|

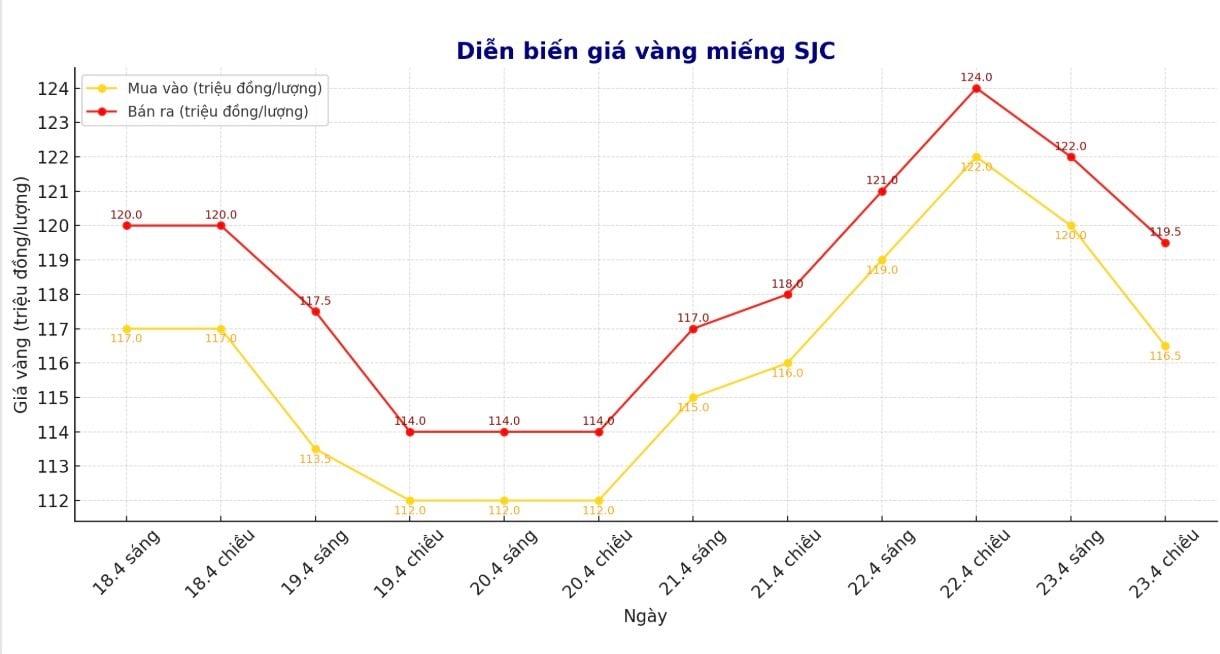

| Gold bar price movements in recent trading sessions. Chart: Phan Anh |

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 116.5-119.5 million VND/tael (buy - sell); down 5.5 million VND/tael for buying and down 4.5 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.5-119.5 million VND/tael (buy - sell); down 5.5 million VND/tael for buying and down 4.5 million VND/tael for selling. The difference between buying and selling prices was at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.5-119.5 million VND/tael (buy - sell); down 4 million VND/tael for buying and down 3 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 112.5-115.3 million VND/tael (buy - sell); down 4.7 million VND/tael for buying and down 3.7 million VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); down 4 million VND/tael for both buying and selling. The difference between buying and selling prices is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying and selling gap is pushed too high, increasing risks for individual investors.

World gold price

As of 11:30 p.m. on April 23, the world gold price was listed at 3,291.3 USD/ounce, down 39 USD/ounce.

Gold Price Forecast

According to Kitco, gold prices fell sharply in the morning trading session in the US, due to profit-taking pressure from short-term investors after prices reached a record of 3,509.9 USD/ounce (June gold futures contract on the Comex floor) on Tuesday.

The return of risk appetite in the market in mid-week is also negative for safe-haven metals like gold. Gold bulls now appear exhausted, suggesting the market may have reached a short-term top.

Gold prices for June are down $90.7 to $3,328.7 an ounce. Silver prices for May are down $0.12 to $32.785 an ounce.

Asian and European stock markets rose overnight. US stock indexes are also expected to rise sharply when they open today in New York.

Risk-on sentiment really returned to the market midweek when President Trump said on Tuesday that he had “no intention” of firing Federal Reserve Chairman Jerome Powell.

“There was never any intention,” Trump said in the Oval Office when asked about firing Powell. Trump continued to call for the Fed to cut interest rates sharply, saying “this is the perfect time to cut interest rates” and expressing frustration that Powell had not acted quickly. However, Trump also acknowledged that Powell is protected by law.

In addition, Mr. Trump also seemed to soften his tone in the trade war with China, saying that the 145% tax that the US imposed on imported goods from China would be "significantly reduced" after the two sides reached an agreement.

He said the tariffs “won’t be as high anymore,” and “will come down substantially, but not to zero.” Trump also said that “the U.S. and China are doing fine,” and suggested that the U.S. would not escalate tensions or bring up the COVID-19 issue again. “They’re going to have to make a deal eventually,” he said.

Markets are awaiting a slew of key economic data due on Thursday, including durable goods orders, weekly jobless claims and U.S. home sales, to gauge the health of the economy and the outlook for the Fed’s interest rate policy. These figures are expected to have a significant impact on investor sentiment and financial market developments in the short term.

External factors are currently unfavorable for the metals market. The US dollar index rebounded after hitting a three-year low on Monday. Nymex crude oil prices fell and traded around $63.25 a barrel. The yield on the 10-year US Treasury note is currently at 4.305%, down slightly from the beginning of the week.

According to laodong.vn

Source: https://baodanang.vn/kinhte/202504/cap-nhat-gia-vang-sang-24-4-lao-doc-mat-moc-khang-cu-4005728/

Comment (0)