| Commodity market today, October 17th: Sugar prices fall to their lowest level in nearly a month. Commodity market today, October 18th: Raw materials market experiences a 'red' trading week. |

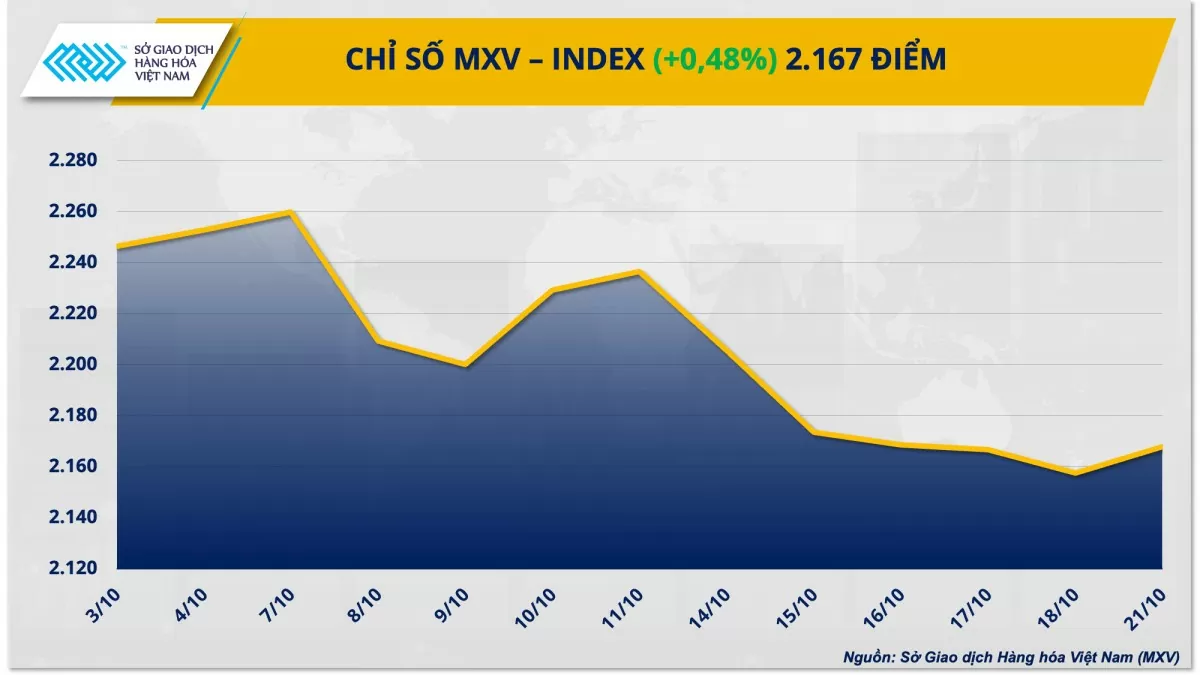

Closing on October 21st, the MXV-Index rose 0.48% to 2,167 points, ending a five-day losing streak. Notably, the energy sector led the market's gains, with all five commodities recording impressive increases. Meanwhile, the industrial materials sector bucked the general trend, with seven out of nine commodities experiencing price declines.

|

| MXV-Index |

Crude oil prices unexpectedly reversed course and started to rise.

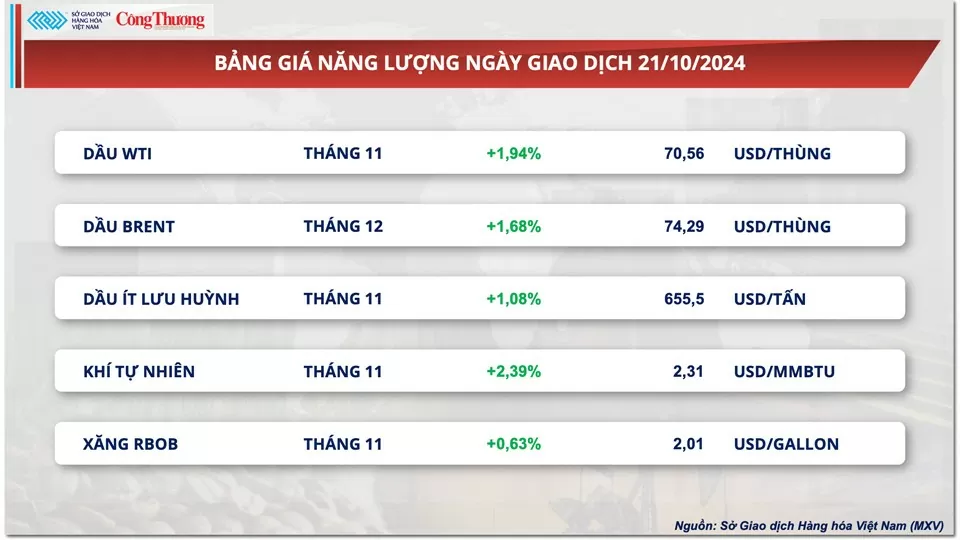

Crude oil prices rose across the board in the first trading session of the week after a series of consecutive sessions under heavy selling pressure last week. The upward momentum stemmed from new economic stimulus measures from China and escalating tensions in the Middle East.

