On the afternoon of June 25, the National Assembly listened to the Government report on salary reform; adjustments to pensions, social insurance benefits, preferential benefits for people with meritorious services and social benefits from July 1, 2024.

Presenting the Government 's report, Minister of Home Affairs Pham Thi Thanh Tra said that in the process of implementing and developing 6 specific contents on public sector salary reform in accordance with Resolution No. 27 of the 12th Central Committee, the Government found that many problems and shortcomings arose.

Including issues of new payroll; rearranging allowances; building and perfecting job positions...

These contents were reported by the Government to the Politburo . On June 21, the Politburo issued Conclusion No. 83 agreeing on the policy for the Government to report to the National Assembly for implementation.

Supplement bonus regime equal to 10% of salary fund

Regarding the public sector, the Minister of Home Affairs said that the Government reported and recommended that the National Assembly allow the implementation of 4/6 contents of Resolution No. 27, which are clear and have sufficient conditions for implementation.

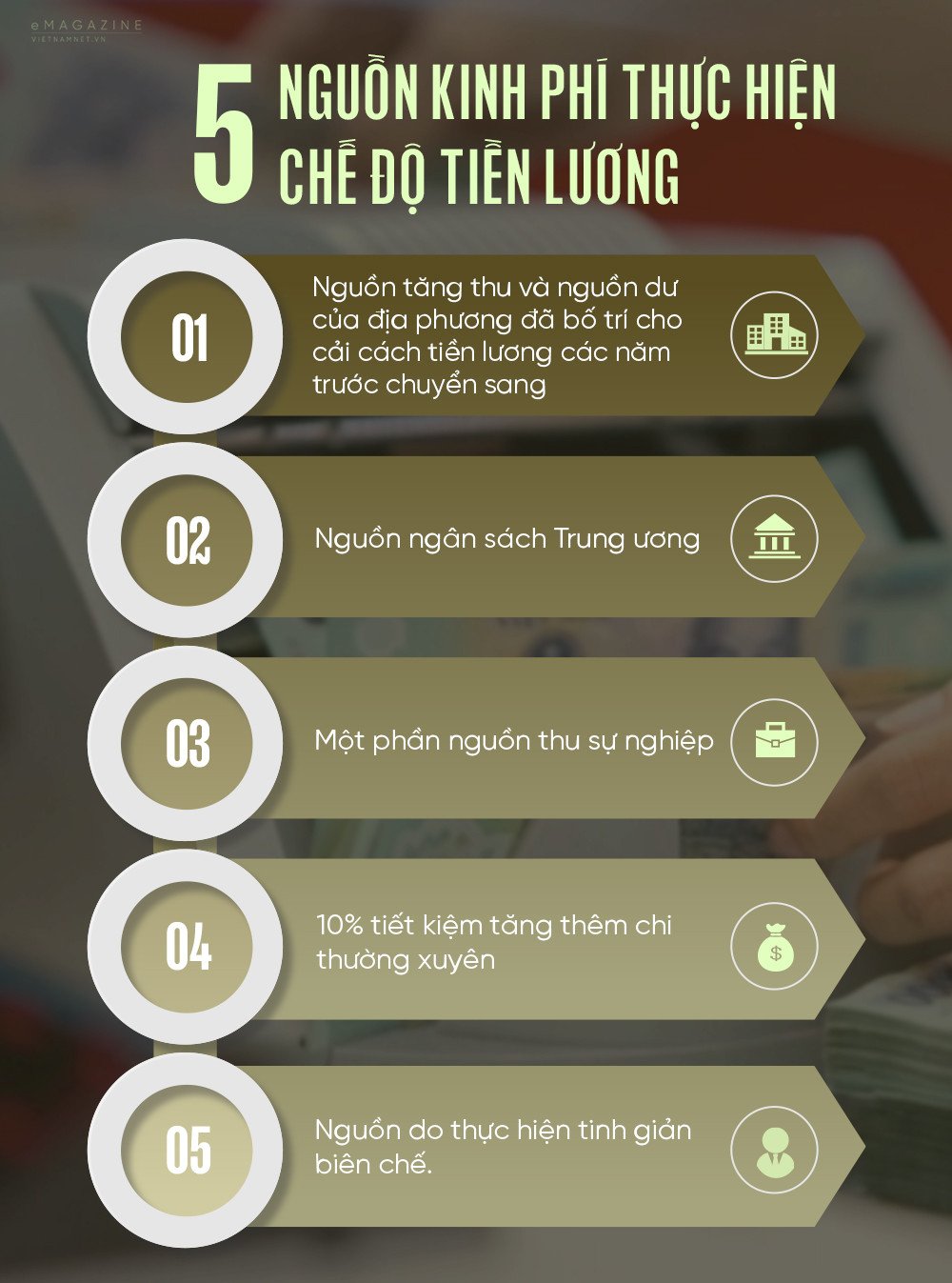

Specifically, perfecting the salary increase regime; supplementing the bonus regime from July 1, 2024 (equal to 10% of the basic salary fund) linked to the assessment and classification of work completion level, creating work motivation, improving work quality and efficiency; implementing regulations and clearly guiding 5 funding sources for implementing the salary regime; perfecting the salary and income management mechanism.

In particular, the Government will regulate and guide the authority of the head to use the salary fund and regular expenditure budget to hire experts, scientists, and talented people to perform the tasks of the agency or unit and to decide on the income payment level associated with the assigned tasks; expand the pilot of increased salary for localities that have balanced their own budgets...

Regarding 2/6 contents of public sector salary reform including new salary tables (removing basic salary and salary coefficient), restructuring and arranging into 9 new allowance regimes, the Minister of Home Affairs said that this is the content that still has many shortcomings.

Therefore, these two contents need to continue to be carefully researched and perfected step by step, and at the same time, many current regulations related to basic salary must be considered for amendment or abolition.

The Government proposes to abolish the basic salary and salary coefficient for implementing the solution to increase public sector salaries from July 1, 2024 with 3 contents during the time when conditions are not met.

Firstly , the Government is assigned to adjust the basic salary from the current 1.8 million VND to 2.34 million VND/month (an increase of 30%), without abolishing the current basic salary and salary coefficient.

Second , to research, amend and supplement the allowance regime and some special regimes of the armed forces and of cadres, civil servants and public employees in some specialized fields where unreasonable conditions arise during the implementation process.

