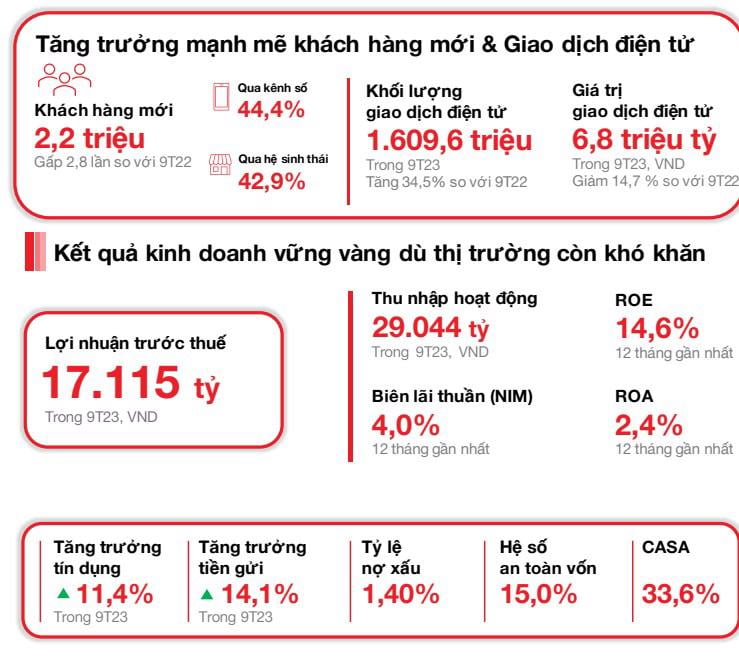

Attracted 2.2 million new customers

On October 23, 2023, Vietnam Technological and Commercial Joint Stock Bank (“ Techcombank ” or “the Bank”) announced its third quarter business results, recording sustainable growth, in the context of the economy showing signs of recovery. Techcombank ended the third quarter of 2023 with the number of customers reaching nearly 13 million, an increase of about 2.2 million newly attracted customers (3 times higher than the accumulated 9 months of 2022). Of which, 44.4% of new customers joined through digital channels, and 42.9% through partners in the ecosystem. The number of individual customer transactions through electronic banking channels increased to 577.6 million in the third quarter of 2023, an increase of 15.6% compared to the previous quarter and 49.4% compared to the same period last year, while the total transaction value reached ~2.4 million billion VND.

Customer deposits reached VND409.0 trillion, up 14.1% YTD and 7.1% QoQ. CASA balance increased for the second consecutive quarter, reaching VND137.6 trillion, up 3.2% QoQ, led by retail CASA (up 4.9% QoQ). Total assets reached VND781.3 trillion as of September 30, 2023, up 11.8% YTD. For the Bank alone, credit grew 11.4% YTD, reaching VND495.4 trillion. Techcombank's credit balance grew healthily, in line with the latest credit limit granted by the State Bank.

In the third quarter of 2023, pre-tax profit (PBT) reached VND 5,843 billion. In the first 9 months of the year, Techcombank's pre-tax profit reached VND 17,115 billion.

Premiums recovered strongly in Q3 2023, with new business written (APE) increasing by 32.1% QoQ. In September 2023, the Bank regained the No. 1 position in the industry in APE. This encouraging result was due to a customer-driven sales strategy, enhanced service capabilities, and active development of new digital products.

“ CASA balances grew for two consecutive quarters, reinforcing the Bank’s CASA growth momentum. Credit growth and deposit growth were higher than the industry average in the first 9 months of 2023. With the results achieved in Q3/2023, the Bank is confident that it will achieve its profit and asset quality targets for the whole year, ” said Techcombank CEO Jens Lottner.

Stable asset quality, tightly managed capital base

As at 30 September 2023, the regulatory loan-to-deposit ratio (LDR) was 76.7% (vs. 80.4% as at 30 June 2023). The ratio of short-term funds used for medium- and long-term loans was 30.5% (vs. 31.6% as at 30 June 2023), reflecting efforts to further reduce this ratio to 30% after 1 October 2023 as required.

The Bank's capital adequacy ratio (CAR) stood at 15.0% as at 30 September 2023, well above the minimum requirement of 8.0% under Basel II Pillar I.

The Bank's asset quality remains under control. The Special Mention (B2) ratio decreased to 1.3% as of 30 September 2023 (compared to 2.0% as of 30 June 2023). The Bank's own B2 ratio remained at 0.9%, down from 1.4% as of 30 June 2023.

Accumulated in 9M2023, card service fee revenue reached VND1,526 billion, up 38.7% YoY. The main growth drivers of the card segment were driven by transaction volume (up 29.4% YoY) and installment volume (up 36.2% YoY) which continued to be high. Revenue from letters of credit (LC), cash and payments reached VND3,218 billion, up 109.4% YoY. The growth momentum was maintained as the Bank continued to enhance its offering, expand and refine its payment and collection solutions (e.g. QR247 for convenience stores, restaurant chains and delivery services, etc., virtual accounts, instant digital signatures) as well as cash and liquidity management solutions (C-Cash with Kyriba, Bao Loc CD on digital platforms, etc.). Foreign exchange (FX) service fees reached VND 731 billion, up 19.0% YoY.

Operating expenses in 9M2023 increased slightly by 5.8% to VND9.6 trillion, with CIR increasing to 33.2%. In Q3 alone, operating expenses increased by 24.7% YoY, mainly due to higher depreciation expenses as Techcombank continued to invest in digital and cloud technology, and increased marketing expenses as the Bank promoted its brands dedicated to different customer segments: Private, Priority and Inspire as well as activities to celebrate its 30th anniversary.

Bad debt ratio maintained at 1.4%, among the lowest in the industry

The Bank’s non-performing loan (NPL) ratio remained at 1.4%, among the lowest in the industry and within the forecast range. The total corporate debt and bonds ratio stood at 1.3%. This increase was mainly due to NPLs from retail customers and SMEs, while NPLs from large enterprises remained at 0%. The Bank’s credit costs were generally stable at 0.7% before the reversal and 0.5% after the reversal, reflecting the large value of collateral.

On a consolidated basis, retail lending has stopped declining on a quarterly basis, driven by growth in credit cards. While primary home loan demand has shown signs of recovery, the market remains relatively subdued compared to pre-2022 levels. Corporate credit (including loans & bonds to SMEs and large corporates) grew by 5.1% QoQ and 33.7% YTD. This reflects credit demand from corporate customers who are ready to borrow and invest in anticipation of the economic and market recovery.

Source

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)