According to TPBank, the number of new credit cards opened at TPBank has been increasing rapidly over the years. This figure increased by nearly 140% in 2023, bringing card transaction turnover to VND 29 trillion. Total card transaction turnover grew by 190%. For TPBank Visa cards alone, the value of card spending transactions exceeded USD 1 billion/year last year.

In 2023, recognizing TPBank's efforts, partner Visa honored TPBank in the top 3 banks leading in card sales transaction growth. Notably, the TPBank Visa Signature premium card is the only product to win the award for the card with the highest growth in foreign transaction sales in the market, with a growth of 340% compared to 2022.

JCB - an international payment brand from Japan also honored TPBank in 3 important categories: Leading bank in new card issuance 2023; Leading bank in growth of activated cumulative cards 2023; Leading bank in growth rate of card transaction turnover 2023. This is the 3rd consecutive year that TPBank is honored to participate in JCB's annual awards ceremony to honor prestigious strategic partners in the Vietnamese market.

“With the spirit of being ahead of the curve, TPBank has changed its mindset from “product-centric” to “customer-centric”. We recognize the importance of satisfying each customer and building and realizing a sharp personalization strategy for products to suit each customer segment. Up to now, TPBank has owned a diverse card product portfolio to meet the needs of key customer segments,” said a bank representative.

Card Privileges: Customer Profile Design

Drawing from the process of in-depth understanding of customer characteristics, TPBank designs appropriate preferential privileges based on the needs and tastes of each customer segment. “We hope that TPBank credit cards will become a “companion”, understanding and satisfying customers on every journey of experience,” shared a TPBank representative.

As a long-time customer, owning a TPBank Visa Signature card for 5 years, Ms. Dang Thanh (35 years old, Hanoi) expressed: "Due to the nature of my job, I often have to travel between countries with long flights, the privilege of using airport lounges and low foreign currency conversion fees are a big plus for me in addition to domestic incentive programs."

Ha My (27 years old, Da Nang) is most "satisfied" with the shopping, dining, cashback, and reward points and gift exchange offers from TPBank JCB card: "I eat out, shop, or hang out with friends a lot every month, so this TPBank card offer is a great deal."

In addition to the lifetime incentives for each card, TPBank also continuously launches attractive incentives suitable for each customer at the right time. “Right person - right time” and fully conveying the message are the consistent goals in the communication strategy of this dynamic bank.

In addition, TPBank customers also have the opportunity to win big in the lucky draw promotion programs that continuously take place on the TPBank app. Accordingly, from now until December 31, 2024, thousands of gifts will be drawn to find their owners every week; the highest prize of the entire program is a VF3 electric car.

Elevating the card personalization experience with technology

To help customers easily own cards, TPBank develops solutions that allow card opening on the TPBank app, website and TPBank LiveBank 24/7, helping users have more options for suitable card opening methods.

Continuously cooperating with the "big guys" Apple, Google, Samsung, TPBank credit card payment is raised to a new level when "purple bank" cardholders only need to add the card in a snap on: Apple, Google, or Samsung wallet to pay anywhere with a device that accepts contactless payments.

TPBank credit cardholders can also be granted an automatic limit based on the credit that customers have built up during their use of banking services. This feature has appeared on some credit card lines, especially the TPBank Visa Flash 2in1 card - a multi-function card line that integrates a credit card and an ATM card (international) in the same chip.

Creative Communication

TPBank “breathes a new wind” into the finance and banking industry with a creative, colorful and user-friendly banking image. TPBank’s large-scale communication campaign always appears on prestigious rankings on social networks. The creative combination of impressive advertising images and product introduction activities, especially card products, integrated with multiple channels has spread the “Purple Bank” brand to all parts of the country.

“TPBank strives to create a “touch point” for customers that is sophisticated, interesting, and full of the “purple bank” style that is difficult to copy. With your companionship, TPBank confidently aims for even higher milestones… “Because we understand you”, TPBank always wants customers to choose each experience, to fully live each “quality of me” when using any of the bank’s products”, a representative of TPBank expressed.

Le Thanh

Source: https://vietnamnet.vn/chien-luoc-ca-nhan-hoa-giup-the-tpbank-hut-hang-trieu-khach-hang-2327784.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

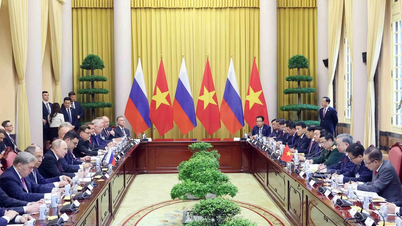

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)