|

| Mr. Luong Duy Phuoc, Acting Director of Market Research - Kafi Securities JSC |

Domestic policies will play a key role.

Global financial markets are experiencing strong fluctuations as trade policies become the focus of attention. Mr. Luong Duy Phuoc commented that the US, under President Donald Trump, is using tariffs as a strategic tool to reshape supply chains and consolidate advantages in bilateral negotiations. A basic tariff of 10% applied globally, along with a reciprocal tariff of up to 145% with China, has increased the risk of disruption to international trade.

Mr. Phuoc predicted that the US will continue to expand tax packages targeting strategic industries such as electric vehicles, semiconductors, solar energy as well as traditional sectors such as steel, shipbuilding and pharmaceuticals with the goal of bringing production back to the country and curbing technological influence from China.

The response from countries has been varied. China responded with similar tariffs, while the EU, Canada and Mexico took a softer approach. Vietnam, according to Phuoc, has shown flexibility by proactively negotiating and expressing goodwill with the US to protect its position in the global supply chain.

The global economic outlook is becoming more fragile. Goldman Sachs has cut its forecast for China’s GDP growth in 2025 to 4%, while Morgan Stanley kept its forecast at 4.5% but warned of rising risks.

Mr. Phuoc assessed that world trade may enter a “post-globalization” phase, shifting from multilateral to bilateral and regional cooperation. In this context, Vietnam has the opportunity to reposition itself on the global economic map, taking advantage to consolidate its position in the value chain.

Vietnam’s economy, with its high trade openness and the US market accounting for a large proportion of total exports, is not immune to risks from trade tensions. Mr. Phuoc warned that if the 46% reciprocal tax rate is fully applied to Vietnam, GDP growth could fall by 2-3 percentage points, directly impacting industries such as textiles, wood, seafood and electronic components.

However, Vietnam's 90-day tax deferral and ongoing negotiations to achieve a lower tax rate, expected to be 10-15%, along with a commitment to reduce the trade surplus, will help minimize negative impacts and strengthen investor confidence.

In this context, domestic policies will play a key role. Mr. Phuoc emphasized that public investment, stimulating consumption and supporting businesses will be the main drivers of growth. He forecast that economic growth this year could reach 7.5-8%, but Vietnam needs to reduce its dependence on exports and focus on industries serving the domestic market, infrastructure and technology. Investment flows will shift to businesses that are less dependent on the US, have good adaptability to supply chains and benefit from public investment projects.

Investment strategy and potential industry in 2025

In terms of the impact on businesses, Mr. Phuoc commented that in the short term, most export businesses have not been directly affected by the new tax policy, especially in the first and second quarters of 2025. Some businesses even recorded growth thanks to the import of "tax-evading" goods from US partners.

However, a major challenge will arise from the second half of 2025 if the 46% tax is maintained. At that time, the profit margin of the textile, wood, seafood and electronic components industries may decrease by 5-20%, affecting orders, production costs and logistics.

FDI inflows, an important driver of long-term growth, may slow as investors await the outcome of negotiations, putting pressure on industrial park and infrastructure businesses.

To cope, businesses are accelerating the restructuring of their output markets, shifting to markets with less tariff risks such as Europe, Japan, South Korea and ASEAN. However, Mr. Phuoc noted that this process requires time and flexible adaptation capacity. Therefore, the second half of 2025 will be a period testing businesses' resilience to external policy shocks.

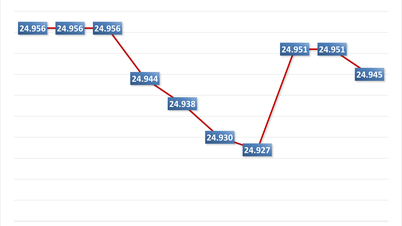

The Vietnamese stock market is being strongly affected by US tariff policies, with high volatility and investor sentiment being influenced by external factors. Mr. Phuoc pointed out that the market is clearly differentiated: shares of export enterprises and industrial zones have fallen sharply, while defensive and highly localized stocks have held their prices better, reflecting the market's sensitivity to global policy risks.

The 90-day tax deferral creates a psychological buffer, helping investors focus on fundamentals such as first-quarter earnings, shareholder meeting season and the KRX system launch in May.

He assessed that KRX is an important turning point, improving the quality of transactions through new products such as T+0, short selling and odd-lot trading, and is also a premise for Vietnam to upgrade to an emerging market. Although it is difficult to achieve the upgrade in 2025, KRX still has strategic significance in attracting medium- and long-term foreign capital flows.

Regarding investment strategy, Mr. Phuoc recommends that investors focus on risk management and maintain investment discipline in the context of volatile markets. He advises investors to slow down to look further, re-evaluate their portfolios, reduce leverage and prioritize businesses with sustainable domestic operations that are less affected by global trade.

Amid global trade tensions, the Vietnamese stock market will see a sharp divergence between sectors. Mr. Phuoc predicted that major export sectors to the US such as textiles, seafood and wood products will be directly affected if the tax takes effect after the 90-day delay, with profit margins falling significantly from the third quarter. Industrial park enterprises may also be indirectly affected due to the slowdown in FDI flows.

However, some sectors remain defensive. The banking sector, especially joint stock commercial banks such as MBB and ACB, with a focus on credit to domestic enterprises and a stable ecosystem, are benefiting from policies to promote public investment, personal consumption and bad debt handling.

The infrastructure and construction materials industry is also a bright spot, as public investment becomes a replacement for weak international demand. Mr. Phuoc cited the example of HPG, a leading enterprise participating in key projects such as the North-South Expressway, which forecasts profit growth of 15-20% in 2025.

Industries less dependent on the US such as technology, software, digital services (notably FPT), food, beverage and pharmaceuticals are forecast to maintain positive prospects.

He concluded that businesses with stable value chains, balanced markets and domestic expansion capabilities will be safe destinations for investment cash flows in 2025.

Source: https://thoibaonganhang.vn/chien-luoc-dau-tu-va-nganh-tiem-nang-nam-2025-163209.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)