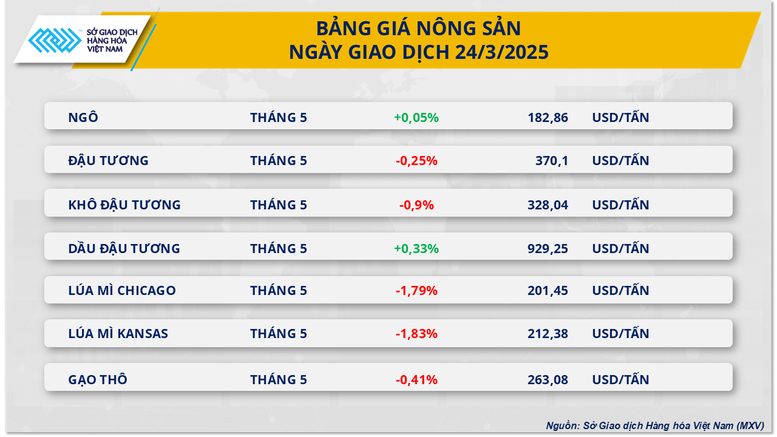

At the end of yesterday's trading session, the agricultural market was in the red as most of the commodities in the group decreased in price. In particular, soybean prices decreased by 0.25% to 370 USD/ton in yesterday's trading session, marking the 5th consecutive session of decrease. Low trading volume reflected investors' cautious sentiment before a series of important information expected to be announced this week. The market fluctuated due to the impact of conflicting fundamental factors.

On the domestic market, on March 24, the selling price of finished soybeans tended to increase slightly. At Cai Lan port, the price of dried soybeans for delivery in May and June 2025 was offered at VND10,850/kg. At Vung Tau port, the selling price was recorded to be about VND100 lower than at Cai Lan port.

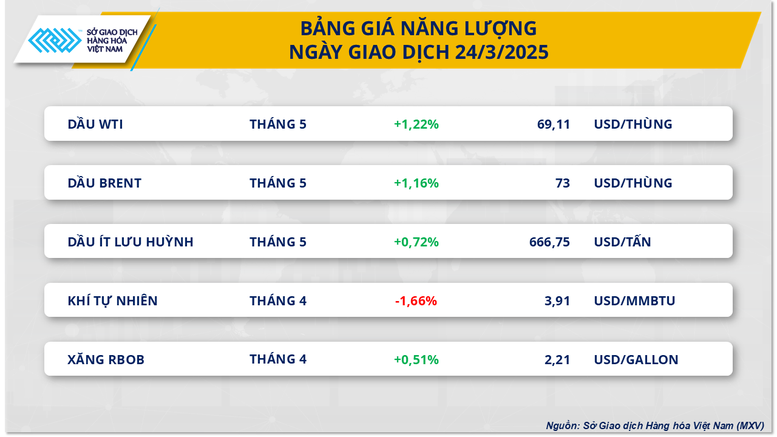

In the energy market, except for natural gas, all four remaining commodities increased in price. Crude oil prices increased sharply in the first trading session of the week, with Brent crude up 1.16% to $73/barrel and WTI crude reaching $69.11/barrel, up 1.22%. These are the highest prices since early March for both commodities. The price push comes from the latest moves by the US targeting Venezuelan crude oil.

On March 24, US President Donald Trump announced a 25% tax on countries importing oil from Venezuela, starting April 2. This will be an additional tax rate along with other taxes according to the plan that will be announced by the White House on the same day.

Oil prices were also supported by the OPEC+ production cut plan announced on March 20. According to Goldman Sachs, OPEC+ production growth will decrease by about 300,000 barrels per day over the next 12 months for each $10/barrel reduction if Brent crude oil prices remain above $70/barrel. This production reduction will continue to increase as the market price declines, and a similar effect may also apply to US shale oil production.

A rare factor that has kept oil prices from rising is the positive developments in peace negotiations between Russia and Ukraine. After initial agreements on ensuring security for energy infrastructure, yesterday in Riyadh, the capital of Saudi Arabia, the US and Russia concluded negotiations on a ceasefire in the Black Sea region with positive responses from both sides.

President Donald Trump also announced on the same day that the US and Ukraine are very close to a mineral revenue-sharing agreement. However, both Russia and Ukraine are still reporting sporadic attacks, causing significant obstacles on the path towards ending the conflict in Ukraine.

Source: https://baochinhphu.vn/chi-so-mxv-index-cham-nguong-2300-diem-10225032509490368.htm

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)