| Commodity market today, March 28th: Selling pressure dominates the global raw materials market. Commodity market today, March 29th: Investment flow into agricultural markets surges. |

Data from the Vietnam Commodity Exchange (MXV) shows that at the close of the last trading week of March (March 25-29), buying pressure completely dominated for 3 out of 4 commodity groups traded globally on the MXV, including Industrial, Energy, and Agricultural products; supporting the MXV-Index to continue rising 1.08% to 2,237 points. The average daily trading value across the entire exchange reached nearly 5,700 billion VND, 15% lower than the previous week.

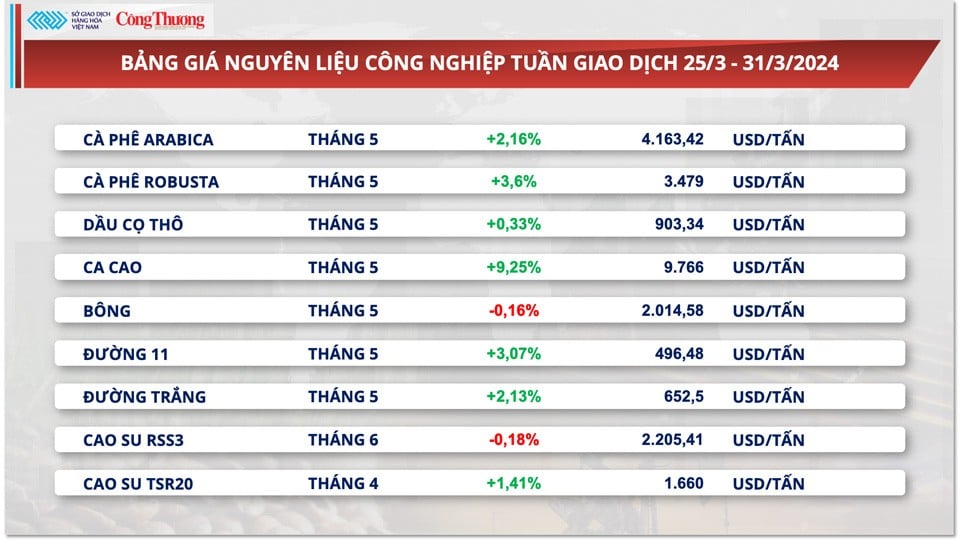

Thus, at the end of the first quarter of this year, this commodity index had increased by nearly 6% compared to the beginning of the year, showing an upward trend in prices for many important commodities. Cocoa continued to lead the market trend, closing up 9.25%, setting a new historical high. Coffee and sugar prices maintained strong upward momentum throughout March, closing the week with increases of 2-3%. Oil prices also reached their highest level in 5 months after the strong increase last week.

Cocoa prices rose 128% in the first quarter.

At the end of last week, cocoa prices reached a new historical high of $9,766 per ton, after surging 9.25%. Compared to the beginning of this year, cocoa prices have now increased by 128%. MXV stated that severe supply shortages in major producing countries continue to be the main factor driving strong buying demand for cocoa.

|

| Cocoa prices hit a new all-time high of $9,766 per ton. |

According to the Ivorian government , from the beginning of the season until March 24th, the amount of cocoa transported to ports in the country decreased by 28% compared to the same period of the previous season, reaching 1.28 million tons. Along with this, Ivory Coast's cocoa production for the 2023/2024 season is estimated to have decreased by 21.5%, to 1.75 million tons.

Furthermore, Commerzbank stated that some cocoa-growing regions in Africa are being affected by illegal gold mining. This further exacerbates concerns about potential supply shortages in the market.

|

| Industrial Raw Material Price List |

Crude oil prices rose 16% in the first quarter.

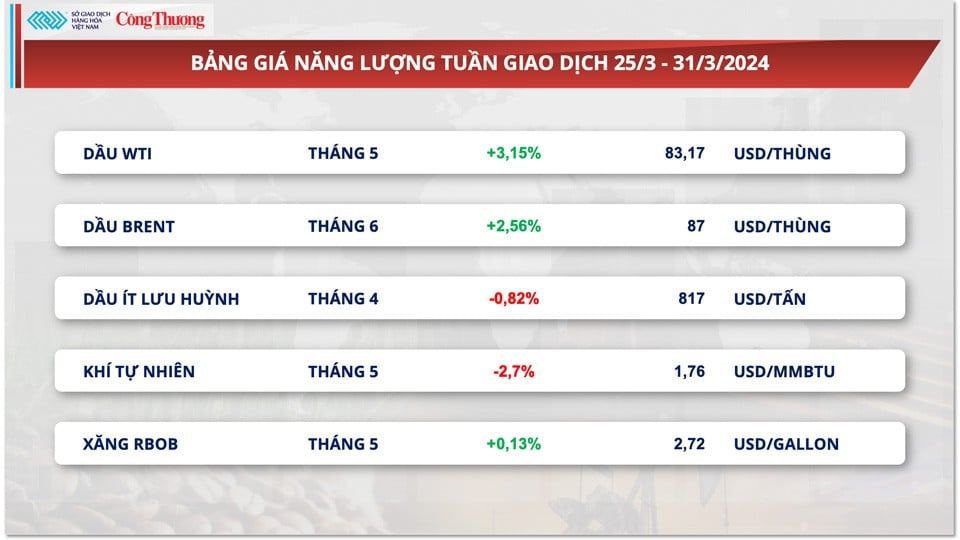

At the close of the week, WTI crude oil prices rose 3.15% to $83.17 per barrel. Brent crude oil increased 2.56% to $87 per barrel. After three consecutive months of price increases, crude oil has now reached its highest level in five months. Simultaneously, the commodity also achieved a 16% price increase in the first quarter. According to MXV, this is considered the latest sign that production restrictions by the Organization of Petroleum Exporting Countries (OPEC) and its allies (OPEC+) are curbing global supply.

|

| Energy Price List |

The OPEC+ alliance has extended supply cuts of around 2 million barrels per day until the end of June, reinforcing expectations that global inventories will shrink. In addition, prices were supported by some geopolitical tensions and increased global demand over the past week.

In March, at least seven Russian oil refineries were attacked by drones from Ukraine, affecting approximately 12% of Russia's total oil processing capacity. This has made the supply of crude oil more competitive, leading to strong buying demand in the market.

In the U.S., amid tight supply, gasoline prices are projected to rise to their highest level since the summer of 2022, reaching $4 per gallon, according to the American Automobile Association (AAA).

On the other hand, US economic growth shows continued positive signs, reducing the risk of recession and supporting the outlook for future oil consumption. Specifically, after two revisions, official figures from the US Bureau of Economic Analysis show that US gross domestic product (GDP) growth in the fourth quarter of 2023 increased by 3.4% compared to the previous quarter, higher than the figures released in the two previous preliminary reports.

Meanwhile, US crude oil production is also trending downward, leaving a supply gap in the market. According to the US Energy Information Administration (EIA), US crude oil production fell in January to 12.5 million barrels per day, down 6% from a record high in December, due to freezing weather disrupting extraction operations.

MXV stated that this week, the market's focus will be on the online meeting of OPEC+ ministers taking place on the evening of April 3rd (Vietnam time), to review the group's production policy and discuss future plans.

Source

Comment (0)