating goods and budget losses.

Increasing taxes may bring about budget efficiency in the short term, but in the long term, it risks reducing output, reducing added value, leading to a decrease in revenue from value added tax and corporate income tax, leading to a decrease in total benefits.

Studies show that if taxes are increased too strongly and too quickly, it will negatively affect the industry, employment, social security and supporting industries such as packaging, transportation, tourism, etc.

Emphasizing the viewpoint that the tax increase roadmap needs to be reasonable and have a scientific basis, Ms. Phan Minh Thuy, representative of the Legal Department (VCCI), said: The tax increase roadmap should be implemented from 2028, increasing gradually every 2 years by 5% so that businesses have time to adapt, invest in new technology, and change business strategies.

Economist Le Duy Binh, Director of Economica Vietnam, analyzed that in the current economic context, increasing taxes could be a risk. Tax policy in this period must play the role of "relaxing the people and businesses", instead of tightening too quickly.

In particular, Dr. Binh cited that "grass" beer and wine currently account for 63% of the market, a figure that shows the risk if tax policies are not adjusted appropriately.

It is important to control smuggling and support businesses to innovate products. The ultimate goal is still to ensure GDP growth and protect the livelihoods of millions of workers in the beverage and related industries.

Mr. Minh

Source: https://baochinhphu.vn/chinh-sach-thue-can-lo-trinh-hop-ly-ho-tro-tang-truong-kinh-te-102250422175313842.htm

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)