Apartment prices in Hanoi are increasing abnormally, far beyond the ability of the majority of people with average and low incomes to buy houses - Photo: N.TRAN

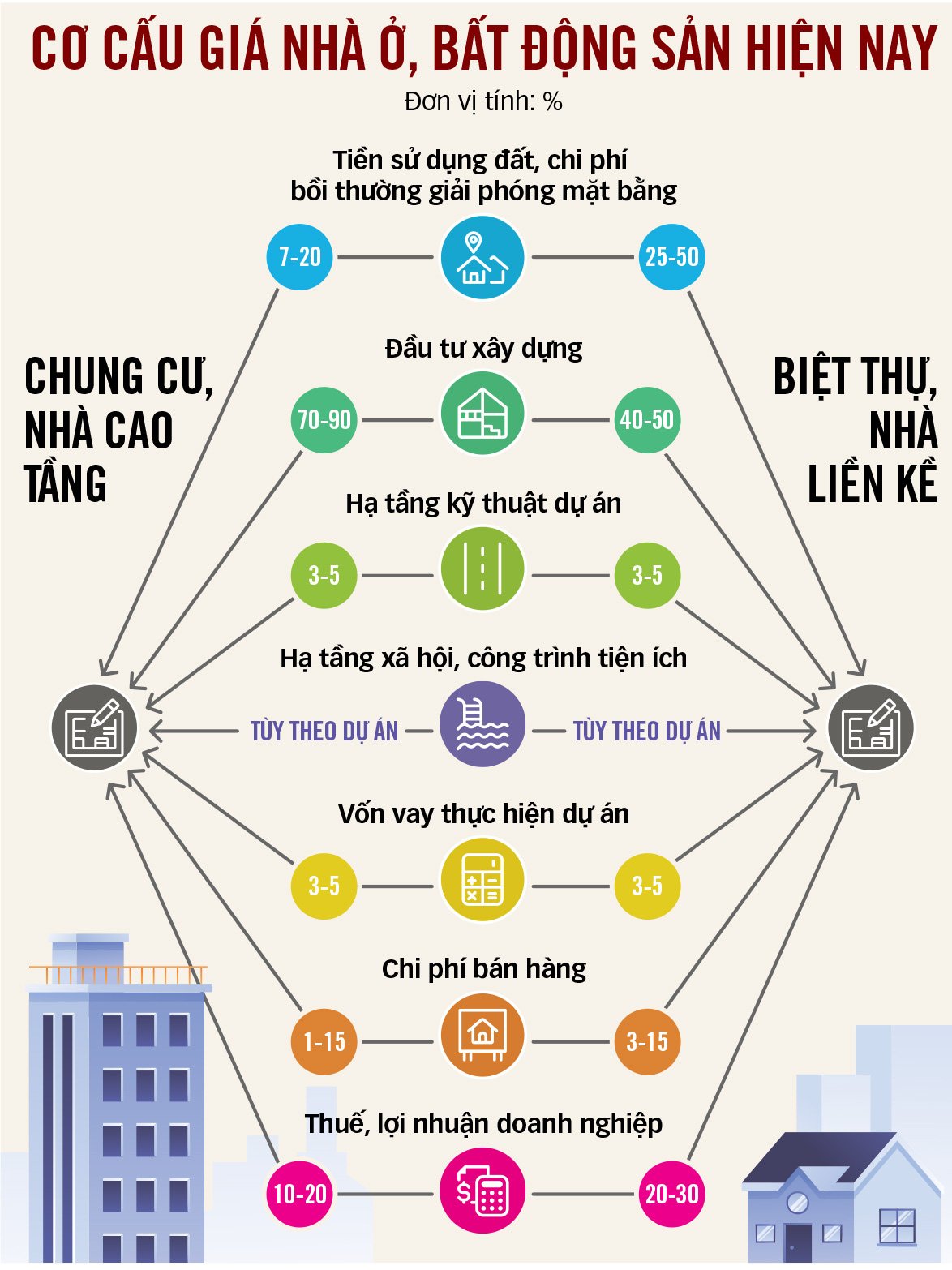

According to the Ministry of Construction , current housing prices are made up of land costs, construction costs, loan interest, business profits, taxes and brokerage fees...

To control housing prices, some experts recommend solutions to adjust land prices, calculate taxes, fees, and project loan interest at appropriate levels, while controlling input material prices, balancing supply and demand, and preventing real estate speculation.

