After breaking through the 1,240-point mark, the VN-Index recovered strongly as bottom-fishing demand emerged. However, the HNX-Index and UPCoM-Index both closed in red.

High bottom-fishing demand pushes VN-Index up sharply, green returns at the end of session on November 13

After breaking through the 1,240-point mark, the VN-Index recovered strongly as bottom-fishing demand emerged. However, the HNX-Index and UPCoM-Index both closed in red.

|

| VN-Index traded sideways with significant rebound when reaching 1,240 points |

VN-Index closed the session on November 12 at 1,244.82 points, down 0.44% from the previous session, with trading volume down 27.5% and equal to 80% of the average. Entering the trading session on November 13, negative sentiment continued to dominate the market. This caused many stock groups to continue to be in the red. The indices all fell below the reference level since the opening of the trading session.

Trading was negative in the morning session. After opening in red, the market fluctuated with alternating increases and decreases. In the second half of the morning session, negative developments appeared when selling pressure increased while buying pressure remained weak. VN-Index fell sharply and at one point lost more than 8.5 points.

The afternoon session was completely opposite to the morning session. Bottom-fishing demand gradually appeared and helped the general market recover significantly. VN-Index closed today's session in the green with improved liquidity.

At the end of the trading session, VN-Index stood at 1,264.04 points, up 1.22 points (0.1%). Meanwhile, HNX-Index slightly decreased 0.48 points (-0.21%) to 226.21 points. UPCoM-Index decreased 0.04 points (-0.04%). On the three floors (HoSE, HNX and UPCoM), there were a total of 311 stocks increasing, 358 stocks decreasing and 894 stocks remaining unchanged/not traded. The number of stocks increasing to the ceiling was 33 while there were 15 stocks decreasing to the floor.

The real estate group had positive fluctuations in today's session and somewhat helped reduce the pessimism of the general market. NVL was the most prominent name when it went against the general market trend early on. At the end of the session, NVL increased by 2.37% to VND 10,800/share and matched 15.8 million units. In addition, real estate codes such as HDG, HDC, DXG, PDR or DIG also increased sharply in price. HDG increased by 2.9%, HDC increased by 2.8%, DXG increased by 2.2%...

The VN30 group improved today when 15 stocks increased, 11 stocks decreased and 4 stocks remained unchanged. MWG, after being sold off heavily yesterday, recovered by increasing 1.8% to VND61,900/share and contributing 0.39 points to the VN-Index. Stocks such as VCB, VPB, FPT... increased well and all had the most positive impact on the VN-Index. VCB increased by 0.65% and contributed the most with 0.8 points. VPB recovered spectacularly by increasing by 1.3% and contributing 0.48 points.

|

| VCB contributed the most points to the VN-Index on November 13. |

On the other hand, HPG was the stock with the biggest drop in the VN30 group today with 1.64%. HPG took away 0.7 points from the VN-Index. The strong selling of steel king Hoa Phat's stock is believed to have come from the news that Vietnam has ended and not extended the anti-dumping tax on cold-rolled stainless steel from China, Indonesia, Malaysia, and Taiwan (China). However, HPG and units such as HSG or NKG do not produce stainless steel.

Besides HPG, large stocks such as PLX, GVR, SSI... were also in red and put great pressure on the general market.

The outstanding stock group different from the market today is chemical fertilizers when recording strong increases such as CSV (6.5%), BFC (3%), LAS (2.7%)...

The highlight of today's session was the significant improvement in market liquidity. The total volume on HoSE reached 661 million shares, equivalent to a trading value of VND15,335 billion (down 7.8% compared to the previous session), with negotiated transactions contributing VND1,619 billion. The trading values on HNX and UPCoM were VND947 billion and VND522 billion, respectively.

Today's session, no stocks were traded with a value exceeding a thousand billion VND. HPG was the code with the highest trading value with 604 billion VND. VHM and STB traded 570 billion VND and 495 billion VND respectively.

|

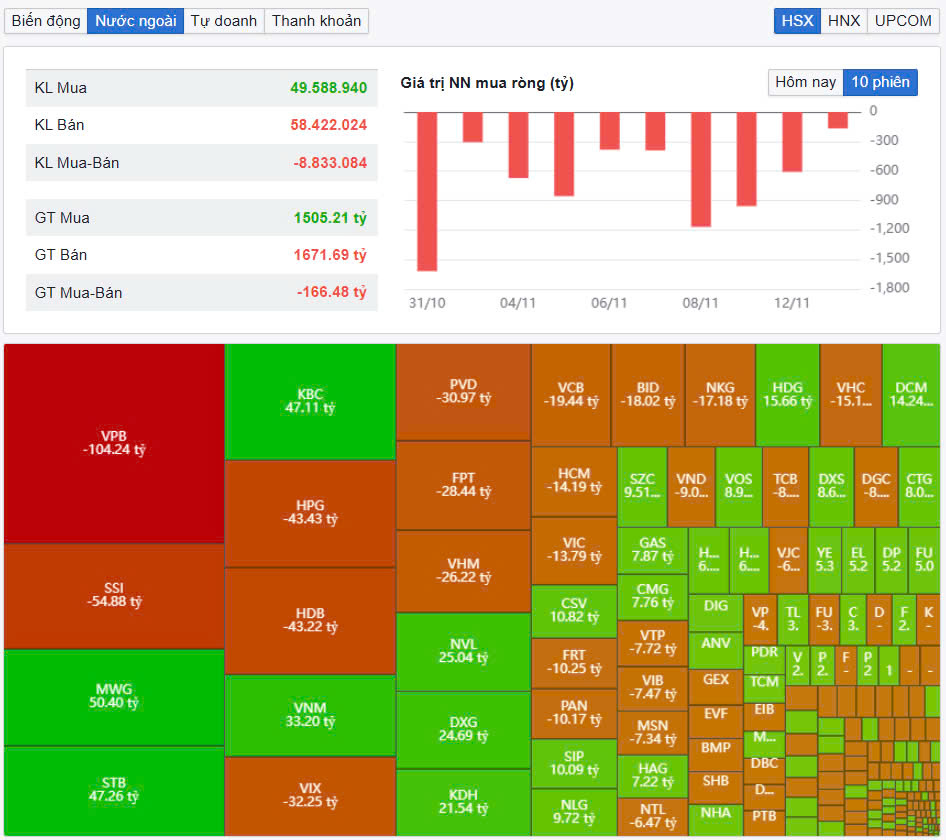

| Foreign investors continue to net sell but selling pressure has decreased significantly. |

Foreign investors significantly reduced their net selling value in today's session with about 174 billion VND on all 3 exchanges. VPB was the most net sold by foreign investors with 104 billion VND. Next, SSI and HPG were net sold with 55 billion VND and 43 billion VND respectively. On the other hand, MWG was the most net bought with 50.4 billion VND. STB and KBC were both net bought with more than 47 billion VND.

Source: https://baodautu.vn/cau-bat-day-dang-cao-keo-vn-index-tang-manh-sac-xanh-tro-lai-cuoi-phien-1311-d229942.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)