Third , retain salaries and income for agencies and units currently applying special financial and income mechanisms.

The Government continues to direct the review of the entire legal framework to submit to competent authorities for consideration and decision on amending or abolishing the financial and special income mechanisms of agencies and units that are being implemented appropriately.

During the period of not amending or abolishing these mechanisms, the monthly salary and additional income increase will be implemented based on the basic salary of 2.34 million VND/month according to the special mechanism from July 1, 2024, ensuring that it does not exceed the salary and additional income enjoyed in June 2024.

In case of calculation according to the above principle, if the salary and income increase from July 1, 2024 according to the special mechanism is lower than the salary according to general regulations, the salary regime according to general regulations will be applied.

Preferential allowance for meritorious people will increase by 35.7%

In addition, the Government also proposed that the National Assembly allow a 15% increase in pensions and social insurance benefits.

For those receiving pension before 1995, after adjustment, if the benefit level is lower than 3.2 million VND/month, the adjustment will increase by 0.3 million VND/month, if the benefit level is from 3.2 million VND/month to less than 3.5 million VND/month, the adjustment will be 3.5 million VND/month.

Regarding preferential subsidies for meritorious people, the Government proposed to increase the standard subsidy level from VND 2.55 million to VND 2.789 million/month (an increase of 35.7%).

Social allowance according to the social assistance standard increased from 360,000 VND to 500,000 VND/month (increased by 38.9%).

The Government will soon report to the Central Executive Committee on expanding the scope of using the accumulated salary reform resources of the central and local budgets to pay for pension adjustments, social insurance benefits, preferential benefits for people with meritorious services, social subsidies, social security policies and streamlining of payrolls.

For the business sector, the Government proposes to fully implement Resolution No. 27 with 2 contents. That is, adjusting the regional minimum wage according to the provisions of the Labor Code (increasing by 6% from July 1, 2024); regulating the wage mechanism for State-owned enterprises (applied from January 1, 2025).

The Government proposed to include these contents in the Joint Resolution of the 7th session to submit to the National Assembly for consideration and decision.

How much will civil servant salaries increase if the basic salary increases to 2.34 million from July 1?

Minister of Home Affairs: Competent authorities agree to increase basic salary by 30%

Source: https://vietnamnet.vn/chinh-phu-trinh-quoc-hoi-tang-30-luong-co-so-15-luong-huu-2294977.html

![[Photo] Government holds a special meeting on 8 decrees related to the International Financial Center in Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762229370189_dsc-9764-jpg.webp)

Comment (0)