Mid-range apartment price is also 100 million VND/m2

According to the Ministry of Construction, in the second quarter of this year, in Hanoi, the selling prices of some apartment projects increased sharply, in which the price of apartments in the Royal City urban area increased by 33%, The Pride apartment increased by 33%, My Dinh Song Da - Sudico urban area increased by 32%, Vinhomes West Point increased by 28%. Some old urban areas such as Trung Hoa - Nhan Chinh urban area, apartment prices also increased by 25%, the resettlement apartment area in Nam Trung Yen increased by 20%.

The average apartment selling price in May 2024 increased compared to the end of 2023, specifically Udic Westlake project 56.7 million VND/m2, D'. El Dorado 85.3 million VND/m2, HDI Tower 160.1 million VND/m2, Feliz Homes 53.9 million VND/m2, GoldSeason 63.8 million VND/m2.

The Ministry of Construction stated that previously, mid-range apartments had asking prices ranging from 50 to 70 million VND/m2, but now the transaction price has increased to 70 to 100 million VND/m2.

For example, the Noble Crystal Tay Ho project is priced at around VND187 million/m2, Mandarin Garden is priced at VND80 - 105 million/m2. Particularly at The Grand project on Hai Ba Trung Street, Hoan Kiem District, some apartments are priced at nearly VND1 billion/m2.

In Ho Chi Minh City in the second quarter of 2024, the mid-range apartment segment increased by 2%, the high-end segment increased by 5% compared to the same period in 2023. The scarcity of new supply also pushed up the selling prices of used apartment projects in Ho Chi Minh City.

Specifically, the City Garden apartment project has an average selling price of VND85 million/m2, an increase of 18%; the Antonia project (District 7) and Masteri Thao Dien (Thu Duc City) increased by 11% and 10% respectively. At the end of the second quarter, the price of apartments in Ho Chi Minh City increased by an average of about 6% compared to the end of 2023.

Some apartment projects in Ho Chi Minh City have high selling prices such as Cantavil An Phu increased by 22.6% to 54.5 million VND/m2, Zenity (District 1) increased by 18.2% to 101.4 million VND/m2, Green View (District 7) increased by 25.1% to 53.9 million VND/m2, The Panorama (District 7) increased by 15.5% to 69.6 million VND/m2.

Why are the prices unusually high?

Recent surveys and assessments by the Ministry of Construction show that the cost of land use fees per square meter of housing is quite high. At GP Invest's housing area in Hanoi, it is about 15 million/36.35 million VND, equivalent to 41.5% of the selling price; the apartment project in Hai Phong is 6.67 million/34.54 million VND, equivalent to 19.3% of the selling price; the low-rise housing project in Hai Phong is 60.14 million/156.83 million VND.

Similarly, in Dong Tang Long urban area, Thu Duc city (HCMC), it is 2.34 million/8.84 million VND. In the villa project of Chanh My urban area, Binh Duong province, land use fee accounts for 16.3% of the selling price.

According to the Ministry of Construction, if the 2024 land price is applied, the land use fee of the projects will continue to increase sharply. Specifically, the land use fee in the housing price structure of GP Invest's project will increase by 60%, the Dong Tang Long urban area, Thu Duc City will increase by about 60 - 65%, and the Chanh My villa project will increase by 50% of the selling price.

The Ministry of Construction assessed that the application of a new land price list close to the market in the coming time will increase the selling price of houses and real estate by an average of 15 - 20% compared to the previous period. Specifically, the construction investment cost per square meter of housing at the GP Invest housing project (Hanoi) is 5.1 million/36.3 million VND, accounting for about 14.1% of the selling price. The apartment project in Hai Phong is 15.7 million/34.5 million VND, accounting for about 45.5% of the selling price. The low-rise housing project in Hai Phong is 31.2 million/156.8 million VND, accounting for 20.53% of the selling price of houses...

In addition, although each project has different scales and products, the investment costs for construction of housing projects in recent times have fluctuated little or insignificantly due to increased fire prevention and fighting costs, the Ministry of Construction stated.

Regarding the cost of borrowing capital to implement housing, according to this ministry, if housing projects borrow commercial capital from 30 - 70% of the total project investment capital, the interest cost will be about 3 - 5% of the total construction investment cost. The normal selling cost of commercial housing projects is from 3 - 7% of the real estate selling price, with some projects being up to 15% of the house selling price.

