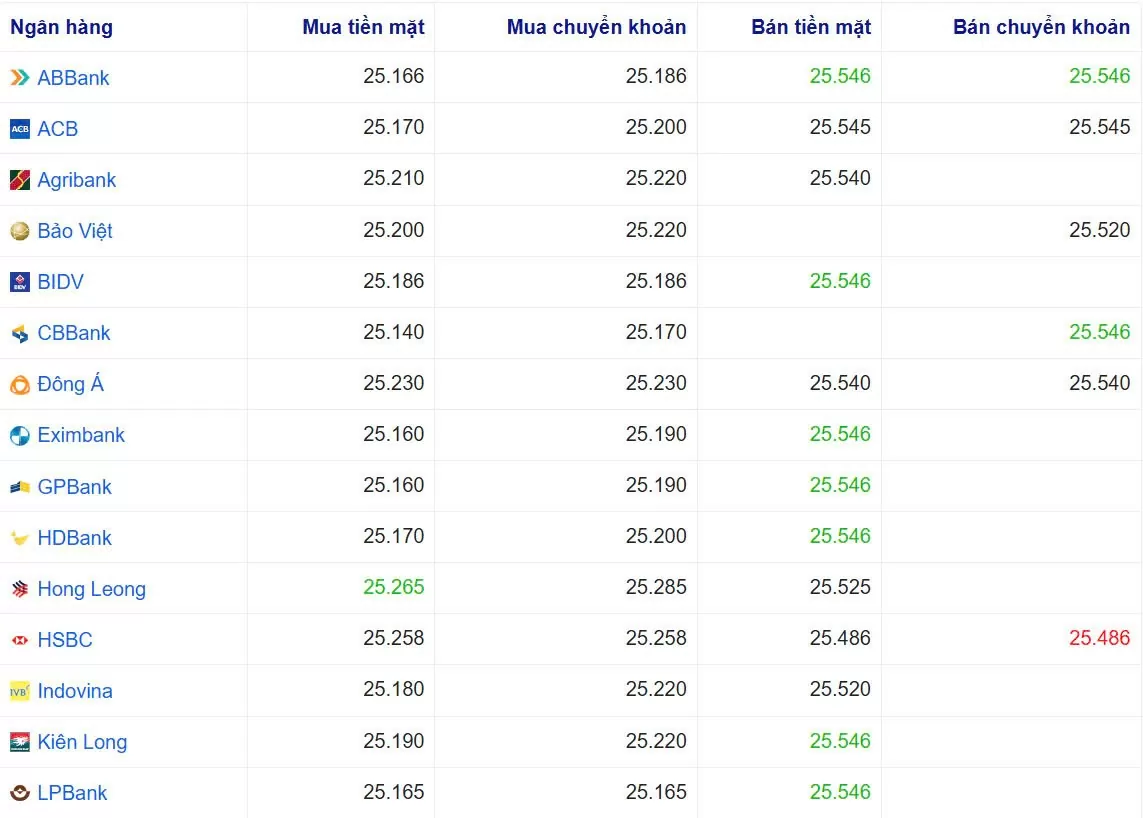

USD exchange rate today 09/01/2025

At the time of survey at 5:00 a.m. on January 9, the central exchange rate at the State Bank was currently 24,330 VND/USD, down 2 VND compared to the previous trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,156 - 25,546 VND/USD, down 2 VND for buying and selling.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

Hong Leong Bank is buying USD cash at the highest price of: 1 USD = 25,265 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,546 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 25,486 VND

ABBank, BIDV , Eximbank, GPBank, HDBank, Kien Long, LPBank, MSB, MB, OCB, OceanBank, PGBank, PublicBank, PVcomBank, Sacombank, Saigonbank, SeABank, UOB, VietABank, VietCapitalBank, Vietcombank, VRB are selling USD cash at the highest price: 1 USD = 25,546 VND