At the close of trading, WTI crude oil futures for December delivery rose $1.35 to $70.04 per barrel, ending a six-session losing streak. Similarly, Brent crude oil futures for December delivery also recorded a 1.68% increase to $74.29 per barrel.

|

| Energy price list |

On the morning of October 21st, China cut its benchmark lending rate (LPR) as previously announced by the People's Bank of China to revive its slowing economy. Specifically, the one-year LPR was reduced by 0.25% (from 3.35% to 3.1%). Meanwhile, the five-year LPR (applied to long-term loans such as home loans and mortgages) fell to 3.6% from 3.85%. This move comes after data showed that China's GDP grew by only 4.6% in the third quarter, lower than the country's target of 5% for the whole year. The easing of monetary policy is expected to boost China's crude oil consumption for economic activities, thereby supporting oil prices.

In the Middle East, markets are reassessing the possibility of escalating conflict between Iran and Israel. Over the weekend, the residential area of Israeli Prime Minister Benjamin Netanyahu was attacked by a Hezbollah drone, although no casualties were reported. Meanwhile, Tel Aviv is urging Washington to deploy additional missile defense systems to Israel. This move is believed to be in preparation for a potential Iranian retaliation following Tehran's missile attack on October 1st. These developments increase the risk of tensions in the Middle East erupting into a full-scale conflict and disrupting crude oil supplies from the region. This information also helped crude oil prices reverse course and recover yesterday.

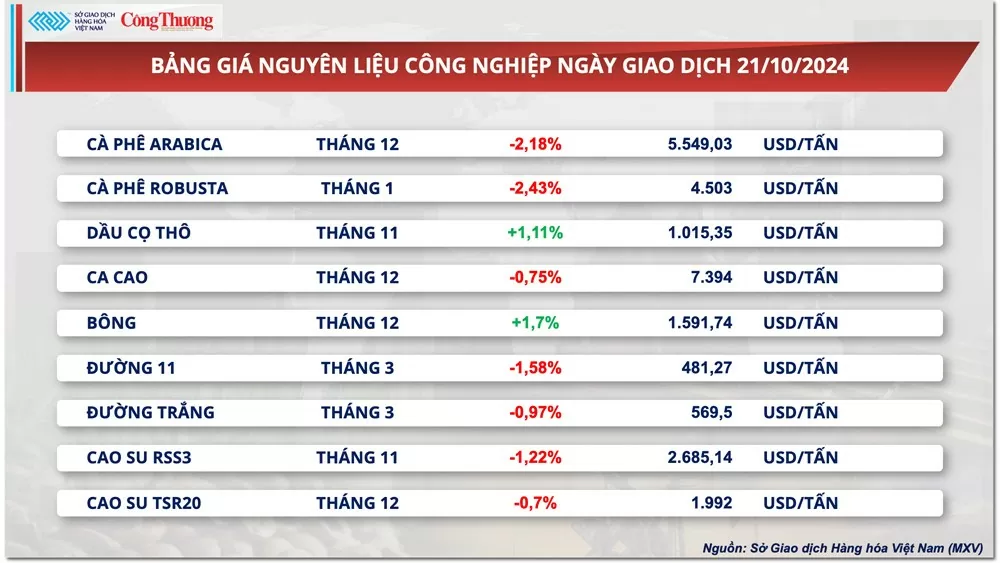

Prices of some other goods

|

| Industrial raw material price list |

|

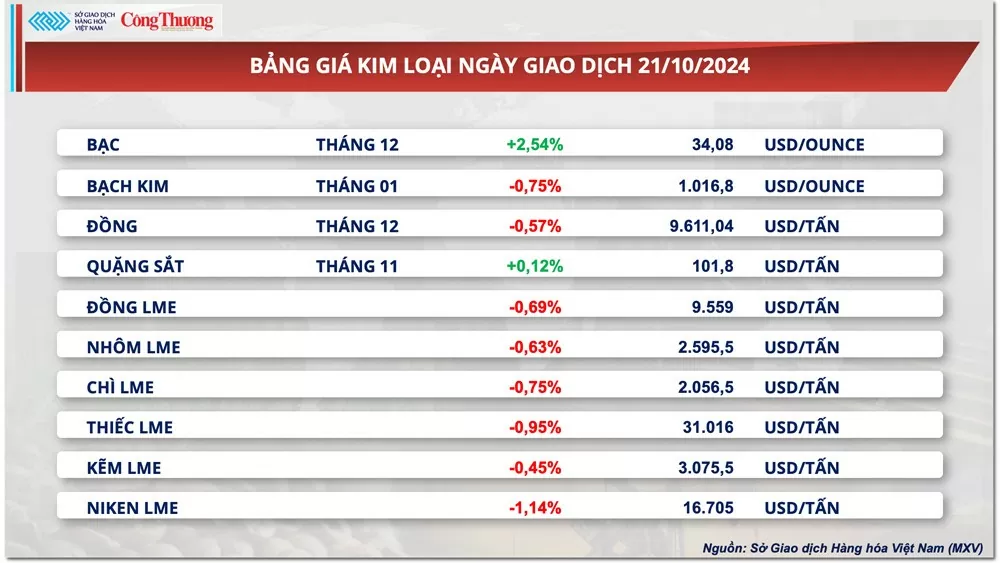

| Agricultural product price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2210-chi-so-mxv-index-phuc-hoi-cham-dut-chuoi-giam-5-phien-353939.html

![OCOP during Tet season: [Part 3] Ultra-thin rice paper takes off.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F28%2F1769562783429_004-194121_651-081010.jpeg&w=3840&q=75)

Comment (0)