The final group that makes up current housing prices is tax costs, profits, and project owner management costs for high-rise housing from 10 - 20%, and low-rise housing from 20 - 30% of the selling price.

Source: Ministry of Construction - Graphics: T.DAT

How to reduce house prices?

Based on all types of costs and the ratio of costs that make up the house selling price as above, speaking with Tuoi Tre , Mr. Nguyen Chi Thanh, vice president of the Real Estate Brokerage Association, said that current land prices are very high compared to people's income, so management agencies need to adjust land prices to suit reality.

"The principle of land prices according to the market is suitable for urban areas that have developed stably, with clear transaction parameters such as District 1, Thu Duc City (HCMC), Hoan Kiem, Ba Dinh, Dong Da districts (Hanoi). However, for undeveloped areas, if we do not adjust land prices to create development momentum, it will be very dangerous," said Mr. Thanh.

Mr. Thanh cited a lesson from China that shows that businesses build a lot of houses but the prices are high (partly due to high land costs), so the houses cannot be sold. When businesses are in trouble, the government cannot save them. Because in the end, the home buyer is the one who makes the final decision.

According to Mr. Le Hoang Chau - Chairman of the Ho Chi Minh City Real Estate Association, the land cost structure of a housing project including land use fees and site clearance costs is a large amount depending on the construction density of each project.

From the perspective of a real estate investment enterprise, Mr. Nguyen Quoc Khanh, Chairman of DTJ Investment and Distribution Joint Stock Company, emphasized that the most important thing for enterprises investing in housing projects today is time. Shortening the time to carry out procedures related to housing projects through clear regulations will help enterprises reduce compliance costs, thereby reducing housing prices.

According to Mr. Thanh, the development orientation of the real estate market needs to aim at stability and improving the quality of life of the people. The profit margin of 10-20% of the selling price of the house of the real estate investor is normal, but it is necessary to review the reality to see if it is true, because there are large-scale real estate projects, built on completely new land, attracting buyers, the profit of the project investor is many times larger than the number of statistics.

Many real estate experts also believe that to balance the current housing supply and demand, it is necessary to increase the supply of low-cost housing. This supply depends largely on the participation of ministries, branches and localities. Furthermore, it is necessary to change the mindset towards not exploiting land, but to control land costs at a level suitable for the income of the majority of people. With the current high land costs, many businesses will not dare to invest in projects, making it difficult to increase housing supply in the near future.

To reduce current housing prices, Mr. Le Hoang Chau said that the following 6 things need to be done:

1. Reduce land costs.

2. Reduce related taxes and fees.

3. Reduce interest costs.

4. Maintain stable input material costs for the project, including gasoline and electricity.

5. How to simplify the housing project approval process, thereby reducing regulatory compliance costs.

6. Prevent real estate speculation, intentionally create virtual price levels for profit, increase the deposit for land auctions to 20%, and severely punish those who abandon their deposits after winning the auction.

There are also speculative reasons, creating virtual prices.

The Ministry of Construction also confirmed that high housing prices are partly due to real estate investors taking advantage of the scarcity in the market to offer high prices. Some associations, groups of speculators, investors and individuals operating as brokers disrupt the market to "inflate prices and create virtual prices".

Normally, housing project investors spend about 3% of the house selling price to pay to the trading floor and sales broker, but the trading floors often choose according to the market situation to add the price when transacting with customers, this difference is not fixed, it can be at 5% of the selling price, 10% of the selling price or 20% of the house selling price.

For example, a low-rise housing project in Hung Yen has a selling price of 7 - 8 billion VND/unit, the average price difference is about 750 million VND, but when the market cools down, the price difference is only 250 million VND/unit.

Real estate project under construction in District 7, Ho Chi Minh City - Photo: QUANG DINH

Shortage of housing supply, feverish prices, low real transactions

The housing price fever in Hanoi since the beginning of the year has raised many issues with the current housing development policy for people. Housing prices have increased continuously over the quarters and set a new sky-high price level, far exceeding the price level a year ago, and actual transactions on the market have decreased. While housing supply continues to be scarce, affordable housing is "extinct", social housing and low-income housing supply is limited, with almost no new supply in Hanoi and Ho Chi Minh City. Housing prices are high, and the majority of people with average and low incomes who have real housing needs cannot afford to buy a house.