ABBank, CBBank, MSB, MB, NCB, PublicBank, Sacombank, SeABank, VietBank are selling USD transfers at the highest price: 1 USD = 25,546 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank – Updated: 09/01/2025 06:30 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,210 | 25,220 | 25,540 |

| EUR | EUR | 25,751 | 25,854 | 26,948 |

| GBP | GBP | 31,083 | 31,208 | 32,166 |

| HKD | HKD | 3,201 | 3,214 | 3,318 |

| CHF | CHF | 27,392 | 27,502 | 28,351 |

| JPY | JPY | 156.98 | 157.61 | 164.33 |

| AUD | AUD | 15,489 | 15,551 | 16,054 |

| SGD | SGD | 18,277 | 18,350 | 18,857 |

| THB | THB | 715 | 718 | 749 |

| CAD | CAD | 17,373 | 17,443 | 17,937 |

| NZD | NZD | 14,060 | 14,545 | |

| KRW | KRW | 16.71 | 18.43 | |

| 2. Sacombank – Updated: 12/24/2000 07:16 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25222 | 25222 | 25546 |

| AUD | AUD | 15431 | 15531 | 16099 |

| CAD | CAD | 17316 | 17416 | 17969 |

| CHF | CHF | 27427 | 27457 | 28330 |

| CNY | CNY | 0 | 3427.2 | 0 |

| CZK | CZK | 0 | 990 | 0 |

| DKK | DKK | 0 | 3500 | 0 |

| EUR | EUR | 25731 | 25831 | 26704 |

| GBP | GBP | 31093 | 31143 | 32253 |

| HKD | HKD | 0 | 3271 | 0 |

| JPY | JPY | 157.46 | 157.96 | 164.47 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17.1 | 0 |

| LAK | LAK | 0 | 1.122 | 0 |

| MYR | MYR | 0 | 5820 | 0 |

| NOK | NOK | 0 | 2229 | 0 |

| NZD | NZD | 0 | 14053 | 0 |

| PHP | PHP | 0 | 412 | 0 |

| SEK | SEK | 0 | 2280 | 0 |

| SGD | SGD | 18182 | 18312 | 19039 |

| THB | THB | 0 | 677.8 | 0 |

| TWD | TWD | 0 | 770 | 0 |

| XAU | XAU | 8350000 | 8350000 | 8550000 |

| XBJ | XBJ | 7900000 | 7900000 | 8550000 |

|

| USD exchange rate today January 9, 2025. Illustration photo |

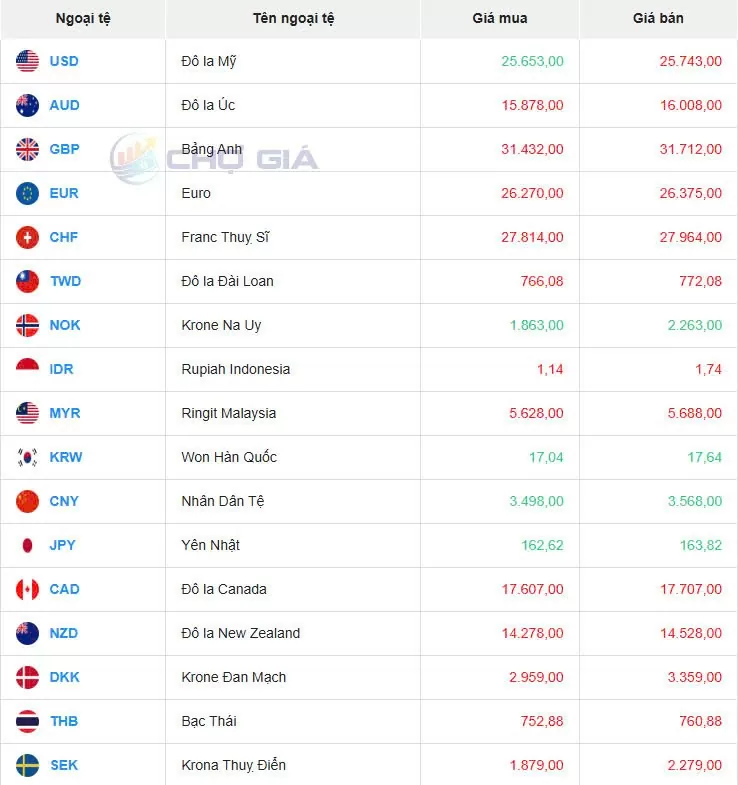

In the "black market", the black market USD exchange rate as of 5:00 a.m. on January 9, 2025 is as follows:

|

| Black market on January 9, 2025. Photo: Chogia.vn |

USD exchange rate today January 9, 2025 on the world market

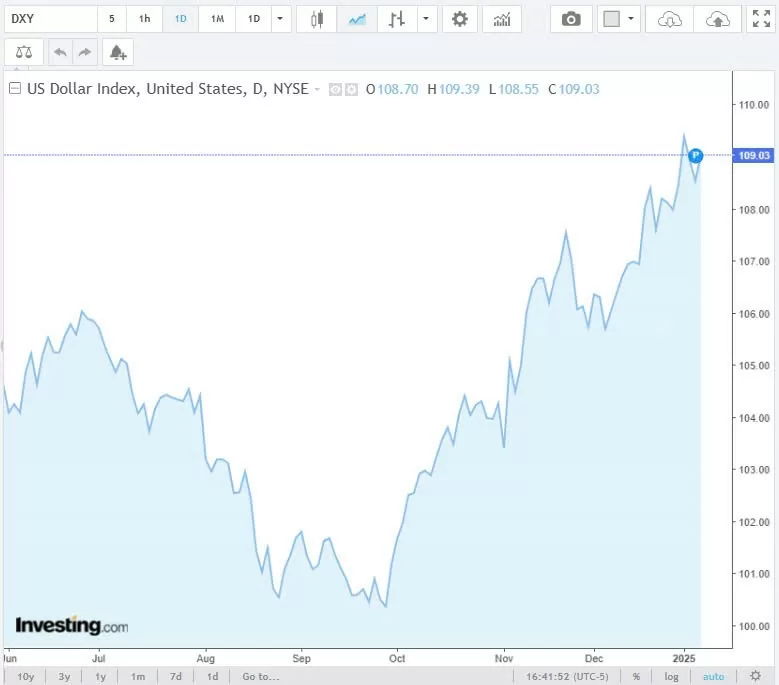

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 109.03 – up 0.34 points compared to trading on January 8, 2025.

|

| DXY index developments in recent times. Source Investing |

The dollar rose for a second straight session on Wednesday as U.S. bond yields continued their recent rally, following reports that President-elect Donald Trump is considering using emergency measures to allow new tariffs to be imposed.

The yield on the 10-year US Treasury note hit 4.73%, its highest level since April 25, after CNN reported that Trump was considering declaring a national economic emergency to create the legal basis for a series of blanket tariffs on allies and rivals.

Investors are hoping Trump's policies such as deregulation and tax cuts will boost economic growth, but there are also concerns that, along with yet-to-be-confirmed tariff actions, could cause inflation to accelerate again.

On Monday, the Washington Post reported that Trump was considering more subtle tariffs, which he later denied.

“This fits into the theme of a strong dollar and even with the disappointing ADP jobs data, the dollar was stronger on the day,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. “ That means people shouldn’t fight this, it’s a genuine move and it’s not over yet.”

Earlier data on the US labor market was mixed, as the ADP national employment report showed US private payroll growth slowed sharply in December to 122,000, from 146,000 the previous month. Economists polled by Reuters had forecast a gain of 140,000.

However, weekly initial jobless claims fell to an 11-month low of 201,000 and below the 218,000 estimate in a Reuters poll of economists.

The dollar index, which measures the greenback against a basket of currencies, rose 0.28% to 109.00, after hitting a more than two-year high of 109.54 last week, while the euro fell 0.2% to $1.0318. The data came ahead of the U.S. government's key monthly jobs report on Friday.

Markets are currently pricing in just 39 basis points of easing from the Federal Reserve this year, with the first rate cut likely to come in June.

Fed Governor Christopher Waller said Wednesday that inflation will continue to decline into 2025, allowing the U.S. central bank to continue cutting interest rates, although the pace is uncertain.

The greenback held on to gains after minutes from the Fed’s December 17-18 meeting showed policymakers agreed that inflation was likely to continue to slow this year but also saw increased risks that price pressures could remain muted as they grapple with the potential impact of Trump’s policies.

Sterling fell 0.87% to $1.2364 after falling to $1.2321, its lowest since April 22 and its second-weakest level of the year even as it coincided with a sharp sell-off in British stocks and government bonds, with the 10-year government bond yield hitting a 16-1/2-year high.

Against the yen, the dollar rose 0.25% to 158.41 and edged closer to the 160 level that prompted Japanese authorities to intervene to support the currency.

A government survey showed Japanese consumer sentiment worsened in December, casting doubt on the Bank of Japan’s view that solid household spending will underpin the economy and justify further interest rate hikes.

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop – No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts – No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store – No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company – No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store – No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones – No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store – No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store – No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store – No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange – 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop – 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop – 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center – 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store – Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop – No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop – No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop – No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-09012025-chi-so-dxy-vuot-nguong-109-368644.html

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Infographic] Numbers about the 2025 High School Graduation Exam in Dong Thap Province](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/c6e481df97c94ff28d740cc2f26ebbdc)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

Comment (0)