Faced with unusual signs in the real estate market, in the coming time, the Prime Minister will meet with corporations and groups in the real estate sector to discuss solutions to ease the market.

According to the report analyzing the cost structure, selling price and reasons for the increase in real estate prices recently sent by the Ministry of Construction to the Government Office (September 18), the country's housing supply is seriously decreasing. In the second quarter of 2024, only 9 housing projects were completed, with a scale of about 6,000 apartments, single-family houses and townhouses put into use. And if we count the first half of this year, the completed housing supply only reached about 9,000 apartments, single-family houses and townhouses. The number of housing projects licensed for new construction has a scale of only about 20,000 units.

The scarcity of housing and land supply in Hanoi since the end of 2023 has pushed housing prices up rapidly. Some luxury apartment projects in the West Lake area have been launched for sale with initial prices of over 100 million VND/m2. Meanwhile, the Vinhomes Co Loa super urban area has just launched with prices of over 300 million VND/m2 of townhouses. Notably, auctioned land plots in rural villages and suburban districts of Hanoi such as Hoai Duc, Thanh Oai, Phuc Tho, 30-40km from the city center, have also been pushed up to over 100 million VND/m2.

Ministry of Construction identifies causes and solutions to reduce housing prices

4 reasons for increasing house prices:

1. Land costs increase according to the new land price list, land auctions are many times higher than the starting price, increasing the land price level.

2. The phenomenon of "creating virtual prices and inflating prices" by speculators and individuals practicing real estate brokerage.

3. Lack of real estate and housing supply to meet the needs of the majority of people with low and middle incomes.

4. The recent economic fluctuations related to the stock, bond, and gold markets have caused a strong flow of money into real estate to find a safe "haven".

6 solutions to reduce house prices:

1. Removing difficulties in procedures and legality, increasing market supply, promoting safe and sustainable market development.

2. Rectify land auction work, perfect regulations on land auctions in the direction of increasing deposits, determining starting prices closer to reality, shortening the time to pay auction winnings, and limiting bidders with speculative purposes.

3. Research and propose tax policies for people who own many houses and lands to limit speculation.

4. Have solutions and measures to limit negative impacts from the issuance of new land price lists according to the 2024 Land Law.

5. Pilot model of real estate and land use rights transaction center managed by the State.

6. Strengthen inspection and examination of the organization of land use rights auctions, bidding for projects using land, effectively manage real estate service business activities, real estate trading floors, and brokerage activities.

Low-income housing in neighboring countries

According to the Nation newspaper (Thailand) reported in early April, Secretary General of the Board of Investment of Thailand (BOI) Narit Therdsteerasukdi said that the housing tax incentives were approved by the board on March 15. These incentives are part of the third phase of the project to provide loans to support low-income people to buy individual houses and condominiums, proposed by the Government Housing Bank of Thailand (GHB).

Currently, the tax support program only applies to houses with a minimum area of 70 square meters for individual houses and apartments with a floor area of at least 24 square meters. According to Mr. Therdsteerasukdi, BOI has supported housing projects for low-income workers since 1993. Of which, BOI has participated in providing 44 apartment projects with 34,900 apartments in the capital Bangkok, Nonthaburi, Samut Prakan, Pathum Thani, Nakhon Pathom and Chonburi provinces.

The Malaysian government announced on September 17 that it will launch at least 23 new affordable housing projects through the People's Housing Programme (PPR) across the country, according to Bernama News Agency. Deputy Minister of Housing and Local Government (KPKT) Datuk Aiman Athirah Sabu said that as of September 2024, the Malaysian government has completed 166 affordable housing projects, with 104,081 units for low-income workers, and is continuing to build 16 more projects.

Houses in the PPR project are priced from 45,000 to 60,000 ringgit (from 10,700 to over 14,000 USD) per unit. Future projects will be integrated with new facilities, helping to improve the quality of life of residents.

Source: https://tuoitre.vn/chi-phi-nao-khien-gia-nha-cao-bat-thuong-20240923083409462.htm

![[Photo] The Prime Ministers of Vietnam and Thailand witnessed the signing ceremony of cooperation and exchange of documents.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/935407e225f640f9ac97b85d3359c1a5)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

Comment (0)